Articles

The FBAR Filing Date is April 18. Treasurers, Are You Ready?

- By Staff Writers

- Published: 4/11/2017

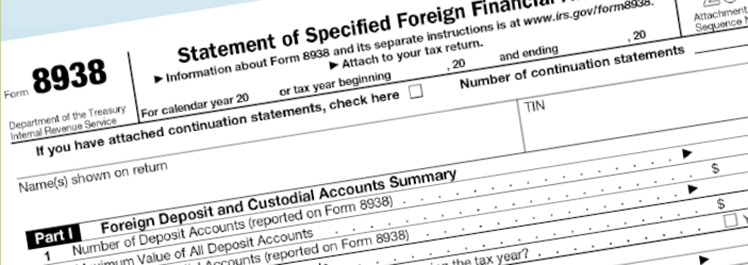

Many treasury and finance professionals have questions about filing Reports of Foreign Bank and Financial Accounts (FBAR), especially since the FBAR filing date has been moved up from June 30 to Tax Day (April 18 this year, April 15 in subsequent years).

The Financial Crimes Enforcement Network (FinCEN) and the Internal Revenue Service (IRS) have actually granted taxpayers a six-month extension. But if you are filing next week, you’ll want to double-check and make sure you’re clear on the FBAR requirements. Conversely, if you’re waiting until October 15 to file, it’s probably because you need some questions answered. There has been a great deal of confusion on several aspects of the regulation—even before the change in the due date.

Lucky for treasury and finance professionals, AFP compiled its coverage on FBAR for your convenience. AFP staff and several corporate practitioner members spoke with regulators from FinCEN and asked specific compliance-related questions. Who has to file an FBAR? Who is exempt? Who has ‘signature authority’? These and more questions are answered.

Again, FBAR requirements have been nothing if not confusing. That’s why you should take some time to review AFP’s guide on FBAR before you file.

Download FBAR: What You Need to Know here.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.