Articles

Bridging Data Science and FP&A

- By Hector Rubalcava, FPAC

- Published: 10/5/2023

By building relationships and changing mindsets, a Director of FP&A was able to flip a siloed work culture and skills deficit in a newly formed FP&A team, elevating the entire team to award-winning and vital business partners.

By building relationships and changing mindsets, a Director of FP&A was able to flip a siloed work culture and skills deficit in a newly formed FP&A team, elevating the entire team to award-winning and vital business partners.

The AFP FP&A Case Study series is designed to help you build up key FP&A capabilities and skills by sharing examples of how leading practitioners have tackled challenges in their work and the lessons learned.

Presented at an AFP Advisory Council meeting, this case study contains elements that are anonymized to maintain privacy and encourage open discussion.

Insight: Tapping into the vast amounts of company data that exists beyond the scope of a typical finance team can yield new insights and benefits; the key is to partner with the experts who have the tools, talents and techniques to do that.

| Company Size: | Medium |

| Industry: | Financial Services |

| Geography: | North America |

| FP&A Maturity Model: | Analytics |

Financial analytics: FP&A applies financial expertise and business understanding through modeling, pro-formas, and analysis. FP&A and the business actively partner.

Background: General Information About the Company

A new director of FP&A began in a financial services company with an annual revenue of $450-$500 million and approximately 775 full-time employees. “Nearly a year ago, I was hired into the role of director of finance with the goal of advancing the finance unit using industry best practices converted to best fit approaches. After some turnover in my team, we are now starting fresh with a lot of new people which gives me the chance to really disrupt the status quo processes that were in place before,” said the director.

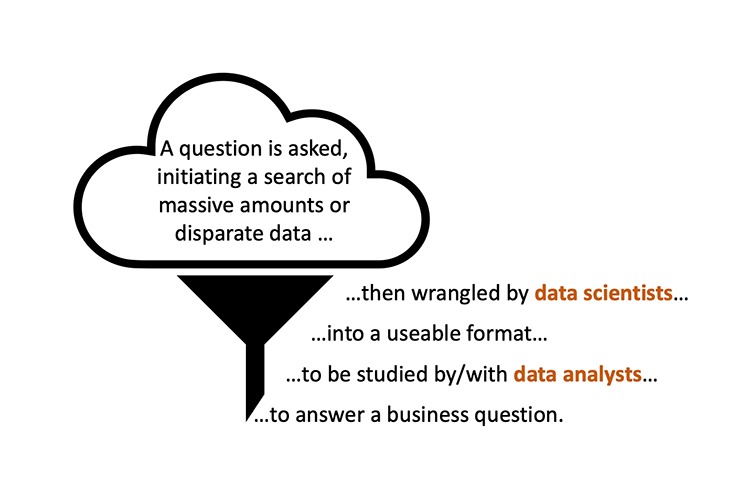

The team’s biggest challenge centered on data. If you think of it as a funnel, the company was overflowing with data on the top, but was not fully distilling it to useful analysis and action at the bottom. The work at the top and bottom of the funnel required understanding the difference between data science and data analysis. “Some people say that data science and data analytics are basically the same thing. That’s not correct,” he said. “There is a different skill set, scope and overall goal for each field.”

Generally speaking, data science starts at the top of the funnel. It pulls together big, disparate data sets, cleans them up, and tries to discover new insights. Advanced statistics are applied; data modeling and heavy engineering, using languages like Python or R, and the results are iterated with the finance or business user.

At the mid-to-bottom of the funnel, you find data analytics. This is where the data is further refined, interpreted and applied to business cases. The skills needed are an understanding of the data lifecycle, the ability to interpret statistics, use BI tools and apply relevant programming skills such as SQL. “The key to the last stop is to craft compelling stories with a focus on influencing decision-making practices,” he said. If successful, the team would also convert the process from a one-off exercise to a routine application.

