Articles

Build Design Thinking Into Financial Processes

- By Dr. Douglas Streeter Rolph, Senior Lecturer of Finance, Singapore University of Technology and Design (SUTD)

- Published: 2/11/2022

What does design have to do with finance? Finance has the ability to design processes that derive more value for themselves and their business partners with lower pain points and increased efficiency by applying design thinking principles.

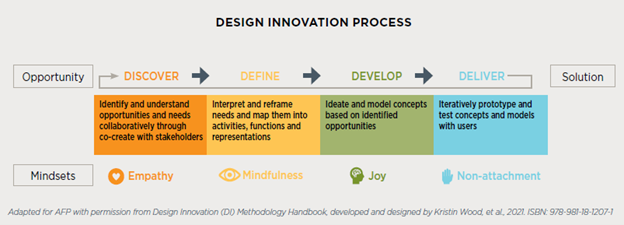

The Design Innovation (DI) Process is a formal set of tools used to bring out the goals and motivations of the business, and to expose any potential sticking points. It is focused on people, their needs and their wants in the context of the experiences they have. The benefit of having a formal approach to creating processes is that it distances people from the immediacy of the emotional aspects of something they want from that particular process or outcome. The graphic below presents a high-level example to help you conceptualize the DI process.

A human-centered approach

Think about the process for management reporting: There will be users, FP&A people conducting analysis, and also the senior team receiving that analysis and applying it as they move forward. Design thinking recognizes that the financial reports and the insights they provide are fitting into a broader narrative, both for people and the company. The senior executives have a narrative. The FP&A professionals have a narrative. By understanding those narratives, their motives and desired outcomes, you can deliver more value.

Internal and external focus

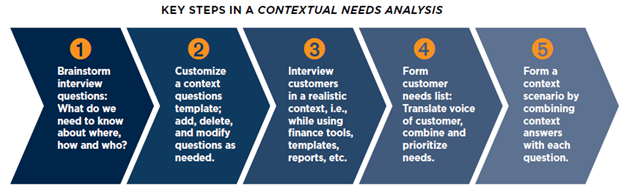

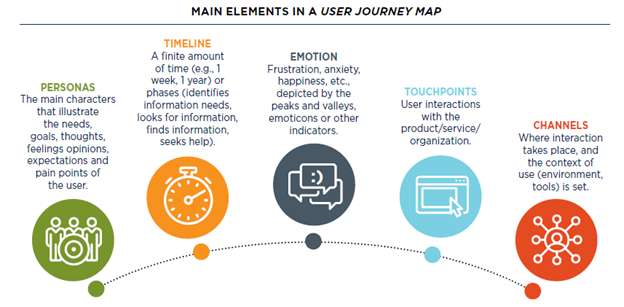

It is useful to balance the considerations inside a company with those in the market. Consider a common process such as creating financial reports. The internal focus is looking at the people generating the analysis, whereas the external focus might be, “Are there multiple benefits or outcomes for the funds we raise?” User satisfaction (and process success) is often context dependent, that is, related to the circumstances and settings of the individual. A contextual needs analysis allows us to bring that out in a structured format to understand what the situation is. To gain empathy for others and to understand your process through their experiences, consider a user journey map. This is a tool that tells a visual story from the perspective of the user’s relationship with the organization, service, product or system, as perceived over time and across channels. Both these tools are part of the “Discover” phase and are outlined below.

Insight to value creation

We want to have methods to understand what’s happening within the business and with the customers and our relationships with them. Generating these insights revolves around asking questions about what’s important, why it’s important to the organization, and bringing this out in a way so that we can see what’s there and decide which things to focus on. Traditionally, when looking at finance process improvement initiatives, a lot of focus was driven by cost reduction strategies. Encouraging finance people to understand the context, goals, frustration, and pain points of their customers builds sustainable value into routine processes.

For more information on this topic, check out the Guide to Becoming a Value-focused Finance Organization and download the extended version of the Design Thinking Tool.

PARTNER CONTENT:

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.

.tmb-small.png?sfvrsn=3731146b_1)

![UMB Bank Vert Full Color CMYK[2] UMB Bank Vert Full Color CMYK[2]](/images/default-source/default-album/association_of_financial_professionals/umb-bank-vert-full-color-cmyk-2.tmb-small.png?sfvrsn=169a146b_1)