Articles

The Mission, Model and Management of Value-focused Finance

- By Bryan Lapidus

- Published: 1/11/2022

How should we think about — and position — all the changes that we talk about in finance and FP&A, digital transformation and business partnering?

A panel of experts recently presented a framework for thinking about all these changes globally, in terms of how new capabilities are leading to a new business model for finance and for FP&A, in the AFP webinar, “Value-focused Finance.” On the panel were Analia Castelo, senior director for International Accounting and Tax, Choice Hotels International; John Thompson, partner, Automation and Transformation Practice, Oliver Wyman; and Bryan Lapidus, FPAC, director of FP&A Practice, AFP.

CFO, steward of capital

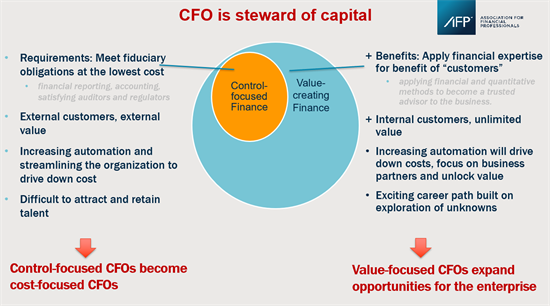

The Mission is what CFOs want to accomplish (and what the board hired them do), and really embodies the control-versus-value debate. As the “steward of capital,” the CFO is responsible for reporting where the capital went, where it is deployed so it is ready to spend and receive, and where the next dollar should be allocated for best use.

Moving from a control-focused to a value-focused finance organization can be explored in three different ways. First, by defining the mission and the aspiration of finance. Second, by creating an operating model that allows you to structure your finance organization in a way that gets you to your mission. And finally, by managing ourselves and our teams.

Mission: Migrate from control to value

When we talk about control-focused finance, we're talking about the base-level requirements the CFO has to take care of in order to meet the fiduciary obligations at the lowest possible cost. As a fiduciary, we have to do our financial reporting and our accounting that satisfies the auditors, the shareholders, the investors, and the regulators. That's in large part what it means to be the CFO, but the trouble is, when that's the sole aspiration of finance organizations, then all the main customers are external — the auditors, the regulators, everybody is outside. And so is your value.

When you operate solely from a focus of control, many of your customers are external and so your operational costs are layered onto the internal business like a tax. Then, the goal is to deliver these services quickly, effectively and at the lowest possible cost, and your guiding metric is to lower finance as a percentage of revenue. Over time, control-focused CFOs become cost-focused CFOs The panel sees that as a challenge — a challenge that makes it difficult to attract and retain the best talent.

Using an analogy from psychology, think of the concept of Maslow’s Hierarchy of Needs: at the base are your basic physiological needs, such as food, shelter and clothing. The base level control never goes away, but as we move beyond, we are able to deploy our financial expertise for the benefit of our internal customers, thereby providing unlimited value as a trusted advisor to the business. We’re going to drive down costs in some areas, increase automation, and invest in the business in other areas to unlock value. That creates a different, exciting and expansionary career path — one built on the exploration of unknowns.

Model: The pillars of partnership

Thompson presented an operating model for how finance can structure itself to deliver on mission to deliver value-accretive services to the business based on research and interviews with clients and AFP members. First among the pillars of partnership is the operating model: How is finance structured? Is the finance function formulated in a manner that makes it easy for people to engage? Is it clear who to go to when there are questions? Is it clear what the handoffs are? In other words, what does finance expect from you? What do you expect from finance? This pillar defines the interaction.

The next pillar is around business acumen: Do the individuals within finance understand your business or your function? Business acumen is not just about understanding how you operate, it’s understanding what your key challenges are, what your top three priorities are — and how finance can help.

The third pillar is analytic capabilities/decision support: Are you learning something new? Are these types of analyses coming from finance helping you better allocate your own resources or make better decisions? You don’t just need the right types of skills within finance, you need the right types of models.

