Articles

AFP Benchmark Survey: Insights into the Current Economic Climate

- By Bryan Lapidus, FPAC

- Published: 3/22/2022

If there's anything we've learned in the past year, it's that there is no normal anymore. We at AFP realized that most of our members were going to be creating a budget or a forecast without a stable basis of comparison for operations due to market, talent and high supply chain disruptions. All of our historicals were thrown out of whack!

The survey allowed you to Benchmark your company against others and will remain open through July 15, 2022. We also analyzed the information collected in the fall of 2021 and created the Practitioner Planning Report, underwritten by Workday. The analysis we have is based on 223 responses globally. One more step, we held a webinar to discuss the survey results with two members of the FP&A Advisory Council, Frank Chou, FPAC, CTP, director of FP&A at Nevada Copper, and Cathy Jirak, co-founder, principal and COO of Qubit Consulting. The following are excerpts from that webinar.Insight #1: More revenue, more spending … and more earnings?

NET CHANGE IN TOTAL REVENUE

NET CHANGE SCORE IN SPENDING CATEGORIES

NET CHANGE IN NET MARGIN

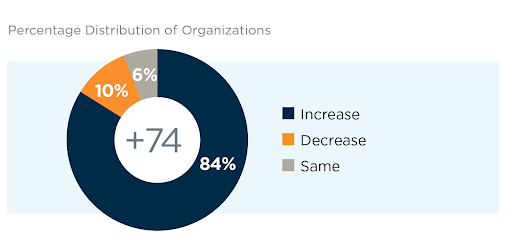

Finding: Most respondents from the survey were expecting revenue to increase: 84% of companies thought they were going to have an increase in revenue year over year, whereas 10% were seeing a decrease. The difference between the two is our net change score: 74%. So, three quarters of companies were expecting revenue to increase.

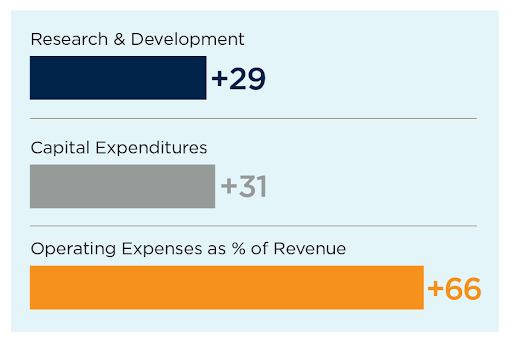

There's also an expected change in spending on the upside, and it was in all categories — research and development (29%), CapEx (31%) and OPEX, spending itself as a percentage of revenue. And when you see that much spending on OPEX, you have to ask: What's happening to earnings?

“Specifically in the industry I work in, mining, you're looking at commodity prices,” said Chou. “And so those may not actually be within your control. Maybe you do get an increase in revenue, but it's not necessarily going to be a factor that you can influence per se. The markets will dictate that; you can't pass on the additional cost to your customer base. And so, while you may see an increase in your cost, that may not proliferate through to your net margin.

“Looking at the changing costs, CapEx is a big one for us. We may plan a high level of CapEx as part of projects, but one thing we saw last year is that just because we plan to do a CapEx project doesn't mean the materials will be available. It doesn't mean that if they are available, they can make it to us. And it doesn't mean that we have the labor. There are a lot of other factors outside of the numbers that come into play when you're looking at this.”

“A lot of the increase in revenue that we’re seeing today is going to be due to price increases, due to inflationary aspects,” said Jirak. “You see the operating expenses going up, salaries going up, product costs, raw materials — they’re all going up.

“Many companies are coming back and asking us to implement some top-line inflationary modeling. We've also seen some lost opportunities on price optimization, because in certain industries they have either bought up the raw materials or they're setting the price for their industry, and they keep raising and raising the prices. If you can set the price, there's no need to do any optimization.

“A few of our customers have bought up a lot of the supply, so now they're the ones creating the constraint in the marketplace and can set the price to whatever they want. It's very interesting how this occurred. That's part of the investment — going out and buying up whatever resources or raw materials were available to them and creating a stockpile.

