Articles

Why Agility Matters to Finance

- By Bryan Lapidus, FPAC

- Published: 10/19/2023

Finance’s reaction to a disruptive world is to incorporate agility into its processes.

Finance’s reaction to a disruptive world is to incorporate agility into its processes.

The term agility implies a mindset open to change, the ability to rapidly assess the environment and the capability for action that effects change. The importance of agility is often seen in adapting capabilities of working toward goals, while resilience is a complementary term often phrased as the ability to achieve goals in the face of difficulties, such as COVID, supply chain disruptions and instability.

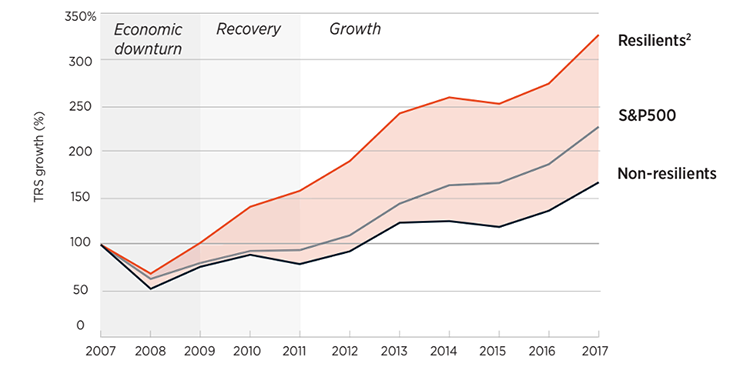

Agility powers resilience, a relationship that’s marked by higher overall survival rates over the long term, and better company performance throughout the economic cycle:

RESILIENT COMPANIES DID BETTER AT THE OUTSET OF THE DOWNTURN AND AFTER

Cumulative TRS performance1

Source: S&P Capital IQ and McKinsey & Company analysis

¹ TRS = total returns to shareholders; calculated as average of subsectors’ median performance within resilient and non-resilient categories; n = 1,140 companies; excludes financial companies and real-estate investment trusts.

² Resilient companies defined as top quintile in TRS performance by sector.

McKinsey & Company writes, “Resilience is the ability to not only recover quickly from a crisis but to bounce back better — and even thrive. Agile is a way of working that seeks to harness the inevitability of change rather than work against it. As such, organizations that have fostered agile processes are better able to pivot when the situation demands it. Agility lets organizations respond in ways uniquely suited to each crisis, rather than apply one-size-fits-all, inflexible solutions.” Their data shows that resiliency cushions downsides in recessions, and accelerates advantages afterwards.

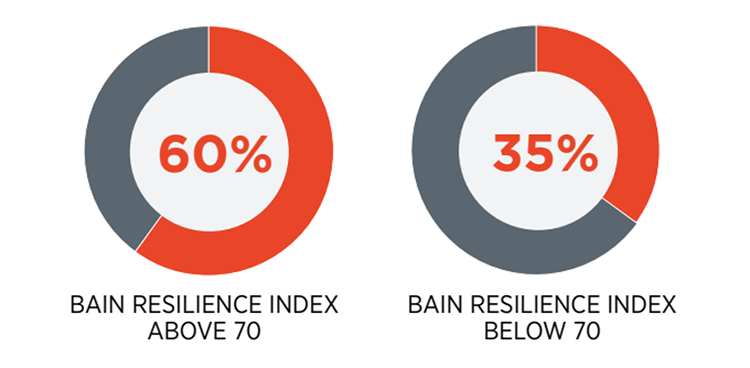

Similarly, Bain & Company research notes that companies scored as more resilient have higher survivability rates than less resilient companies. This is an important finding because the U.S. economy in particular, and global economies in general, enjoying three decades of “relative predictability of the business environment enabled firms to pursue efficiency. Yet this focus on efficiency has come at the cost of increasing structural fragility” as we enter more turbulent markets.

MORE-RESILIENT FIRMS HAVE NEARLY DOUBLE THE SURVIVAL RATE

Survival rate for larger US nonfinancial companies 2000-19

Notes: Survival rate based on nonfinancial companies listed in 2000 and still listed in 2019; excludes firms with less than $1 billion in annual revenue; the Bain Resilience Index is based on the statistical relationship between share price performance during a crisis and variables including scale, growth, margin, leverage, liquidity, capital intensity, and geographic and product concentration.

