Articles

Creating Value in APAC: FP&A's Role for Organizations

- By Joanne Oh

- Published: 10/7/2022

FP&A has an opportunity to lead the charge as a real-time data analyst, trusted advisor and skilled communicator. To get there, however, FP&A will need to upgrade its tools and create new capabilities for finance, ultimately forming new operating models for how FP&A delivers its services to the company.

FP&A has an opportunity to lead the charge as a real-time data analyst, trusted advisor and skilled communicator. To get there, however, FP&A will need to upgrade its tools and create new capabilities for finance, ultimately forming new operating models for how FP&A delivers its services to the company.

The AFP webinar, “The Who, What and Why of Financial Planning & Analysis” discussed ways in which companies and teams have become more agile, the role of FP&A in offering real-time and forward-looking decision support, and the need for technologies to help teams operate more efficiently. The webinar was a companion to the discussion begun in AFP’s FP&A Handbook, underwritten by Jedox, and featured speakers from the Asia-Pacific region: Cecile Francais, FP&A Director for Cartier China; Rahul Pandey, head of solution advisory, APAC, for Jedox; and Siang Leng Tay, CFO for QBE Asia.

The faster, nimbler decision-making process

The past few years of uncertainty have changed the decision-making process and increased the cost of doing business. Companies have had to stay agile and adapt to changes quickly in order to stay in business. For Francais who is based in China, a concrete example of her company staying agile was putting multiple supply chains in place. The operational redundancy ensured that if one location went into lockdown because of COVID, the company could still source materials from another location. In addition, the company changed the structure of contracts to enhance cancellation policies in case terms cannot be fulfilled. Francais has noticed a change in investment decision criteria, adding cash flow indicators (including payback) to existing profitability indicators.

Finance teams are also embracing dynamic rolling forecasts. “It's no longer acceptable for organizations to do only budgets or forecasts, which will take weeks or months,” said Pandey. “They need to respond quickly. They need to build models. They need to adjust and see new projections, and this has to be on demand.”

Building bridges between finance and IT

Pandey sees the ability to harness data to form real-time decisions as being critical to decision support. To do this, FP&A teams need to free themselves from manual processes so they can focus on forward-looking decisions. And before a shift to automation can take place, companies need to first make sure that their data and infrastructure are in order.

As the C-suite has become more familiar with different technologies on the market, executives have become more open to ways in which technologies can help their teams become more agile and improve decision-making. In order to implement these technologies, finance teams must collaborate with IT, as Pandey explained: “You can’t do transformations without involving IT because they understand the source system. They understand the actual data that is coming in.”

Traditionally, IT and finance teams may have had challenges communicating because of their different domain expertise. To overcome this challenge, increasingly, CFOs are building a Center of Excellence (COE) team — a group that understands both technology and finance and is able to collaborate with the IT department.

“The more cross-pollination we have across functions and the more open conversations we have with each other,” Tay said, “will allow us to bridge that gap, which will lead to better outcomes.”

A trusted advisor to the business

FP&A is still relatively new in the CFO’s organization, leading to some confusion about what the team delivers. Additionally, FP&A often goes by different names across different companies and industries. Because of that, non-finance people often do not understand what FP&A does. “It’s very important that the FP&A function has a clear definition of where they belong and what value they can bring,” Francais explained, for once people in the business know what FP&A does, they will “come to us with the right questions and give us the chance to participate in the discussion before the decision is made.”

Tay echoed the sentiment and said that he values “being a trusted advisor and challenging the norm.” He sees FP&A supporting the business best in the areas of allocating capital, prioritization and ensuring a strong return on capital.

In order to succeed as an advisor, FP&A professionals need to have a variety of competencies. When Tay hires, he focuses on three core skill sets — data analysis, comfort working in uncertainty, and communication — and looks for people to have at least one of the three, if not more. Communication skills, in particular, are necessary when serving as a bridge between finance and business. FP&A professionals need to be able to tell a “compelling vision and story to all levels of the organization,” said Tay.

When it comes to data analysis, Tay explained that it is important to look for the underlying reasons behind data trends. For example, if you were to look at the loss history of motor insurance over the past couple of years, you might see that the claims numbers are down and stop there. But by digging deeper, you would realize that this is because there were fewer cars on the road when people stayed home during the pandemic. Knowing that the numbers were driven by abnormal circumstances would affect any recommendations you would make based on the data.

Too many priorities, not enough time

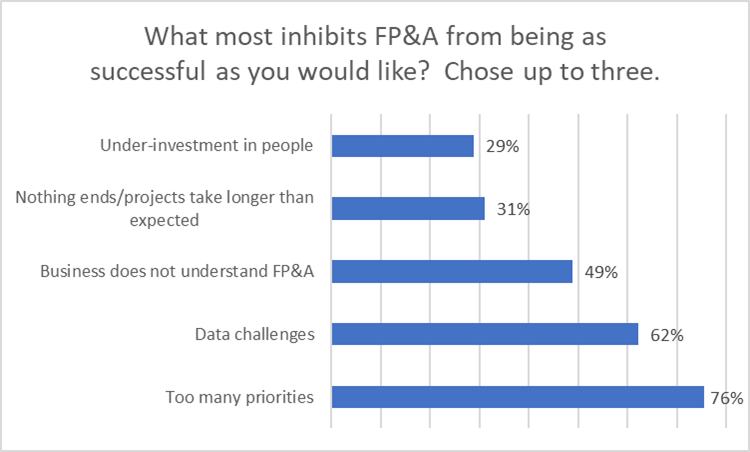

When polled on which factor prevents the FP&A function from being as successful as it could be, webinar attendees overwhelmingly selected “too many priorities.” Francais has also seen the problem of “too many priorities” play out in her own experience, citing FP&A’s efforts to dive into the business are crowded out the many regular deadlines, including monthly closing and forecasting, budgeting, quarterly running forecast and three-year plans.

“Sometimes we lose the purpose of what we are doing with so much forecasting,” said Francais. Perhaps with fewer, more meaningful priorities, “it would help us do a proper analysis, go deeper in the numbers, go deeper into the parameters of the business, so we can understand better as the business keeps evolving and get a better sense of the trends.”

“Sometimes we lose the purpose of what we are doing with so much forecasting,” said Francais. Perhaps with fewer, more meaningful priorities, “it would help us do a proper analysis, go deeper in the numbers, go deeper into the parameters of the business, so we can understand better as the business keeps evolving and get a better sense of the trends.”

Better tools to help with predictive analysis, particularly modeling tools with artificial intelligence and/or machine learning, could help automate manual processes and free up time. Tay also pointed to data integrity challenges as taking up too much of FP&A’s time: “We spend 70% of our time scrubbing and 30% of time analyzing, which should be zero and 100% respectively once the data is clean.”

But quality matters as much as speed, and any new technology needs to excel in both. “The worst thing that can happen is if you're not aware that the data has limitations and you present a set of recommendations to an executive,” said Tay. “Very quickly, it falls apart and the credibility and trust of the function are severely impacted.”

Interested in learning more about how FP&A can add value to the business? Download the FP&A Handbook: The Who, What and Why of FP&A.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.