Challenge: The Work or Difficulty FP&A Had to Address

There were two key challenges the director faced in turning its operational data into actionable insight. The first challenge was building organizational capability to leverage the data:

- Incomplete models. The company’s key driver centered around business order volume, and yet they didn’t have a driver-based volume scenario or projection.

- Lack of data visualization infrastructure. There wasn’t any, so the team didn’t have the ability to view and understand patterns or relationships in the data.

- No one knew about the data scientist. Finance had no idea there was a data scientist already on staff, and without that knowledge, they were missing out on the ability to leverage the data scientist’s capabilities.

The second challenges lay within the team culture:

- The team was operating in silos. They were working by themselves, heads down, getting their tasks and responsibilities completed without really exploring and connecting with others. And they were focused on the past and closely aligned with accounting, converting historical general ledger data into management reporting. “From an FP&A standpoint, I saw an opportunity to become that forward-thinking, futuristic component,” he said.

- Skills deficit. First, there was a deficit in the knowledge the team collectively had of best practices related to industry tools. The incumbent professionals had been in the industry for many years and yet lacked the ability to look at things from different perspectives and angles.

Second, there was a lack of data skills. The team didn’t understand the lifecycle, knowledge or vision of data. “A lot of information was coming in from different platforms and systems. I had a step back and take a wide-angle view to understand the schema, to see how the data was flowing, how to mine it and how to extract useful information,” said the director. He developed the following map of a data science journey:

Data Analysis Journey

- Understand the business needs, challenges and opportunities.

- Assess systems, platforms & processes where data resides.

- Mine large & complex raw data.

- Exclude non-relevant data to convert into useful information.

- Develop knowledge & actionable insights.

- Create best-fit visuals.

- Build compelling stories.

- Influence decision-making and strategy.

- If useful, convert to routine process.

- Celebrate and keep the cycle going!

Approach: How FP&A Addressed the Challenge

The first step in the director’s approach was to establish a solid relationship with data science. For this, he used his natural sense of curiosity. He got to know the people within the technology organization, and that’s when he found the data scientist — the person tasked with helping translate the complexity of data to help other units.

The director connected with the data scientist. They went to lunch to get to know each other and to discuss finance’s needs and challenges. Listening intently with a mind toward understanding what the data scientist was working on, the director looked for a way to merge their experiences and tools to find the best solution.

“There were a lot of projects we needed help with, but we took the relationship and efforts step by step,” he said.

They started with small efforts to help create a working relationship, and eventually, they were able to tackle major projects that involved a lot more internal stakeholders. Part of this approach was experimenting and exploring existing tools, and what they learned is that they had tools within the organization that were not fully leveraged. This knowledge allowed them to begin to understand the functionalities and features available, and eventually to put a nice value proposition together.

The project the team tackled was to set up a volume projection model while targeting a specified operating margin:

- The first step was to leverage historical daily volume data and use mathematical modeling to project future average daily and aggregated volume. A Holt-Winters decomposition was used to capture potential seasonality of data. In addition to the expected volume, the methodology provides volumes associated with different confidence levels — projected volume decreases as the confidence level increases.

- The second step was to calculate the volume associated with different confidence levels and other inputs (e.g., future expenses, future non-clearing revenue, underspent amount), which is then used to project the required fee to target a specified operating margin.

- The third step was to put the data to work by bringing it to the business and visualizing it using a business intelligence tool. Several interactive dashboards were designed with input parameters, allowing various clearing fee outputs at different confidence levels. Prior to the deployment of this enhanced tool, it was all done manually and without agility. Within the volume projection approach, a confidence level matrix displays different aggregated volumes for different confidence levels.

- From there, the FP&A team decided to take it a step further and extend their insights and efforts. They asked themselves: What can we do now that we have the information? How can we go deeper? They were able to slice, dice and segment volume by key groups for senior leaders in a visually accessible way, and to turn their ad hoc analysis into a routine report — something requested by leadership because they found it so insightful.

