Articles

The DuPont System: Comprehensive Ratio Analysis

- By Karl Kern

- Published: 12/14/2023

Am I getting my money’s worth?

Every consumer wants to know this before spending or investing. For investors (and those working for the CFO), the most common way to address this question is to ask, “How does the company create income (the return) relative to the investment of the shareholders (the equity)?”

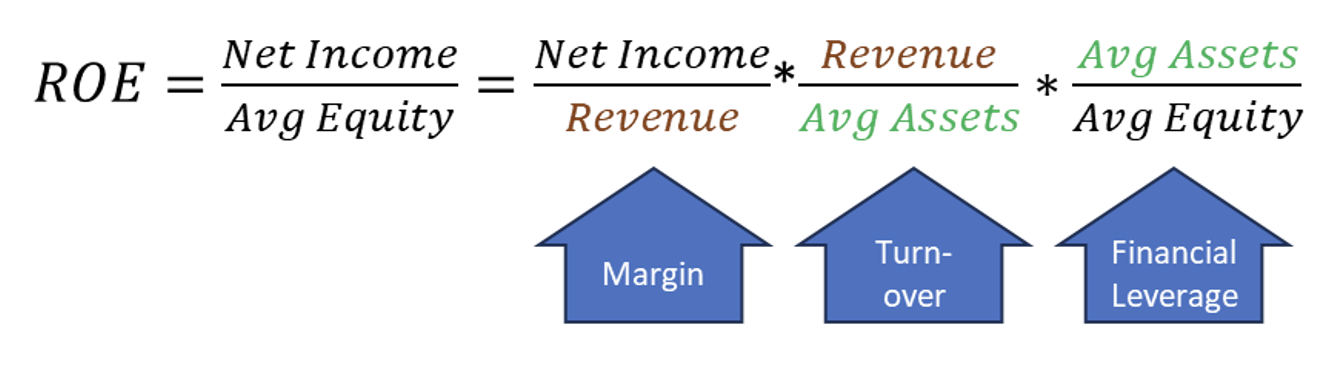

The return on equity (ROE) is easy to calculate, but as often happens, a single number does not tell the whole story. Enter the DuPont System, a way to disaggregate ROE and understand the business operations as revealed across both the income statement and balance sheet.

The key to the math is to notice how the revenue and assets can be applied in the smaller calculations but cancel out in the overall ROE calculation.

- Margin = Net Income / Revenue (also called Net Sales): This informs how well the company can make money and make good on its promises. Beyond investors, this matters to creditors like suppliers, service providers and lenders. Employees have a huge stake in knowing if their company is profitable.

- Turnover = Net Sales / Average Total Assets: This element tells how well the company is extracting value from investments in long-lived assets like inventories, fixed assets and intellectual property.

- Leverage = Average Total Assets / Average Total Stockholders’ Equity: A balance sheet contains three parts: assets on the left, balanced by debt and equity on the right. A higher asset leverage implies a smaller debt level for the company to manage.

An Application of the DuPont System

Let’s say we want to compare potential investment opportunities. Let’s start with a trend analysis of selected companies over the last five fiscal years:

- Caterpillar

- JP Morgan Chase

- Merck

- Microsoft

- Nike

Let’s begin with Caterpillar.

| Fiscal Year End | Margin | Turnover | Leverage | ROE |

| December 31, 2018 | 11.23% | 0.70 | 5.58 | 44.15% |

| December 31, 2019 | 11.33% | 0.69 | 5..47 | 42.45% |

| December 31, 2020 | 7.18% | 0.53 | 5.22 | 19.98% |

| December 31, 2021 | 12.73% | 0.63 | 5.05 | 40.96% |

| December 31, 2022 | 11.28% | 0.72 | 5.08 | 41.38% |

Let’s continue with JP Morgan Chase.

| Fiscal Year End | Margin | Turnover | Leverage | ROE |

| December 31, 2018 | 29.78% | 0.04 | 10.07 | 12.68% |

| December 31, 2019 | 31.48% | 0.04 | 10.25 | 14.07% |

| December 31, 2020 | 24.29% | 0.04 | 11.23 | 10.78% |

| December 31, 2021 | 39.73% | 0.03 | 12.43 | 16.86% |

| December 31, 2022 | 29.28% | 0.03 | 12.63 | 12.85% |

Let’s continue with Merck.