Next, we have collaboration, and this is directed at the people and style of interaction: Do the individuals in finance spend time with your team? Are they getting to know them? Are they able to communicate in a way that your team understands? There is a direct correlation between finance developing individual relationships with people within the business, and the perception of finance as stronger and more collaborative.

The last pillar is about information delivery; there is a correlation between the ability to provide information on a timely basis and at the level of detail that makes it useful. In some cases, finance provides too much information, and it's difficult to sift through it all. This pillar is also about the way the information is presented.

Management: Bringing finance expertise forward

Castelo herself is a case study in how to unlock financial expertise and bring it to the forefront. She started in the tax group of her organization, but after some time with the team, she found herself longing to do something different and was thrilled when an opportunity came up to move to the accounting group. "I merged my tax knowledge with the accounting information to create a unique perspective that I was not only able to share with the accounting group, but that also allowed me to understand what information was missing in the reports the rest of the teams were receiving,” she said. “It’s important to share the information and bring in the expertise between teams.”

Defining the finance organization’s mission and aspiration starts from the top and should run through the DNA of the entire enterprise. Read the guide, Becoming a Value-focused Finance Organization

Teams are going to grow in different directions, so how do you make sure there is enough communication between them? One way that worked for Castelo was filling in for someone in another group, in this case a member of the investor relations group who was out on maternity leave. That change of roles “was a fantastic experience. I was able to connect the dots as to how these pieces of information I was creating ended up with the investors in the earning call,” she said. “If you always sit in the same chair, you will always have the same perspective.”

Notice how this exemplifies the connection between proximity and a growth mindset that Castelo wants on her team. “One thing I remember back from my days in public accounting was that sometimes it was hard for the partner to bring lower-level people to the meeting, because you wouldn't charge for those hours,” said Castelo. “But it was an investment because when someone is sitting at the table and seeing the discussions that take place among executives, they connect the dots.”

You want to make sure that your people are happy, engaged, and growing with you. To do this, you have to first make sure that they have the right mindset — that you are working with people who enjoy their work and are eager to learn, develop and try different things.

How can you give that to them? If they are always closing books, and that's all they do, that person is not going to stay long. It's a combination of investing in the people and making sure that they see the big picture.

That requires structuring work and incentives so that the finance team is correctly focused.

“I often find that [finance thinks] the word ‘priority’ is a good one,” said Thompson. “If you are trying to drive change within finance, you can only have two or three priorities and they need to be ranked, and you need to be thoughtful about saying no so that you can say yes to the things that matter.”

“As Stephen Covey said, ‘When the urgent crowds out the important, people urgently accomplish nothing of value,’” commented Lapidus.

Investing for Value: How finance can get better technology

Leaders want more. They want to know what finance can offer and to tap into that expertise. They want to upskill. And yet, the need and the opportunity for better technology for finance so often takes a backseat to other projects. How do we make the business case for better technology?

“It’s not easy,” said Thompson. He suggested that there are three lenses through which people see this issue. The first is to view technology for finance as a foundation that needs to be refreshed every few years. It's just the cost of infrastructure.

The second lens is based on the question: How do we make finance leaner? We look at automation, infrastructure improvements, the operating model or redesign, and figure out how we can do the same with less people. This lens is about building new capabilities empowered by technologies and new data modeling, maybe even some new forecasting capabilities for hypothetical scenarios. And it’s paid for by automating some tasks and getting rid of some of the jobs that are, today, menial.

The second lens has been the more popular one.

“I am seeing a third lens emerge where people are saying: it's going make us empowered as an enterprise, not just finance,” said Thompson. “This is the CEO saying, I want to provide better support for all of you. There are some amazing, impressive things out there that technology for finance can enable.”

In the last few years, there has been an explosion technology applied to finance. It's no longer a question of not doing it, now it’s: you're in trouble if you're not doing it, because your competitors will.

PARTNER CONTENT

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.

.tmb-small.png?sfvrsn=3731146b_1)