Articles

A Problem with Standard Costs

- By Joanne Oh

- Published: 1/17/2023

The problem with a “well-run” business is the false sense of security that takes hold and leaves a company unprepared to handle volatility. In this example of an extended planning and analysis (xP&A) challenge, the vagaries of operational forecasting challenge a manufacturing company to define “normal capacity” for production, as the basis for calculating standard rates, booking charges and creating a forecast.

The AFP FP&A Case Study series is designed to help you build up key FP&A capabilities and skills by sharing examples of how leading practitioners have tackled challenges in their work and the lessons learned.

Presented at an AFP Advisory Council Meeting, this case study contains elements that are anonymized to maintain privacy and encourage open discussion.

INSIGHT: Volatility in operations has different accounting and accountability treatments.

| Company Size: | Small subsidiary of Global Mega Cap |

| Industry: | Engineering and Robotics |

| Geography: | U.S. |

| FP&A Maturity Model: | Financial Analysis |

Financial Analysis: FP&A applies financial expertise and business understanding through modeling, pro-formas and analysis. FP&A and the business actively partner to develop the strategic and financial business case as part of a portfolio strategy.

BACKGROUND: GENERAL INFORMATION ABOUT THE COMPANY AND SITUATION

During the COVID-19 pandemic, production floor managers of a robotics company were challenged with maintaining a full complement of material handlers and assemblers to meet demand for robotic arms — despite employee sick-outs and turnover.

At the time, success was fairly easy to define: meet or exceed production targets. The key metric was the average cost per unit that includes (absorbs) into the numerator, all material, processing, and direct labor costs; the denominator was the number of units produced.

Despite the tumult of lockdowns and illness, the company achieved better-than-expected production volumes and record high-capacity utilization in 2020. By the year-end close, the gap between direct labor costs incurred and costs absorbed by the company’s standard cost system represented a delta smaller than anyone could remember.

When it came time to set production goals and financial budgets for 2021, cautious optimism began to take root, which was reinforced when production during the first six months of 2021 exceeded 2020’s solid performance. The company became lulled into thinking its crisis management skills were well-tested.

This case study was presented by a finance consultant to the company.

CHALLENGE: THE WORK OR DIFFICULTY FP&A HAD TO ADDRESS

By November 2021, the business’s president was confident that the company could achieve an ambitious 2022 Build Plan of 109,240 units. While the goal number of units was a stretch, as long as Supply Chain could get commitments from suppliers for the raw materials and the backlog at the ports started to clear, then there would be a steady stream of inventory ready to support the ambitious growth.

Within a couple of months, the outlook shifted drastically. In mid-February 2022, the demand planning team scheduled emergency meetings to review an updated forecast — nearly 70% below the original 2022 plan. Then there was a glitch in the demand planning system that; it could not handle so many order changes, move-outs and cancellations, so the team switched to using a manual system to avoid potential double counting. However, this slowed the time to develop a forecast.

Procurement only added to the confusion. Lead times for assembly kits and other key components that had ballooned to 60+ weeks were now falling back down to pre-pandemic levels. But the company’s orders had already been placed based on the ambitious 2022 plan and elongated lead times. A sudden contraction in the Build Plan would create headaches for Procurement and Logistics and lead to a lot of idle head count.

Standard Costs

Amidst all the turmoil, the cost accounting team was left with a dilemma. Cost Accounting had been spot-on in 2020, and 2021 had started off well in terms of favorable variances between direct labor costs incurred and costs absorbed into inventory. But the rapid-fire succession of changes to the company’s Build Plan was not something the quarterly tweaks to the company’s standard labor rates were designed to handle.

Finance explained to the leadership team that the drop-off in volume was causing a growing mismatch between actual direct labor costs and year-to-date absorption. The costs in the numerator were essentially unchanged because staffing (salary) is “sticky” and really only moves due to layoffs, but the rapidly diminishing number of units in the denominator meant that the cost per unit was skyrocketing.

The company’s full absorption approach made sense when the production floor operated at full capacity. But Generally Accepted Accounting Principles (GAAP) referenced “normal capacity” as the basis for calculating standard rates. The vice president of manufacturing needed to confirm what “normal” build volumes would be in 2022.