“We have a manufacturing company that's selling to smaller companies, and their resources are constrained. So, they're doing a customer profitability analysis because they don’t have enough material to supply all of their existing customers. They have to pick and choose who they are they going to sell to, plus they’re implementing a 13% price increase to maximize profitability on what they do have.”

Insight #2: ESG is finding more of a home in corporate finance

Response to Business Roundtable’s “Commitment to All Stakeholders” Announcement

NET CHANGE IN ESG-IDENTIFIABLE SPENDING

Finding: Environmental, Social and Governance (ESG) is finding more of a home in corporate finance. We say more because, as part of the 2019 project investment analysis survey, we asked whether you envisioned making major changes to how you adjust your internal investment in the next three years in the spirit of Business Roundtable’s then-issued commitment to all stakeholders announcement. Only 10% said yes, in the next 36 months, we will make major changes. Then we asked retrospectively in 2021, did you make changes? Thirty-five percent said yes, and 27% said they were going to make major changes in the next three years. So, looking back, people did more than they had anticipated.

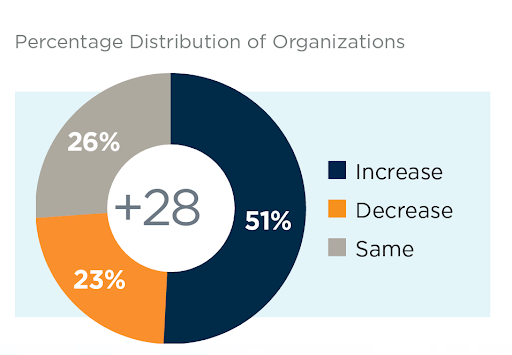

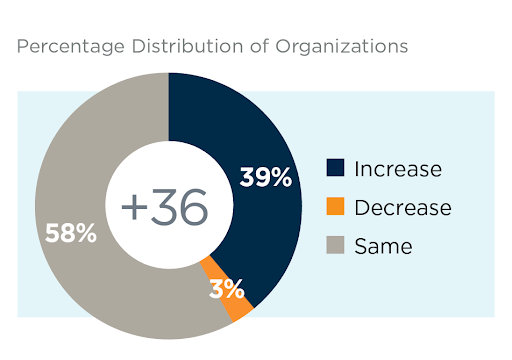

Similarly, we asked a question this year about the ex-net change, or whether you’re going to spend more, less, or the same in ESG identifiable spending. The net change was 36%, so a little more than a third said they are going to increase spending on ESG identifiable projects.

“Environmental considerations are incredibly important for the mining industry,” said Chou. “It's important that you make the right investments. Your investors care much more now about your environmental impact. You don't want to be behind the curve, especially as your competitors are making other investments.”

Another example: “I worked at General Motors from about 2013 to 2016, and at the time we were exploring the manufacturing of EVs, which were, back then, a massive loser for profitability, double negative margins, but it was an investment in environmental impact,” said Chou. “Looking at a project investment portfolio as a whole, you're making selective decisions. We wanted to be able to create the EVs and bring them to people because they care.”

In some cases, “R&D projects are being rebranded as ESG projects, such as the EV project,” Jirak pointed out.

“From where I stand, it seems like it goes in that order: environmental, social and governance,” said Chou. “We never really talk about governance. It's always the environmental and social that seems to get the attention in our conversations, even in the media, right? Those are the two heavy hitters. And then we're talking now about the Great Resignation. How do you make a good culture of diversity and inclusion when, from where we sit, we just have to take whomever will come to us. We want to have more diversity and inclusion initiatives, but we need more applicants, so if somebody is a warm body that knows what they're doing, or can be trained to know what they're doing, we'll take them. You have to kind of find the right balance there.”

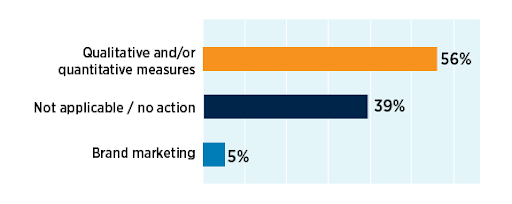

When we asked participants what best describes their ESG metrics, 39% said that ESG is not applicable to their business and/or they are not taking any action. The largest number, 56%, said their ESG actions were measurable either qualitatively or quantitatively. Only 5% said it was simply brand marketing.

