Articles

COVID-19: FP&A Professionals Expect a Painful, Slow Recovery

- By Bryan Lapidus, FP&A

- Published: 5/11/2020

In mid-April, AFP conducted a survey of FP&A professionals on COVID-19. The overall goal of the survey, which closed on May 1, is to help members of the FP&A community calibrate their own responses to the pandemic by sharing how peer organizations are adjusting and planning for the months ahead.

We will be examining the survey results over the next few weeks, culminating in a webinar on June 11. This week’s article focuses on how FP&A professionals view the economy, which obviously is grim. We noted three key points coming into focus.

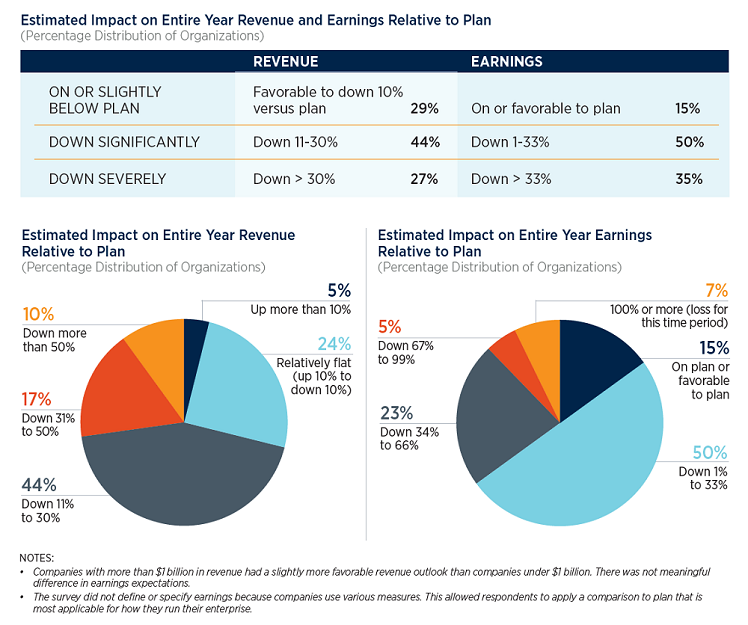

The scope of the revenue and earnings drop is coming into focus: 85% of respondents expect earnings to be significantly or severely below plan.

The survey asked about the expected fiscal year decline in revenue and earnings as compared to their fiscal plan. This view allows for companies to incorporate short-term expectations as the economy slammed on the breaks in March and also a view for the rest of the year. Unsurprisingly, finance professionals anticipate the impact of the pandemic to be severe on both revenue and earnings.

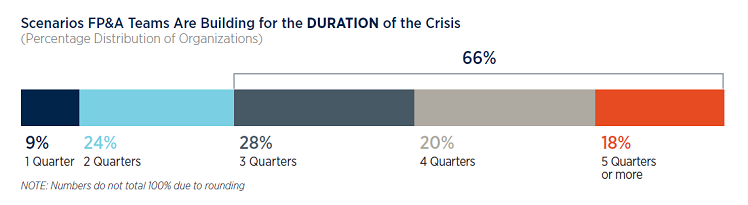

Two-thirds of FP&A are modeling the crisis to last three quarters or more.

Creating financial and operating models is critical to creating alignment across the enterprise, and FP&A professionals are making numerous scenarios to understand actions, impacts and options. FP&A professionals have a sober view of the duration of this crisis, with 66% creating financial models that assume the crisis will last for three quarters or more. This was consistent across companies of all revenue sizes.

