Articles

New Skills Needed in the Workplace for Today’s Digital World

- By Vivek Saxena

- Published: 10/30/2018

New skills needed in the workplace for today’s digital world may seem obvious to many. However, some financial planning and analysis teams still have some catching up to do. FP&A needs to improve its digital skills to make finance greater than the sum of its parts.

Every second that you spend reading this, Google is answering more than 40,000 search queries, harnessing the power of two billion people. The search engine connects what users want with what they choose, producing a body of information that is infinitely greater than the sum of its parts.

The analogy holds true for finance, specifically functions like financial planning and analysis (FP&A) and enterprise performance management (EPM). To make finance greater than the sum of its parts, we need to make similar connections. For example, to become a true business partner we must link:

- An organization’s vision with finance’s role in that vision

- Execution speed with capacity and quality

- How insight is consumed and acted upon.

For many organizations, gaps still exist on all three fronts. But new skills and technologies can change finance and EPM capabilities for the better. As this article outlines, they can provide better, faster insights that result in solid strategic decisions.

WHAT CAUSES THE DISCONNECT?

Before finance can fully connect with the business, it faces four common challenges:

- The data deluge: Is your data a strategic asset? Data is no longer a competitive differentiator for most companies given how much of it they create and bring in. About 80 percent of it is unstructured in the form of emails, social media ‘likes’, call scripts, news, audio, and so on. As a consequence, finance teams are drowning in data instead of using it to drive action.

- Lack of insight: “I’ve noticed that when the anecdotes and the data disagree, the anecdotes are usually right,” Amazon CEO Jeff Bezos recently said at in a recent discussion at the Forum on Leadership at the Bush Center. Trend analyses and other descriptive analyses don’t help in today’s dynamic environment where scenarios change at speed. Organizations need more predictive and prescriptive capabilities.

- Inability to forecast risk: The world is becoming harder to predict. As political, economic, and technology developments create realities nobody could expect, companies are struggling to prepare for new risks and the potential impact on growth, revenues, and overall performance.

- Failing to provide the right tools: While most of us readily connect digitally in our private lives, workplaces have been slow to take advantage of the opportunities from voice, mobility, or advanced technology. Few have the infrastructure or applications that provide the real-time, prescriptive insights needed to act quickly.

FILLING THE INFORMATION GAPS

The best finance teams use digital advancements to fill the gaps between the information business teams want, what finance delivers, and what actions are achievable. They do this by:

- Focusing only on those things that are important to the enterprise. As such, it’s essential for organizations to constantly refresh the leading and lagging indicators they rely on. An unwillingness to change and a lack of scale contributes to the huge volumes of information that can paralyze decision makers. Focusing on what is truly important drives action.

- Harnessing large amounts of structured and unstructured data on customers, finance, and operations. Digital tools handle it all with much less time and effort, empowering organizations to make predictive decisions. One aircraft manufacturer, for example, uses the internet of things and sensors on aircraft to capture data in real time. The result: fewer grounded aircraft and operational costs cut by up to 40 percent.

- Using artificial intelligence (AI) to turn analytics into insights: Progress in computing and AI has significantly improved the accuracy of analytics-driven predictions. Our third-party risk management solution, for example, analyzes vendors’ past behavior and patterns to predict how they will act and recommend whether companies should use them again. That has resulted in fewer compliance issues and more robust supply chains for global firms.

- Using apps to drive user experience and action: A consumer packaged goods major has improved user experiences with an app that quickly connects the right cost-center analytics to the right cost owners in time to drive the right action.

NEW SKILLS NEEDED

While technology is one part of the solution, finance teams need broader business acumen to become true business partners. There are a number of trends we expect to see over the next four to five years that could influence whether they get there:

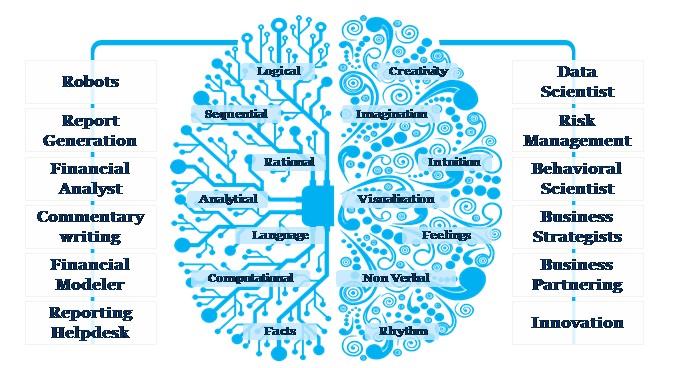

- The digital workforce will take on left-brain activities (see figure 1)

- Talent will become more adaptable and mobile, and the gig economy will change the shape of finance

- Finance teams will develop new capabilities:

- New skills to supervise robots and improve AI, for example

- Specialists will emerge in EPM: cash or risk czars, data scientists, chief economists, statisticians, and even anthropologists

- EPM centers of excellence will become more specialized focusing on tax, risk, compliance, analytics, technology, and more.

Figure 1: As technology takes on left-brain activities, FP&A becomes a better business partner:

Source: Genpact.

THE DIFFERENTIATOR: MAXIMIZING HUMAN AND DIGITAL SKILLS

The widespread adoption of digital technologies will free up people to do what they do best – activities such as reasoning, planning, creativity, and problem-solving. That’s where we have a clear advantage over machines.

With the right blend of skills—across both man and machine—EPM will enable better business partnering by eliminating the gaps between the information desired, delivered, and actioned. The result is a hybrid workforce that helps businesses make faster, more informed, and accurate strategic decisions, a new source of competitive advantage.

Vivek Saxena is Global Record to Report Leader, Genpact. He is based in New Delhi, India.

Companies are looking to FP&A professionals for direction. Show them you can lead the way by earning the Certified Corporate FP&A Professional credential. Download the brochure to learn more.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.