Articles

Transforming FP&A Management Reporting & Planning

- By AFP Staff

- Published: 1/25/2024

Flying in the face of 150 years of tradition, the CEO of a professional services company unveiled a strategic initiative aimed at fostering greater cohesion among the various operating companies, which had all been operating independently.

Operational integration required data and system integration, which fell to the Director of the Regional Center of Excellence for Data and Process Automation — and he delivered.

The AFP FP&A Case Study series is designed to help you build up key FP&A capabilities and skills by sharing examples of how leading practitioners have tackled challenges in their work and the lessons learned.

Presented at an AFP Advisory Council meeting, this case study contains elements that are anonymized to maintain privacy and encourage open discussion.

Insight: Global design principles guided a reporting and forecast overhaul that included a single source of truth, structural alignment, mutually exclusive/collectively exhaustive data elements, reporting consistency and overall simplicity.

Insight: A clean data strategy supports management and operations and lays the groundwork for machine learning.

| Company Size: | Large |

| Industry: | Professional Services (Strategy and Risk Advising) |

| Geography: | Global |

| FP&A Maturity Model: | Management Reporting |

Management Reporting: The mix of business understanding and finance skill to design and deliver the right information to the right person and the right time in the right format. Reports provide value, and business units reference them in making decisions. Insight guides action.

Background: General Information About the Company

For 150 years, this professional services corporation has been operating several independent companies that crossed multiple professional and risk management areas. Two years ago, the CEO unveiled a strategic initiative aimed at fostering greater cohesion among the various operating companies, seeking to align client engagement, product offerings and management perspectives, thereby presenting a unified front to customers. Additionally, it aimed to streamline business services by adopting a singular viewpoint, enabling a holistic understanding of clients across the entire company. The key question they asked themselves: Are we offering our clients the right solutions, or is our thinking too single-minded?

The reorganization resulted in the announcement of new regional management structures. At the same time, supporting initiatives were launched to synchronize business and reporting practices. One offshoot of this came from the Center of Excellence (COE), which initiated a project to redesign reporting and planning applications. The goal was to unify the chart of accounts with hierarchies across all operating companies.

The presenter of this case study is the Director of the Regional Center of Excellence for Data and Process Automation.

Challenge: The Work or Difficulty FP&A Had to Address

The new management structure designated a separate CFO and CEO for each region, resulting in the initiation of a comprehensive overhaul of reporting, planning and financial operations. This required the consolidation of the chart of accounts and the standardization of hierarchical versus matrixed reporting across all operating companies. Steering a large organization in a new direction creates a lot of noise and clutter, particularly given its years of organic growth, numerous large acquisitions and diverse lines of business. Some of the specific disruptions included:

- Tech & Data: There were 260 distinct fiduciary systems feeding into multiple instances of Oracle across several companies, which led to multiple non-reconciling client perspectives throughout the disconnected systems. For instance, during his tenure in the Pacific region, the Director had to extract client data from six different systems and reports, each displaying information in a different format. He had to combine and transform them to create a unified view for client analysis. The lack of unified data also inhibited the advancement of machine learning and AI capabilities, as these technologies rely on consistent datasets.

- Processes: Disparate planning processes existed across the four principal companies, and at a more granular level, variations were observed across regions and countries. Quarterly forecasts were adopted by some, while others opted for monthly forecasts. The timing of forecasts also differed. Some, driven by the month-end closing process, conducted their forecasting immediately after month-end close, while others conducted their forecasting in the middle of the month.

- Finance & Business: Different approaches to analytics resulted in localized reporting and business knowledge. The KPIs differed according to business operations, with one business assessing on a full-time equivalent headcount basis, while another focused on a peer permanent employee headcount. Company resources could not be allocated across businesses, and it was difficult for employees to move because that would require relearning your processes, tools and business structures due to the significant disparities.

Approach: How FP&A Addressed the Challenge

In order to properly reflect their new mission and goals, the team renamed their Center of Excellence the Strategic Insights Group. Along with the new name came a fresh set of goals that included:

- Flexible Planning: Develop a flexible enterprise planning application that enables the efficient input of projections.

- Efficient Reporting: Streamline the consolidation of financials across business units and verticals.

- Streamline: Enable finance and HR to respond to evolving business needs.

- Future Proofing: Develop a structure that enables sufficient performance now and anticipates future growth where there will be more responsibility centers and increased structural complexity.

Next, they formed several workstreams, including a rolling forecast, workforce planning and driver-based modeling. Additionally:

- Structure Design: Enable a unified reporting structure that can simultaneously report for the corporate whole, the operating companies and sub-entity reporting.

- Chart of Accounts: Achieve a unified look and feel by aligning account groupings. This was primarily driven by the perspectives of the corporate head office across all operating companies.

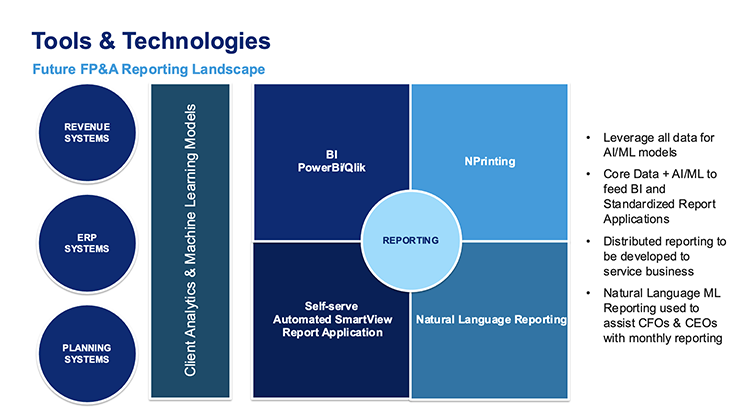

- Budget & Forecast Processes: Minimize the effort required to create monthly reporting and provide the business with an earlier forward view. They started by assessing the models they worked on and tasked the Innovation Center with building out machine learning models (currently undergoing testing). The pilot concept had the system generate the laborious baseline, allowing their FP&A colleagues to focus on working with the business to understand the key drivers that will change the trajectory.