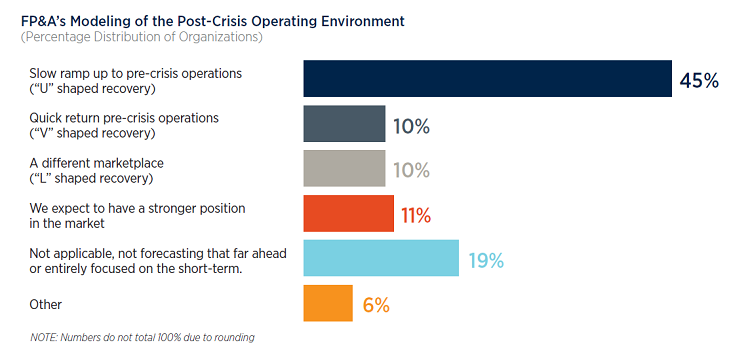

Regarding the recovery FP&A is expecting for their business, the largest share 45% expect a slow ramp up to pre-crisis operations (a "U" shaped recovery). Only 10% estimate a quick return to pre-crisis operations (a "V" shaped recovery), and an equal 10% are modeling that we are in a new normal of an “L” shaped recovery. Nearly one in five respondents are not making forecasts at all, due to uncertainty of their survivability. One respondent said simply, “no outlook—the situation is too volatile.”

Many survey respondents reported that they have multiple scenarios running currently that include the various recoveries mentioned, and most are forecasting a slow economy to the end of the year. It is unclear whether this is due to their economic outlook or because their budget/forecast horizon extends three quarters. Other responses indicated the market or nature of the business impacts the forecast horizon, for example: “Airport industry expected to require 2+ years to recover” and they are building “scenarios for 2021 and 2022 due to the subscription nature of our business.”

One response from the healthcare field included this reasoned assessment: “Our most recent updates have moved into the more realistic scenario that COVID-19 will not go away completely and that we will need to exist with COVID-19 into 2021 until a vaccine is developed. Our modeling is now extending into 2021.”

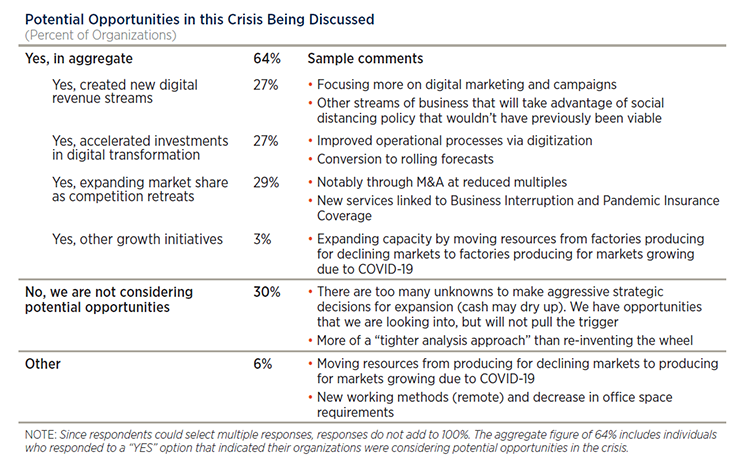

Companies are actively upgrading during this time.

As companies reposition themselves, many are pivoting their business and playing “offense” as they adapt to the new normal. Sixty-four percent of companies indicate they are looking for opportunities to invest in themselves or their products or see an opportunity to expand their market share during this time.

Findings from the survey highlight the severity of the impact on organizations’ revenue and earnings, which have contributed to the grim outlook of finance professionals. Some believe they are unable to plan, as there is too much uncertainty and nearly half are anticipating a slow recovery. However, two-thirds of respondents are planning ahead and looking for opportunities in the new world.

Respondent demographics:

- The survey drew over 600 responses from finance professionals across 20 industries, representing the diversity of AFP’s membership.

- One third are publicly owned, 28% are privately held, 20% are private equity owned, and the remaining 19% were either not-for-profit or government entities.

- By revenue, 28% are under $100 million, 38% are $100 million -$1 billion, and 33% are over $1 billion.

Upcoming articles in this series will focus on the impacts upon the FP&A team itself. As we will explore in later analyses, FP&A is being called on for more insight, more action, and more communication to leadership and line leaders throughout this crisis. The picture that emerges, as one respondent said, is that FP&A is “evaluating all options.”

To access other articles and information relating the survey, please visit www.afponline.org/covid19FPA.

Register for the webinar: “What COVID-19 Means for FP&A” on June 11th.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.