Articles

Check Use Drops to All-Time Low for B2B Payments

- By Joanne Oh

- Published: 10/31/2022

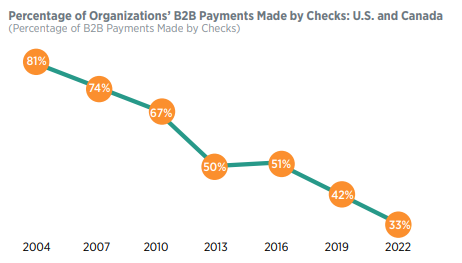

Check usage continues to decline for business-to-business (B2B) payments in U.S. and Canada (North America), falling to an all-time low of 33% since AFP began tracking this data in 2004, according to the 2022 AFP Digital Payments Survey, underwritten by J.P. Morgan.

B2B check payments have dropped 9 percentage points in North America since 2019. This is consistent with the steady deadline in check usage reported by organizations over the past two decades. Since 2004, check usage has fallen by over 40 percentage points.

Within North America, when paying major suppliers, the gap between paper and digital payments has widened to 13 percentage points, with 39% of organizations using ACH credits while 26% continue to use checks. This gap has increased by 11 percentage points since 2019, when the gap between ACH and checks was only two percentage points.

When sending or receiving ACH payments, organizations employ a variety of methods. Email is most widely used to send remittance information (used by 61% of organizations), followed by EDI/CTX or EDI/CCD+ (26%), and regular mail (17%).

Speed matters for B2B payments

In the current business environment, in which supply chain woes continue and suppliers change prices frequently due to heightened inflation, the speed of B2B payments is critical. A majority of all survey respondents (54%) report speed as the primary driver when choosing a payment method.

More efficient reconciliation is considered a key benefit by 40% of respondents — up from 35% in 2019. Fraud control was cited by 39% of respondents as a key benefit. Because digital payments are more difficult to alter, and therefore more secure, switching to digital payments can help guard against fraud attacks.

Interestingly, cost savings ranked fourth among benefits of digital payments, cited by 34% of respondents. Other positive byproducts of moving to digital payments include improved forecasting, better working capital and supplier relations. While these benefits ranked lower, they are evaluated when companies decide to do a large-scale payments transformation project to move away from paper.

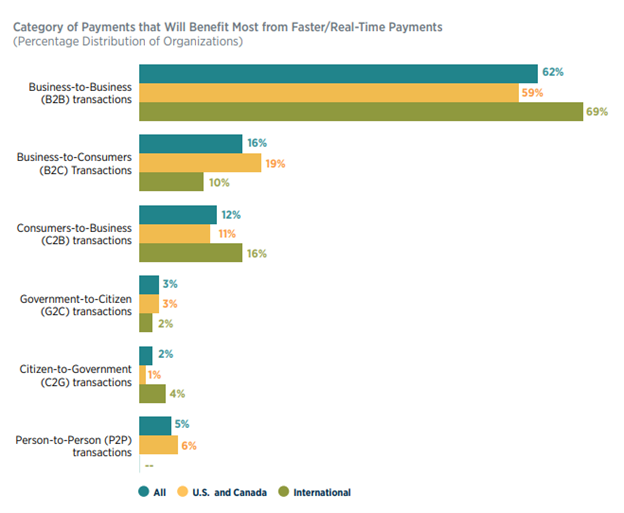

Sixty-two percent of all survey respondents report that B2B transactions will benefit the most from faster/real-time payments. For transaction types beyond B2B, the urgency around faster/real-time payments is markedly lower. Only 16% of survey respondents believe that business-to-consumer (B2C) transactions — the next highest category — will benefit the most from faster/real-time payments.

“In the face of wide-ranging disruptions around the world, financial professionals continue to improve their payments processes and become more nimble in response,” said Jim Kaitz, president and CEO of AFP. “Given that digital payment methods are more efficient and have a much lower risk for fraud, it is encouraging to see that digital payments are on the rise.”

Awareness of ISO 20022

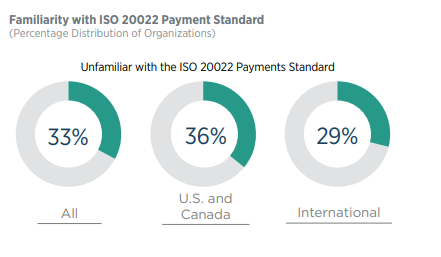

Many of the benefits of faster payment systems are only possible when organizations’ business partners use standardized formats for their payment files. However, a third of all survey respondents (33%) report they are unfamiliar with ISO 20022 — the global standard that new payment systems rely on.

Awareness of ISO 20022 is higher in regions outside of North America, with only 29% of respondents indicating that they are unfamiliar with the standard, compared to 36% in North America. The value of ISO 20022 also scores higher outside of North America. Of those who are familiar with the standard, 70% of respondents in regions outside of North America consider it to be valuable, while only 44% of respondents in North America say the same.

Given that adoption of ISO 20022 in the U.S. has largely focused on sending and receiving cross-border payments, companies that are purely domestically focused may perceive fewer benefits in switching from their current payment file formats.

About the survey

The 2022 AFP Digital Payments Survey was conducted in June 2022 and received 256 responses from AFP corporate practitioners and prospects. 178 of the responses came from corporate practitioners in the U.S. and Canada, and 78 responses came from treasury practitioners representing other countries.

Want to learn about the latest trends in implementing digital payments? Register for the webinar, The Story Behind the Increasing Use of Digital Payments for B2B Transactions, taking place November 8, 2022, at 2 PM ET.

Dive into the full results and analysis of the 2022 AFP Digital Payments Survey, underwritten by J.P. Morgan.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.