APPROACH: HOW FP&A ADDRESSED THE CHALLENGE

Finance faced several options. The business operations team wanted to maintain the fully staffed production team; they did not want to lay off any employees and instead wanted to carry those costs until production picked up again.

Demand forecasts are notoriously volatile and most of the company’s leaders agreed that it was important for the business to be prepared to deliver 100k+ units annually in normal economic conditions. Letting staff go, then finding, rehiring and retraining them would be expensive and time-consuming.

The controller had to debate this issue with Corporate Accounting. The controller considered increasing the company’s standard labor rate, which would reflect poorly on operations, but was not sure if this aligned with GAAP’s “normal capacity” guidance. And then there was the question: What is “normal capacity” in a dynamic environment?

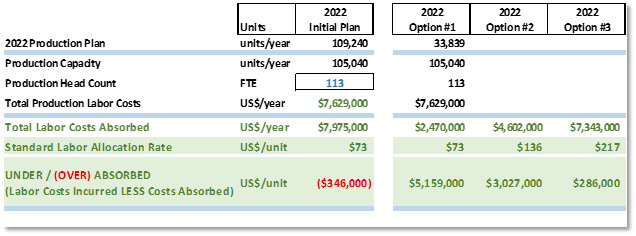

- Forecast 1 shows a standard rate of $73 and an unabsorbed cost of $5.2 million.

- Forecast 2 shows a standard rate of $136 and an unabsorbed cost of $3.0 million.

- Forecast 3 shows a standard rate of $217 and an unabsorbed cost of $0.3 million.

Normal production is something that needs to be allowed to vary since the underlying demand for the business fluctuates widely. But the controller needed to approach Finance and break the bad news about a one-time P&L hit.

Normal production is something that needs to be allowed to vary since the underlying demand for the business fluctuates widely. But the controller needed to approach Finance and break the bad news about a one-time P&L hit.

OUTCOME: WHAT CAME OF FP&A’S EFFORTS AND WHAT WAS LEARNED

At the time of this presentation, the actual outcome had not been determined.

DISCUSSION: A Q&A SESSION AMONG COUNCIL MEMBERS

It seems that the decision on the current year will be whether these production dollars live in your inventory on the balance sheet, or whether you will produce the units and expense the full labor costs in the current period.

Right. We could just throw it all in the balance sheet, which sounds good to the business owner who does not want millions of dollars added to the P&L — he has no way to recover for that. At the same time, the head of operations wants to show this as an efficiency variance so we can properly let the folks running the production floor know that their decision to reduce the number of the production volume has real consequences. And adding it to the balance sheet would hide that.

What would the treatment be on the P&L hit? Would it be a below-the-line adjusted addback to earnings?

I think the way to do this is to book an unabsorbed salary expense. I can't really come up with a valid reason to put it below the line. These are extraordinary times, but it is also not so extraordinary anymore — this is just becoming normal variance, and we're living with the ebbs and flows of the economy.

The kinds of responses a business can make to reduce this impact depend on the expected duration of the downturn.

Where you end up depends on how much time you are giving to the business. In a manufacturing environment, it’s not easy to tell the business to make a decision in a month or two. You can’t do anything about the fixed costs. But if we are anticipating a larger problem that is going to continue to grow in the next six or seven months, and we need to do something now, that is where we are really driving the business.

Maybe the economic recovery is coming in 18 or 24 months — and keep in mind, skilled labor is not the easiest to hire. In that case, you can keep everyone as long as you are willing to write the check, quarter by quarter, until production picks up.

Looking to the long-term, you could try to build flexibility into the operations. The business is actively bidding for other work, approaching other parts of the business, changing the tooling, ramping up and switching over the changeover for the lines. This could prompt you to become more of a mixed-use facility in the long term. That may be the better answer because nobody is anticipating that the volatility will dampen.

The finance processes were originally not designed to be flexible: We grabbed the cost, did the math and produced a rate. Now, we are asking about ranges and probabilities. We are asking, “Is this really the rate you want to put in? And who makes the decisions?”

Build up key FP&A capabilities and skills with AFP’s FP&A Maturity Model, a roadmap to help you and your team become leading practitioners.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.