Of the measurable actions taken, participants said their organizations were doing the following: volunteering, reporting, building mortgages in low-income neighborhoods, a public sustainability plan with specific metrics around carbon use water diversity in index and social investment targets, supplier diversity, and fair-trade products.

WHAT DESCRIBES YOUR BEST ESG METRICS

EMPLOYEE TURNOVER RATE

NET CHANGE IN EXPENSES ALLOCATED FOR EDUCATION AND TRAINING

NET CHANGE IN EXPENSE ALLOCATED FOR EMPLOYEE COMPENSATION

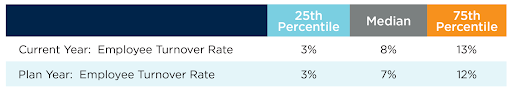

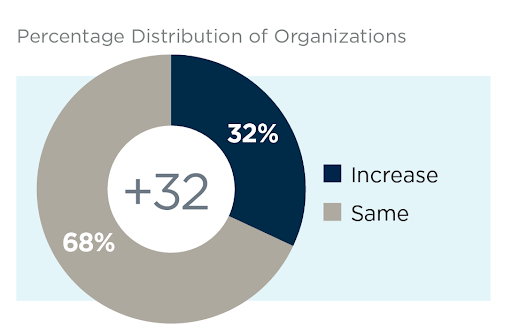

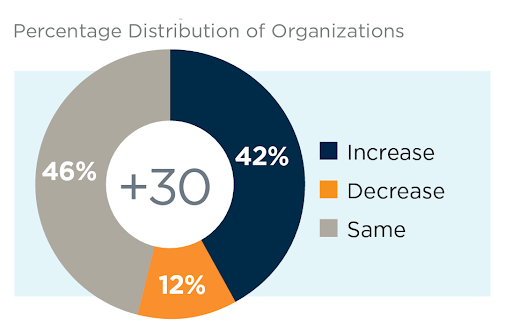

Finding: Our data on employee turnover came mostly from October 2021. The median turnover rate for 2021 was reported at 8%, and participants in the survey said they were expecting a bit less for 2022. The reason for the expectation of stabilization was more investment in people; one-third of companies were looking to increase the amount allocated for education and training to help their people feel more appreciated and enable them to see a path forward within the company. We also asked about increased pay, and 42% said they were looking to increase employee compensation, while 12% were actually looking to decrease, resulting in a net change of 30% overall.

So now we ask: What is the CFO's role in managing employee turnover, in reducing turnover, both within the finance organization and across the entire company?

Chou sees that “So much of [employee turnover] is ‘lack’ — lack of feeling like you're moving the business forward, a lack of communication, a lack of being able to really have an impact on your team and on yourself, to really see where you're going in the next five years or however long you envision yourself with the company. The CFO has to take all of that lack, assess it and overcome it. It really does start at the top because the CFO will create the culture that proliferates to the VPs and directors and managers. There will always be attrition, but we need to understand how to upskill our teams to be able to account for that cross-training, have people who are confident that they can lead and manage through change, and then just be empathetic when there is attrition. If you just dump 20 extra hours a week of work on them, they too will be out the door.”

From Jirak’s perspective, “My company does a lot of workforce planning with different companies, and a lot of demand planning, which will dictate what your resource needs are. What I’ve found is that most companies don't plan for the cost of attrition. They plan for the attrition, but they don't necessarily plan for the cost of retraining.

“As far as the CFO and FP&A in general, one of the things that we so often see is that the folks who work in FP&A are usually overworked and overburdened, and they’re working with antiquated systems. One way in which finance can keep their top employees is by being innovative and using advanced tools so they can see where they are actually having an impact. Doing this removes some of the frustrations that people have, especially in finance, when they know something can be done better, but they don’t have the tools to do it.”

Have we reached the peak of the Great Resignation?

“I think we'll see the peak in Q2 of this year after everyone collects their Q1 bonus and is a little more flush with cash and can better evaluate their options.” said Chou.

