Articles

Winter is Coming: Review Your Treasury Policy

- By Edwin Tey

- Published: 9/18/2015

For the longest time, treasurers with international portfolios have enjoyed a low interest rate environment, weak U.S. dollar and a healthy debt capital market with an abundance of global investors looking for yields. But with the recent volatility in the currency market led by the strengthening of the U.S. dollar and the devaluation of the Chinese renminbi (RMB), as well as a more volatile debt capital market with the U.S. looking to hike rates amid a slowing market in Latin America and China, it would be a wise move to dust off that treasury policy and revisit key points covering foreign exchange and interest rate risks.

As a treasury managing overall financial risk in four operating countries (U.S., Brazil, Japan and China) outside of the base country (Singapore), we have been preparing ourselves to face this new wave of volatility from a continuous effort to test and review our treasury policy regularly.

Treasury policy review

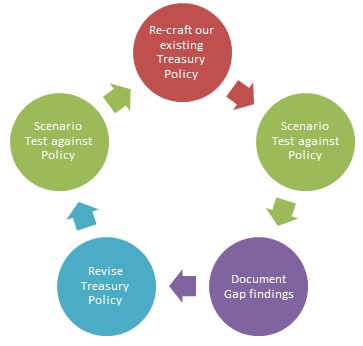

Over the last three years, we have re-crafted our group treasury policy, completed a “winter IS here” exercise, revised the policy and re-ran the exercise on numerous occasions. A “winter IS here” exercise simulates several scenarios that can happen to the treasury team. For example, the exercise addresses what to do if:

- A member of the team leaves abruptly

- FX depreciates quickly against our functional currency

- Interest rates start rising quickly

- Key systems breakdown.

While the scenarios we played out were of an extreme nature, the team has no doubt exposed themselves to crisis management and learned how to manage their work in times of stress. The scenario tests further allowed us to gauge whether our treasury policy is comprehensive and robust enough to provide assurance in good and bad times.

Useful pointers for all treasury departments

- Take this exercise seriously but be sure to inject fun and critical thinking into it. We have simulated an immediate departure of key team member and how the rest will pick up the pieces and go forth in making sure the function operate as normally as possible.

- Identify gaps by role playing. It gives the team a good sense of what each member is doing within the function and thus be able to identify gaps or actual deficiencies in the policy.

- Go crazy on the stress tests, as there are usually minimal impacts unless we stretch the boundaries. Scare yourselves with the numbers so you can fully comprehend the impact if such a scenario does eventuate. This may help participants understand the bigger picture and provide ideas within their realms to help mitigate this risk.

- Know your backup systems. Treasury teams usually rely on the treasury management system and reporting tools. It is imperative that the all members of the team are aware of how the backup systems work, who to approach when there is such a breakdown and how fast this disaster recovery can/must take place.

Taking time off to review the treasury policy and running scenario tests doesn’t sound like a whole load of fun, but it is becoming increasingly important. The holy grail of a treasury policy guides your treasury function, therefore, it must be robust and comprehensive in this ever-changing environment we operate in.

Edwin Tey is vice president, treasury at Global Logistic Properties in Singapore.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.