Articles

4 Insights on Corporate Financial Analysis

- By AFP Staff

- Published: 9/25/2023

The corporate finance function conducts detailed examinations of business and operational data to determine how well our enterprise is functioning and to derive insights to make it better.

This financial and operational analysis is part of an information supply chain that aligns with the enterprise's mission and objectives, then gathers and converts data into insights that can be communicated. CFOs and the business rely on converting financial understanding to actionable insight through the skills of financial analysis, modeling and performance management.

AFP’s fourth FP&A Series, “Getting Analysis Right for Finance,” exclusively sponsored by Pigment, explored the topic of finance analysis from multiple distinct points of view. Here are key takeaways from four of the sessions.

INSIGHT #1: INFORMATION (AND CAREERS) PROGRESSES FROM REPORTING TO ANALYSIS TO STORYTELLING

“People count on us [in finance] because of our understanding of the numbers, and they listen to us because of our ability to tell the story,” said William Washington, III, Global CFO of Baker McKenzie, as he opened the event with the first session, “The Goals and Roles of the Finance Analyst.”

Facilitating the progression of information from reporting to analysis to storyteller is how we achieve that — a progression that works for both information shared and our career. Washington’s career began in FP&A and advanced, as he explained, not by focusing on how to build the best models or the most detailed accounting principles, but by relating to business decisions.

“As a CFO, what I need FP&A to do is to help me see around corners, to surface the most important information before they are asked to do so,” said Washington.

A sampling of finance job descriptions would show you that there exists a need to apply your skills across a few different task categories (with the key skills falling under finance and business acumen) including:

- The planning function.

- Performance management.

- Financial analysis.

- Personal interactions.

- Technology.

In a final note about technology, Washington said he has 1,400 people in finance reporting to him at Baker McKenzie, and he tells every one of them to dig into and learn as much as they can about AI. He has children in college studying finance, and he tells them the same thing. It’s that important.

“This is how work will get done going forward,” he said. “What if all of them were thinking about how to apply AI in their work? Can you imagine the ideas that would surface?”

Take your learning to the next level at AFP 2023, October 22-25 in San Diego. Check out the full line-up of education we've built for FP&A professionals, including a dedicated FP&A Hub, sponsored by Anaplan, where you can connect, learn and grow with your peers.

INSIGHT #2: FINANCIAL ANALYSIS IS ABOUT MAKING DECISIONS

Finance runs the internal capital market of a company, making sure cash comes in, and that it’s allocated around the company to staff, suppliers, investors and investments. Thus began the session, “The Analytical Work of FP&A,” presented by Geetanjali Tandon, Senior Vice President of Financial Planning & Analysis for Ceridian.

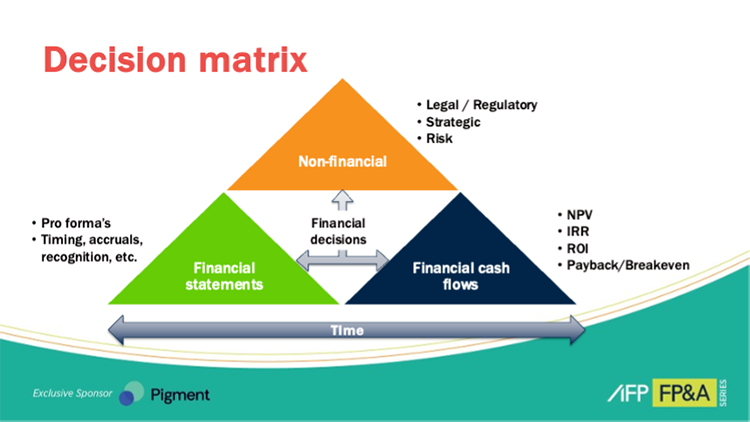

Using what Tandon titled the “Decision Matrix,” finance professionals can easily compartmentalize the three types of decisions required of them: financial statements, financial cash flows and non-financial. Financial analysis is also embedded throughout the year in the planning process.

Evaluating the expected stream of cash flows, known as financial valuation, is the most common way to look at decisions. Typical tools used to do this include NPV, IRR, ROI and payback. “Our investors also scrutinize our financial statements, which are GAAP based, so we need to be able to translate from cash flow to accounting presentations based on timing, accruals, etc.,” said Tandon.