Outcome: What Came of FP&A's Efforts and What Was Learned

In the short term, they delivered on the project. The finance team received a CEO award for leading a revenue optimization project, and for being able to disrupt the norm, which was something finance had never had an opportunity to do at the organization.

“We earned the opportunity to use our voice,” said the director. From that point on, they had the respect of their colleagues and the confidence to pitch innovative solutions. “It opened a lot of doors,” he said. “We were getting invited to a lot of meetings, to the point where some of the meetings would not take place unless someone in finance was partaking.”

More lasting, they changed the culture. This culture change began with relationship building — a tight and technical relationship with the data scientist and becoming a trusted business partner to senior leaders. “We were able to elevate finance. We challenged the perception of FP&A as a reporting group and proved that we are more of a margin improvement unit,” said the director.

And with these relationships came a culture change — first with the way they operated, becoming a team of data analytics and continuous improvement. Second with the people. By showing their staff the values and benefits of working together, they were all able to change their mindsets to one of initiative and open-mindedness, enhancing their organizational capacity.

“I don't see a time where everything will be perfect and I'm done,” he said. “There’s always room to improve from a reporting, processing, relationship management, partnership and learning perspective. We need to ask ourselves: How do we empower ourselves and our team in such a way that we can continuously grow? How do we automate the routine, decommission non-value-added activity, and reallocate that time to analysis? And how do we have more fun? We're spending a substantial amount of our day, and our life, at work. So, we need to figure out what elements we need to add to ensure we keep disrupting, transforming and more importantly evolving to address the many ongoing internal as well as external demands.”

Discussion: Q&A Among Council Members

What advice do you have for companies that are resource-constrained and may be too small to have a data scientist on staff?

My organization was fortunate to have a data scientist who did not reside within finance, but he was a resource for the entire company. This person was probably allocating 30% to 40% of his time to us. If you are going to use an outside consultant, be sure to look at this as an educational transfer.

What specific tools did you use?

Some power users can structure their data in Excel or leverage Power Query or Power Pivot to pull across silos; however, based on what I experienced, the tools used by the data scientists to bring in, mine and basically extract was a combination of mathematical modeling tools (e.g., Holts-Winters decomposition) and Power Pivot query language for data extraction. Then, from a BI perspective, Tableau was used to put together the visuals and the overall scenarios; we used the features to even include input parameters so that it could provide different types of competent level projections.

Can you estimate your time for this project?

From start to finish it took 3-4 months, and anywhere from 10-15 hours per week. I'm going to be honest; we were working outside of normal hours (myself and the data scientist). We were connecting sometimes at night and on the weekends so that we could ultimately put something together to share.

Did you come across the question that’s common to hear from Excel-only people: “Can you put this in Excel?” If so, how did you handle that?

Absolutely. That was brought up many, many times with people saying, why can't we put this into a spreadsheet? People are more comfortable with Excel than they are navigating a new tool like Tableau. Once, I ran a parallel test and tried to mirror what the data scientist was doing, but in Excel. I just couldn't; Excel doesn't have the full capabilities to be agile, to be able to look at it from a matrix standpoint. Input parameters involve a lot deeper insights and modeling skills.

It seems like this was such a good educational and training project for you. You learned about tools, methodologies and what's possible. Was part of your thinking that, beyond the work product, you lifted your own skill set and your team’s skill set in the process?

That's one hundred percent accurate. We need these kinds of challenges. We can turn needs into opportunities when we look at them from a different angle. We can build an appetite for many different things — culture, analytics, team spirit, collaboration and challenging the status quo.

This project opened our people's minds. They started to see the need to do a little bit of upskilling, do a little bit of reskilling; it helped get them comfortable with the uncomfortable. When we get everyone on board, we can drive this together as a team, and once you start seeing the fruits of your labor, it gives you that motivation to go back and tack on another project.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.