Source: Refinitiv; Bain analysis

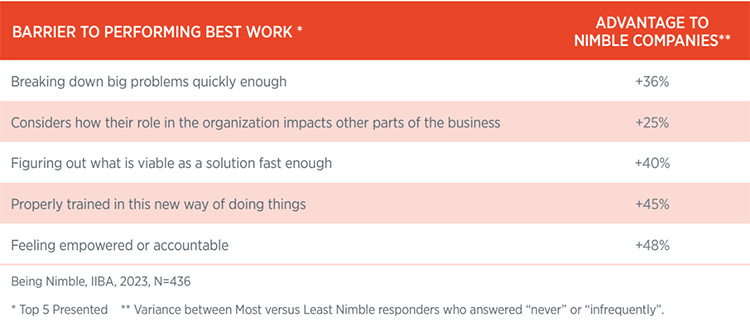

Agile companies outperform because they have a better capability to change internally in a world that is in a constant state of flux. The International Institute of Business Analysis™ (IIBA®) Being Nimble research differentiates between agile (the various development methodologies) and business agility as AFP would define it, calling the latter a “nimble” organization and a scalable capability to sense and respond to change rather than any one methodology. IIBA’s study shows dramatic advantages for the most agile companies in performing their best work:

Agile companies need agile finance

In short, agile and resilient companies are defined by the agile practices built into the daily work of their employees, enabling them to have better outcomes than their peers. The question is, how do we build agile companies? FP&A is an exporter of services and capabilities, specifically planning, performance measurement and financial analysis. These are delivered through the combination of finance acumen and processes, a robust and flexible technology backbone and interpersonal skills.

Keith Ellis, Chief Development Officer at IIBA, presented eight practices of agile companies (many of which are presented throughout this document) at AFP’s FP&A Series, Getting Agile Right for Finance, and noted how finance plays an outsized role in several of them.

Agile organizations can balance rigor and consistency with flexibility in processes, an important challenge for CFOs because they are responsible for financial controls throughout the enterprise. These processes are rigorous by design! Even within FP&A, consistency, standards, governance, discipline, etc. can enhance flexibility and agility. For example, standard metric definitions, enterprise data governance, and a consistent level of planning detail are all foundational building blocks for FP&A that allow others to build in a coordinated fashion. Developing a strong, independent and agile FP&A department then becomes critical for CFOs to deliver financial acumen in an agile way across the enterprise.

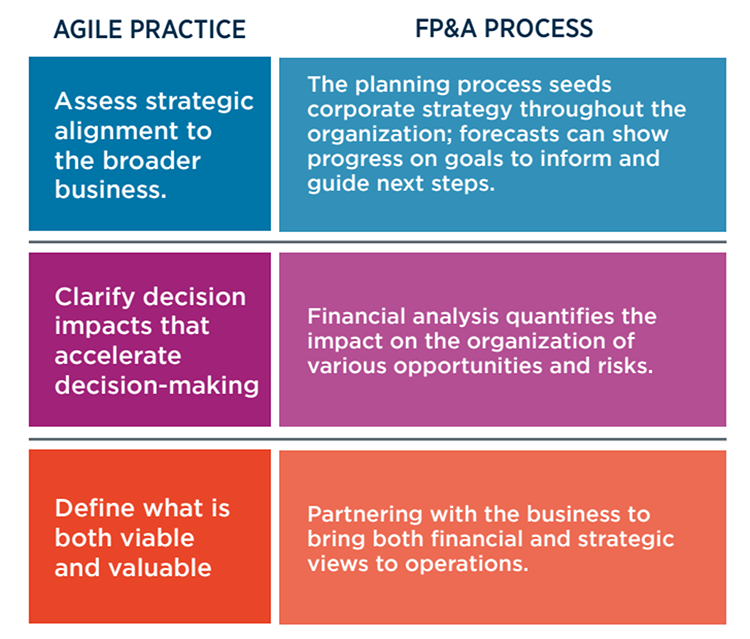

Several routine FP&A processes align and support the practices identified by the IIBA report to promote corporate agility. For example:

For example, companies look to the CFO organization to provide finance-based insights that align outside risks with internal strategy and capabilities; this is commonly seen in faster planning and forecasting processes that consider multiple potential outcomes. These are best practices for FP&A and key elements of company agility. In fact, the 2022 AFP FP&A Survey: Measuring Agility in FP&A shows that Agile Leaders (those who scored in the top 20% of the survey) can reforecast more than 50% faster than the remaining 80% (or Core Respondents), are more likely to use multiple scenarios in their planning processes and have playbooks for specific challenges. Agile FP&A gives advantages to its companies.

As owners of the financial planning process, FP&A needs to adopt the stance that disruption and change are to be expected, and agility is a service FP&A can offer to the company. To do this, FP&A should build agility into its DNA along three axes of action: finance and business process acumen, personal and team effectiveness, and technology and data platforms.1

1 These are the three necessary skill areas defined by AFP’s FP&A Maturity Model.

This article is an excerpt from the AFP FP&A Guide: Finance Agility: Change is Part of the Plan, underwritten by Workday. Read the full guide to learn more.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.