Geared towards the executive membership of AFP, Executive Guides take an in-depth look at specified topics that are developed via interviews with treasury executives. They are presented as studies, with practical applications and tools such as models and checklists.

Concentrating Cash Across Borders

Underwritten by Standard Chartered

Cash concentration is an effective way to mobilize internal cash, with many companies doing so on an in-country basis. Today, a combination of technology and regulatory change means it is increasingly possible to concentrate cash on a cross-border basis too.

Th AFP Executive Guide: Concentrating Cash Across Borders, underwritten by Standard Chartered, outlines why treasurers are working to concentrate cash across borders and highlights, with examples from different regions, the significant barriers of doing so. It illustrates the importance of working with internal partners to achieve buy-in for a project to ensure it is as effective as possible. It discusses how treasurers can use external partners, banks and technology providers to facilitate cross-border cash concentration and concludes by looking at some trends for treasurers to watch.

DOWNLOAD THE EXECUTIVE GUIDE

WHAT IS CASH CONCENTRATION?

Cash concentration is the practice of moving cash from bank accounts across an organization into one (or more) central account, generally known as a header account. The practice is simplest for a company operating in one country via a single legal entity. The task becomes more complex once cash managers want to concentrate cash from bank accounts held in the name of separate legal entities (i.e., bank accounts held by group subsidiaries, even if the ultimate beneficial owner of all the accounts is the same).

ESTABLISHING THE OBJECTIVES FOR CASH CONCENTRATION

Companies are reviewing their approach to liquidity management generally, and to cash concentration specifically, driven by a number of factors. While the wider environment has made it easier to concentrate cash, cash concentration is only a part of a company’s liquidity management strategy. Concentrating cash allows treasurers to meet wider objectives.

WHY IS IT SO HARD TO CONCENTRATE CASH GLOBALLY OR REGIONALLY?

- Regulatory issues

- Operational Considerations

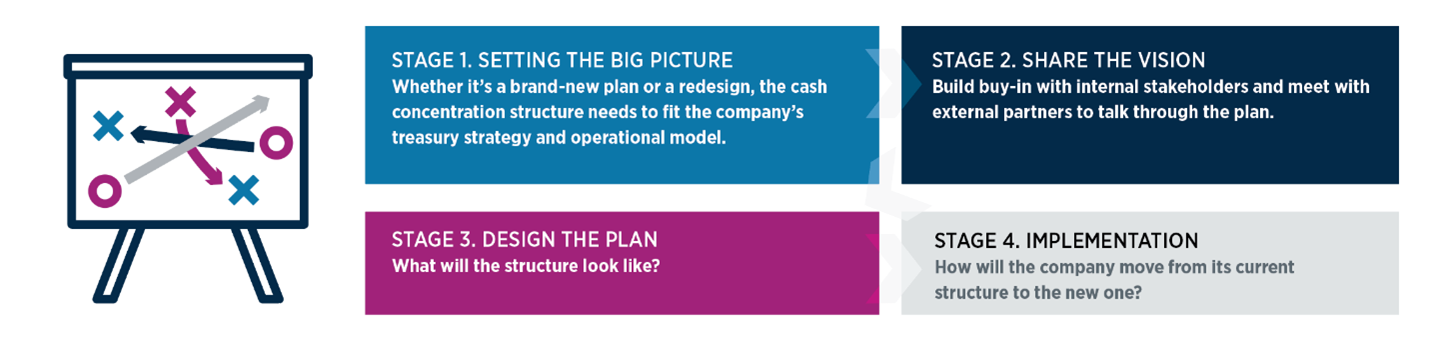

ESTABLISHING THE GOVERNANCE STRUCTURE

To design an effective solution, treasury will need to be able to articulate the key parameters to the various other parties.

EXECUTION OF THE PLAN: THE ROLE OF THE BANK

Banks have a central role in the execution of the cash concentration structure. Even with companies that operate virtual account networks via their treasury management system, there is always at least one header account that is held with an external bank (i.e., a regulated financial institution) and acts as the gateway for making and receiving external payments, and for receiving funding and paying down external debt.

THE IMPORTANCE OF PROPER REPORTING AND RECORDKEEPING

Technology plays a key role in managing any cash concentration structure for two reasons. First, to be as efficient as possible, treasurers want access to accurate and timely information. Second, to demonstrate compliance with tax and regulation, companies need to apply and record their transactions on a consistent basis.

Access to more powerful technology and the impact of regulatory change means it is increasingly possible and practical to concentrate cash on a cross-border basis. Treasurers who want to do so need to work with internal stakeholders and external partners to design a solution that is efficient today and flexible enough to remain efficient into the future.

DOWNLOAD THE EXECUTIVE GUIDEPublished January 30, 2024