| Fiscal Year End | Margin | Turnover | Leverage | ROE |

| December 31, 2018 | 14.71% | 0.50 | 2.77 | 20.24% |

| December 31, 2019 | 21.01% | 0.56 | 3.16 | 37.23% |

| December 31, 2020 | 17.02% | 0.47 | 3.42 | 27.50% |

| December 31, 2021 | 26.79% | 0.49 | 3.10 | 41.00% |

| December 31, 2022 | 24.49% | 0.55 | 2.55 | 34.44% |

Let’s continue with Microsoft.

| Fiscal Year End | Margin | Turnover | Leverage | ROE |

| June 30, 2019 | 31.18% | 0.54 | 2.50 | 42.41% |

| June 30, 2020 | 30.96% | 0.49 | 2.66 | 40.14% |

| June 30, 2021 | 36.45% | 0.53 | 2.44 | 47.08% |

| June 30, 2022 | 36.69% | 0.57 | 2.26 | 47.15% |

| June 30, 2023 | 34.14% | 0.55 | 2.08 | 38.82% |

Let’s end with Nike.

| Fiscal Year End | Margin | Turnover | Leverage | ROE |

| May 31, 2019 | 10.30% | 1.65 | 2.62 | 44.57% |

| May 31, 2020 | 6.79% | 1.36 | 3.22 | 29.70% |

| May 31, 2021 | 12.86% | 1.29 | 3.32 | 55.01% |

| May 31, 2022 | 19.94% | 1.20 | 2.78 | 43.11% |

| May 31, 2023 | 9.90% | 1.32 | 2.66 | 34.63% |

Investment Opportunities

What do we see? The companies are in very different industries and are considered to be mature companies and well-managed. Each company presents areas for further inquiry.

Four of the five companies average ROEs above 30%; JP Morgan Chase requires additional analysis because of its relatively low ROE.

- Caterpillar: Fiscal year 2021 was very difficult as margins were significantly lower, likely due to pandemic supply chain snarls that limited the company’s ability to fulfill orders. Despite this hit to cash flow, the company did not take on excessive debt and returned to healthy ROE the following year.

- JP Morgan Chase: At first glance, the low ROE might scare off investors, but financial services companies will generally have significantly lower turnover and higher leverage due to the huge balance sheets inherent in their lending practices. Notice the margins are very high!

- Merck: Turnover raises questions about which assets are contributing to the low numbers. Are current assets the factor that raises questions about the company’s liquidity? Are long-term assets the factor that raises questions about the company’s solvency? If the answers to the questions are acceptable, investment opportunities may exist based on the company’s improving margin and tolerable leverage numbers.

- Microsoft: Margin clearly indicates the strength of the company’s ROE, which provides opportunities for further examination. The examination should focus on the various divisions within the company, e.g., Intuit and LinkedIn. If divisions like these and others are not seen as contributors to the company’s margin, caution may arise because it may indicate that the company’s expansion into other services may lead to divestiture like Disney is currently facing.

- Nike: At a high level, it appears that the company is relying on efficiency instead of growth to reward stockholders, i.e., high turnover. The question of growth can be answered through margin analysis as well as an examination of leverage. Is the company foregoing growth opportunities because it is not relying on creditors like the other companies in this example? In addition, Nike’s presence in college sports raises questions about the company’s ROE because of the issues associated with “NIL deals” where students can profit from their name, image and likeness.

One of the questions raised about ratio analysis is whether one ratio can assess a company’s financial health. One can argue that one ratio can be used to assess a company's profitability or a company's liquidity or a company's solvency, but the argument can be based on subjectivity.

The DuPont System is an objective approach to assessing a company’s financial health. The objectivity of the system is centered on its coverage of every element within a company’s income statement and balance sheet. It’s this coverage that classifies the DuPont System as an approach to comprehensive ratio analysis.

Looking for More? Get Karl Kern's five steps for effective radio analysis.

About the Writer

Karl Kern is a Visiting Assistant Professor of Accountancy at Providence College. Connect with him here on LinkedIn.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.