Structural Design

The following five core principles guided structural changes.

| 1. Single Source of Truth | Implement a financial structure that establishes a universal approach to reporting accurate and consistent financials. Example: They have centralized the process of endorsing and approving exceptions to structural governance. |

| 2. Structural Alignment | A common business structure across finance and HR technologies, with complete alignment across all dimensions (both members and levels) |

| 3. Mutually Exclusive/ Collectively Exhaustive | Members in each multidimensional attribute (MDA) must be mutually exclusive/collectively exhaustive and adhere to the MDA definition outlined in this document. Example: MDAs are attributes (e.g., geographic, segment, product) assigned to a cost center to enable matrix-level reporting, but they must be unique across dimensions; you can't have a roll-up in your responsibility center hierarchy for segments if it's already within the segment hierarchy. |

| 4. Reporting Consistency | MDAs are the mechanism for generating consistent and accurate consolidated reporting. They create a common framework for reporting various P&L cuts across geographies and businesses. Example: They are ensuring that businesses do not need to create their own custom EPM reports. The team achieved this through the creation of a self-service-automated smart view reporting application that enables users of all levels, even those who do not understand or have training on EMP or smart view, or any complex understanding of the hierarchies, to utilize and run reports. |

| 5. Simplicity | Strive to maintain a simple structure to ensure user-friendly navigation, optimal performance and future-proofing considerations. |

Outcome: What Came of FP&A’s Efforts and What Was Learned

Here is how the team mapped the key principles into management reporting:

- Standardized reporting with a simple user interface was established, empowering users to run their own reports without an in-depth understanding of underlying systems.

- Implemented a single reporting multidimensional hierarchy and definitions across all lines of business.

- Standardized the chart of accounts across the entire reporting framework.

- Migrated all lines of business to a single reporting and planning tool.

- Developed a client revenue analytics platform, consolidating all fiduciary systems, standardizing client data and definitions, and providing a unified client view.

- Cleaned data and incorporated machine learning and AI models for enhanced planning and reporting. Implemented a unified budgeting methodology and calendar.

- Globally restructured FP&A teams and Insight Centers to deliver standardized FP&A support across all regions.

The team is also working on the management of risk in two specific areas. Here is a breakdown of the key issues they are coming up against:

| Risk in User Adoption | Risk in Centralization of the Process |

| FP&A is comfortable with what they know. | Need to create a balance between the advantages of centralization and the benefits derived from localized knowledge. |

| Removing work might create a false concern that people’s jobs are at risk. | Oversimplifying may lead to a loss of transparency in the data, impairing the ability to conduct thorough analyses. |

| It’s not always easy to refocus from data gathering, analysis and reporting to business analysis and the impact changes within the industry will/could have on the organization’s finances. | Lack of familiarity with local business nuances could result in BI and standardized reporting falling short of meeting the specific requirements of business partners. |

| Excessive governance of processes stifles the business's ability to be nimble. |

Discussion: Q&A Among Council Members

How long did the project team plan in terms of building up the project?

About two years. It took us about a year to go live with the one reporting cycle, and it will be another year for the planning cycle. We built in a pause so as not to interrupt next year’s budget cycle.

I heard a presentation at an AFP conference where a similar project took several years longer; how did you get the first part done in a year?

I’ve been talking only about the financial reporting side. If you're asking about the client-level reporting, that started a year earlier and is still ongoing. And I can tell you it's a nightmare; I've created a pseudo-IT department within my team to solve a lot of the complexity.

I want to understand more about the work streams. Were only finance folks involved, or did it include cross-functions? And was it at a global level, or did it include the operational companies as well? What is your feedback in relation to achieving a good balance?

We ensured that we had every regional FP&A leader on the team, and the relevant functional FP&A leaders also. We brought in the business as needed, too. For example, HR systems feed all of our systems downstream, so we worked with the centralized HR team, and others collaborated with field teams.

Even though there was executive sponsorship, were there ever moments when you were stymied by cashflow constraints?

Oh, consistently! The new CEO had a big mandate and a big checkbook to get this done, so we were given quite a lot of leeway in that. But at every point, whenever we put something forward, it was analyzed, and we were questioned: Is there a better way? Can we do this in phases? What needs to be done immediately, and which areas can we work towards four or five years from now? The checkbooks were opened up as long as we made the case that it was the right solution, but there were tradeoffs throughout.

Here’s an example: We got one estimate from the consultants that was exorbitant and would take too long. So, I built an in-house IT team that included a couple of colleagues who are strong in Python. I hired a data manager, and we developed our own way of getting to the data. By the time my team finishes, it's going to be a tenth of what external IT consultants charge.

How are you managing resistance to change within the finance function?

The biggest resistance has been toward changing the organizational structure. We have had discussions with regional senior leadership to help them understand the benefits and how we can assist them in getting their teams on board. We’ve also had discussions with the regions and regional FP&A.

Every step of the way, we work to assure them that we are not imposing a solution on them because there is simply no way we can know everything about their business. For example, if the region has structured designs that break our rules, we'll sit with them to understand why. Is there another way they can get to it? Is there something we can do to assist them in simplifying it?

At the end of the day, if it’s something they feel adamant about, and we can't justify breaking their rules on our side, we aren’t going to simply say no. They can put that request to an enterprise governance committee, which comprises certain FP&A leaders across the regions and central FP&A, who will then review the merit of these requests and make a decision.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.