Articles

Does Green Capital Lead to Green Decisions?

- By Niels Gormsen, Kilian Huber and Sangmin Oh

- Published: 3/14/2023

Insights Based on an AFP and Chicago Booth Survey

The surge of “green investing” in capital markets reflects increased demand among professional and household investors to put their money into climate-friendly products and low-emission production. A common objective of green investors is to stimulate the future investments and growth of “green companies.” For green investing to succeed in this endeavor, two conditions need to hold:

- Green companies need to perceive that their cost of capital falls when green investors purchase their stocks and bonds.

- Green companies need to then actually take advantage of their cheaper cost of capital and invest more.

While recent work has analyzed how green investing influences the prices of stocks and bonds, we know little about how companies have perceived green investing and whether they have actually responded in the way that green investors foresee.

To better understand what is happening in boardrooms and decision-making suites, AFP and academics at the Booth School of Business at The University of Chicago conducted a joint survey in October 2022, surveying 77 treasury and finance practitioners.

Green Capital Markets Are Lowering Cost of Capital

By buying the stocks and bonds of green companies, investors reduce the cost of capital of these companies. That means that green companies can more cheaply get funding for their investments, while the funding of “brown companies” (relatively high carbon emitters) becomes more expensive by comparison. Green companies should then invest more, grow faster, and develop new and even greener technologies. Ultimately, the aim of green investing is for total emissions produced in our economy to fall, reducing the risk of dangerous climate change.

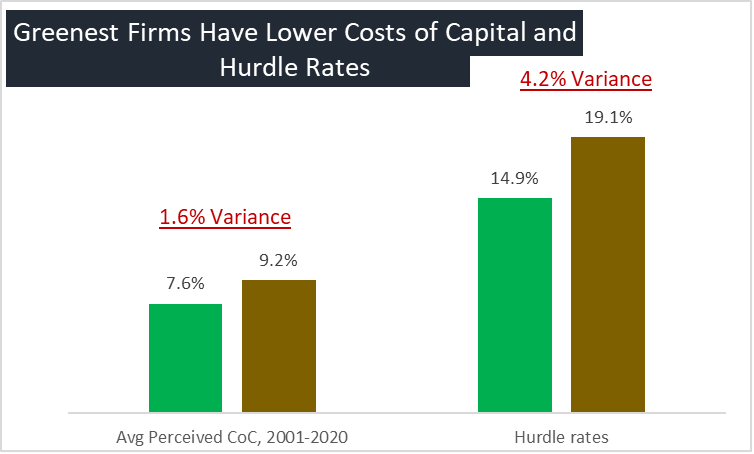

Recent academic research uses the cost of capital reported by firms on their conference calls to shed light on these conditions.1 The average perceived cost of capital was significantly lower for greener firms in the last 20 years by 1.6 percentage points. Firms have incorporated the lower cost of capital into their hurdle rates — the internal measure of expected financial return from a new investment project. The average hurdle of the greenest firms was 4.2 percentage points lower in the last 20 years, both in the U.S. and abroad, relative to the brownest firms.

This effect is likely due to the popularity of green investing in recent years. There was almost no difference in the perceived cost of capital of green and brown firms before 2016, versus a 2.6 percentage point spread after 2016. Similarly, the hurdle rates spread between green and brown firms was small up to 2016 and rose to almost 6 percentage points from 2016 onward. These findings suggest that green firms have also adjusted their investment as green investing has surged.