Not all investment decisions are financial — an important point to keep in mind. The group of non-financial decisions are made to meet legal or regulatory requirements, mitigate risk or hold strategic advantages that are hard to quantify.

INSIGHT #3: FINANCIAL MODELING IS A COMMUNICATION TOOL

Models are a key tool for doing financial analysis. They allow different people to share their concept of what the question, execution and outcome can be. “A good model needs to be a powerful communication tool so that it can be used to make effective decisions, but unfortunately most models are a mess,” said Ian Schnoor, Executive Director of the Financial Modeling Institute.

When a model meets the following criteria, it’s much easier for someone to take ownership:

- Dynamic.

- Flexible.

- Intuitive.

- Printable.

- Transparent.

- Transferable.

There is a set of best practices that help ensure you’re able to meet this “best in show” criteria for modeling, as shared by Schnoor. These practices include:

- Keep the assumptions up front.

- Use different colors, such as blue for inputs and black for calculations.

- Have a scenarios page for every model.

- Never use hard code in the calculations of a model.

- Use keyboard commands rather than the mouse for greater speed and efficiency when creating models.

- Schnoor closed with a couple of tricks:

- Consolidate your assumptions in one place in the model, and then use the Watch Window to see the outcome of changing the assumptions. To navigate to this, go to the Formulas Menu and choose Watch Window, or simply click: Alt + M + W.

- Avoid long formulas with off-sheet linkages by using a “Repeat and link” method to put key elements in front of the viewer.

INSIGHT #4: MOST CFOs ARE FAILING PERFORMANCE MANAGEMENT; FIXING IT REQUIRES A STRUCTURED APPROACH

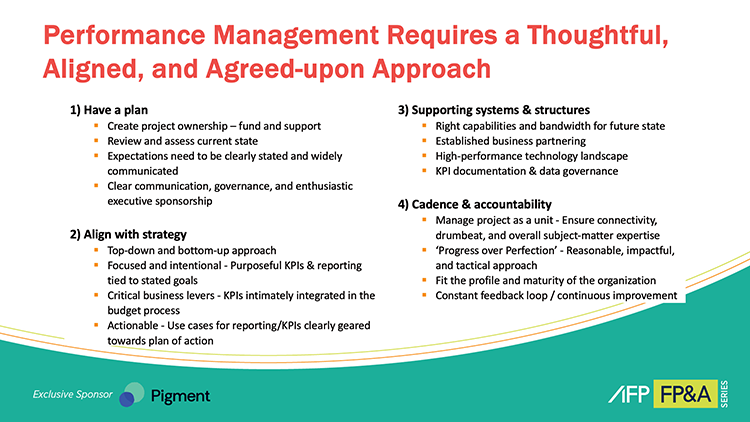

Performance management is “a system that helps companies track and drive continuous improvement through use of KPIs and reporting related to financial, operational and strategic goals,” said Jeremy Pawlak, FPAC, Managing Director for Accordion.

In the session titled “Performance Management: Measure What Matters,” moderated by Scott Corvey, FPAC, Vice President of Finance for Consero Global, Pawlak discussed the idea that performance management requires a thoughtful, aligned and agreed-upon approach. This can be achieved per the graphic shown here, which depicts how to create a simple framework.

Clarity is the primary benefit of a performance management system. When following the simple roadmap above, the system will clarify:

- Need and stakeholder expectations.

- The business strategy to work towards.

- Alignment on the path towards that strategy.

- Accountability on the delivery of results.

But most CFOs are failing in this task. According to Pawlak:

- 81% of CFOs are not living up to their “measure the business” expectations.

- 91% of CFOs are not living up to their “manage the business” expectations.

For anyone wanting to take a deeper dive into the analytical work of finance, from the foundation up to the way in which FP&A understands the business and drives performance, this was an invaluable event. Learning how and why information needs to progress up through the department, the intricacies of the ‘decision matrix’ finance professionals cycle through, best practices to ensure your financial models are being used as the communication tools they were intended to be, and how to take a structured approach to performance management — and why it’s so important — allows finance professionals at all stages of their career to offer greater value and understanding to the team, and ultimately, the entire organization.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.