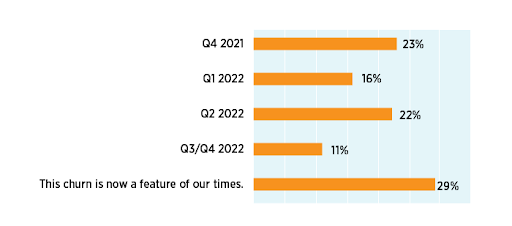

Jirak opined, “I think the Great Resignation is going to continue for a bit. People are trying to combat it with higher salaries to retain their employees, but I think it's still going to happen.” The audience shared their thoughts in a poll as follows:

WHAT WAS/WILL BE THE PEAK OF “THE GREAT RESIGNATION?”

Insight #4: Budgets remain in demand

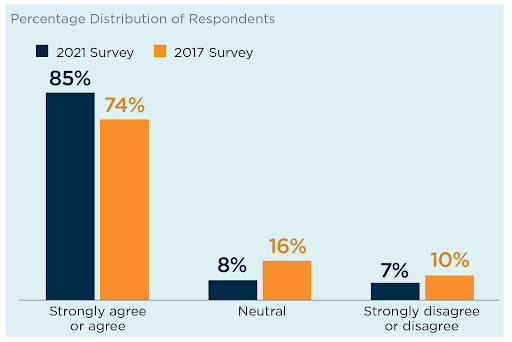

THE BUDGET IS A VALUABLE TOOL

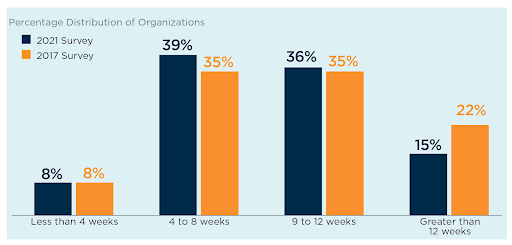

NUMBER OF WEEKS TO DEVELOP A BUDGET

Finding: Budgets remain in demand. In fact, 85% of respondents agree with that statement, up 11% from 2017. We also asked, how long did it take you to create a budget? And what we found is that people are still spending a significant amount of time on budgets. Why are budgets still in demand, and why are they are more in demand now than they were five years ago?

“How we refer to budgets has really changed,” said Jirak. “Most of my customers are not doing a budget in isolation; they're doing a budget initially to set some goals and targets, but it's being followed up with monthly or weekly forecasts. The whole concept of doing a budget once a year, lock it down and never go back and look at it again till the end of the year doesn't happen anymore. The lines are blurred between a budget forecast, rolling forecast, and even scenario planning.

“The other thing we're seeing is more and more forecasts being done at the same level of detail as budgets. I'm sure technology and data are driving that requirement. And public companies are still doing budgets. Compensation packages are still based on a plan, as are other expenses, so there's a lot of reasons why budgets are still important.”

“It's the process of the plan that really is the most meaningful,” added Chou. “It's assessing those inputs. It's having those conversations at a very meaningful and deep level. That's why budgets remain in demand, because you're having that kind of internal discussion and thought process. And maybe you're having it at one point in time in the year, but it triggers those thoughts and conversations later on.

“And another thing, just from an FP&A standpoint, the words budget, budgeting, forecasting, those are so key to our identity. It's how we talk about ourselves. It's how you introduce yourself — ‘I help with the budget.’ So I don't think that will go away either as an identity factor for FP&A or as a function of finance.”

Benchmarking is available through July 15 at this link. The entire report PDF is available to download here.

PARTNER CONTENT:

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.

![UMB Bank Vert Full Color CMYK[2] UMB Bank Vert Full Color CMYK[2]](/images/default-source/default-album/association_of_financial_professionals/umb-bank-vert-full-color-cmyk-2.png?sfvrsn=169a146b_1&MaxWidth=140&MaxHeight=140&ScaleUp=false&Quality=High&Method=ResizeFitToAreaArguments&Signature=27622428BC9C346FF684161B44C690104798350E)

.png?sfvrsn=2c6d166b_2&MaxWidth=80&MaxHeight=50&ScaleUp=false&Quality=High&Method=ResizeFitToAreaArguments&Signature=E38BCEACDE40B47D5C22BBB194B034137985F265)