No Explicit Green Factor Applied to Financial Valuation Today

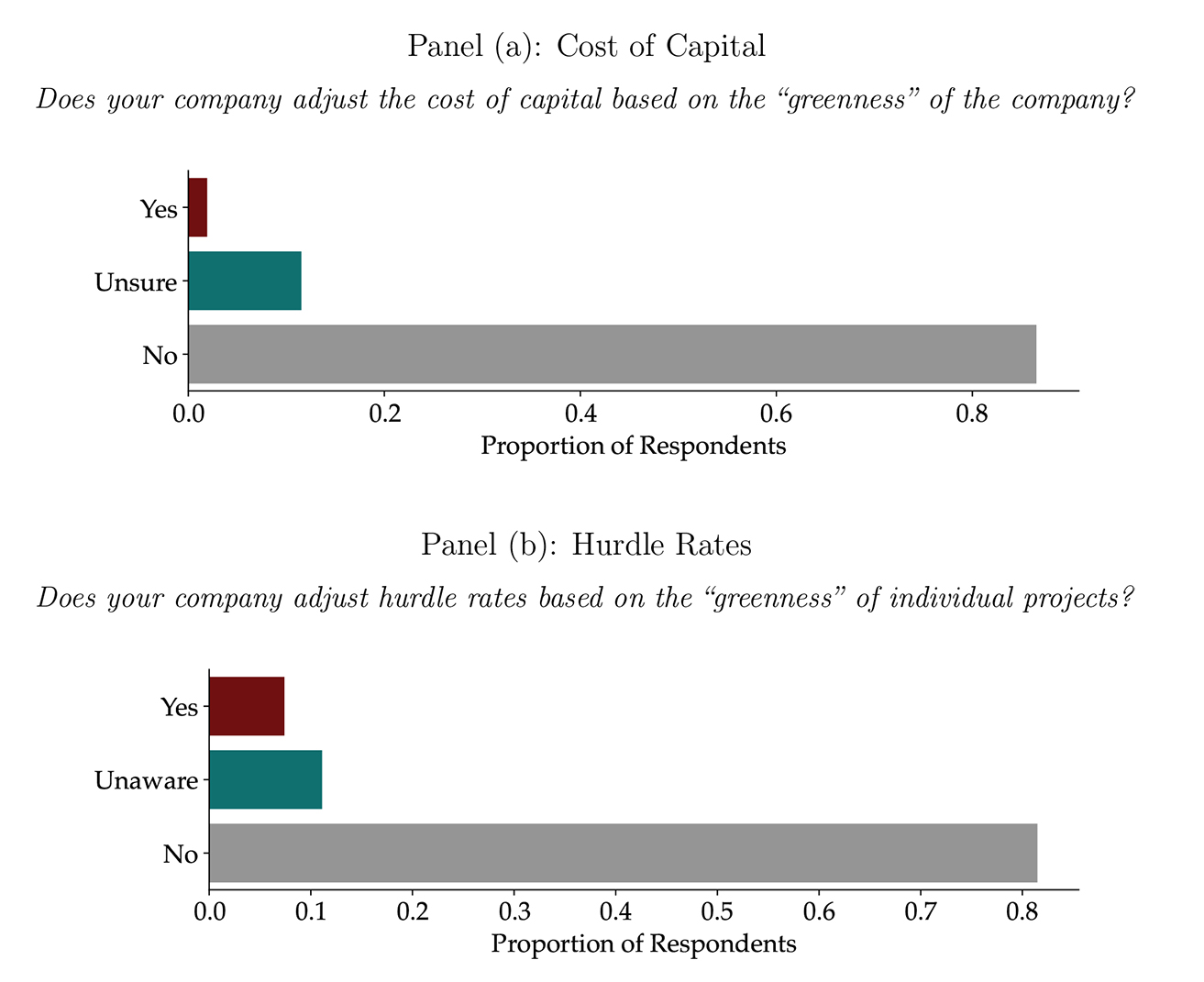

AFP and Chicago Booth’s survey tested the idea that firms directly account for their greenness when estimating their perceived cost of capital. To the question of whether companies incorporate an explicit green factor in their valuation methods and decision models, virtually all respondents say “no.”

While respondents do not apply green discounts to specific project calculations, it seems that firms indirectly reflect the greenness to lower overall perceived cost of capital. Conference call data gives some support to this possibility, as other variables, such as size or market beta, mediate some of the effect of firm greenness in statistical analyses.

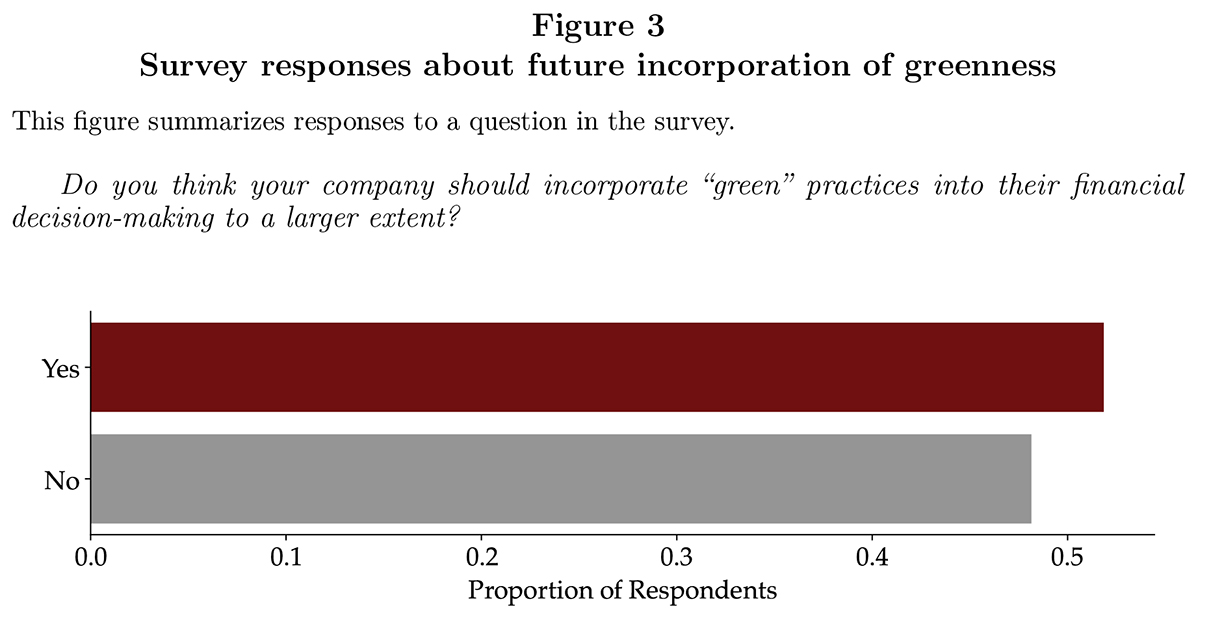

When asked if they should incorporate green practices into their financial decision-making, around 36% of managers are either considering this possibility or believe it to be a good idea. Around 50% of managers think they should incorporate green practices into their financial practices to a larger extent.

Beyond cost of capital/hurdle rates, 36% of respondents arrive at green decisions based on strategic or non-financial reasons, including (in order of importance) company mission, customer satisfaction and branding, and employee satisfaction. Twenty-four percent said that they make green decisions due to regulatory and compliance factors. These trendlines and the proven access to cheaper capital suggest that green investing is going to have even larger effects on the growth of green firms in the future.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.