staging Continuously evolving, AFP's collection of publications reflects the ever-changing treasury and finance environment. Gain insight, knowledge and action plans for success on a wide range of topics impacting your daily working responsibilities.

AFP FP&A Guide to What Is Financial Analysis

The AFP FP&A Guide to What Is Financial Analysis includes comprehensive insights into the role of financial analysis within the CFO framework.

This guide offers theoretical insights and practical strategies, equipping you with the necessary knowledge of financial applications and modeling tools essential for the job.

- The Financial Analyst Role

- From FP&A Analyst to CFO

- The Analytical Framework for Financial Decisions

- Numbers and Narratives: Where Story Meets Valuation

- Build Better Models

- Performance Management as Financial Analysis

- Navigating a Financial Crisis and Turnaround

DOWNLOAD THE GUIDE

THE FINANCIAL ANALYST ROLE

Financial analysis is the heart of what we do in financial planning & analysis (FP&A). Driving strategic business decisions requires the analyst practitioner to:

- Provide insights into the financial decision-making process

- Understand the entire decision support process

- Analyze data and relevant facts

- Communicate with others in a wide range of positions

FROM FP&A ANALYST TO CFO

See William Washington III's career roadmap from analyst to CFO of Baker McKenzie.

"In my work as an analyst or as a CFO, I always saw myself as bringing that finance thinking to the business. Even today, I still feel like I wear the hat of a financial analyst because I’m still the same person that I was 20 years ago."

THE ANALYTICAL FRAMEWORK FOR FINANCIAL DECISIONS

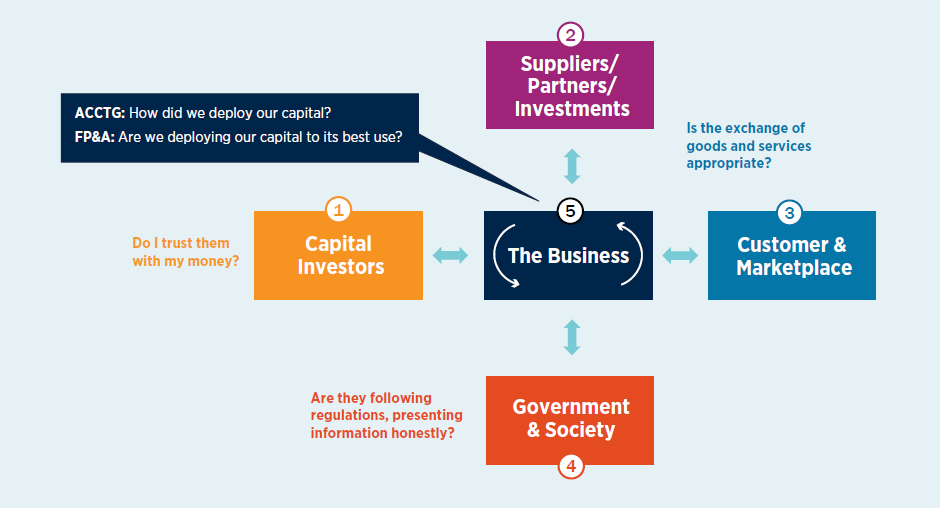

Hear from Geetanjali Tandon, SVP of FP&A at Ceridian, about financial analysis and how it is a structured way to analyze historical data, trends and events to understand the present and think through various pathways of potential futures. Companies operate as an internal capital market (image below), sourcing cash from several places to be used in business operations.

NUMBERS AND NARRATIVES: WHERE STORY MEETS VALUATION

Finance tends to be dominated by the numbers people, which means when we do our financial analysis, we are surrounded by peers who look at numbers through the same training and see the world the same way. This amplifies the three most significant challenges in valuation that befall the quants among us:

- Bias

- Uncertainty

- Complexity

BUILD BETTER MODELS

Ian Schnoor, Executive Director of the Financial Modeling Institute shares that a model is a means to an end, not an end in itself. Done right, it creates tremendous credibility for the builder, inspires confidence in the reader, and makes it easier for someone else to validate or even take ownership.

Attributes of a good model are:

- Dynamic

- Flexible

- Intuitive

- Printable

- Transparent

- Transferable

PERFORMANCE MANAGEMENT AS FINANCIAL ANALYSIS

Performance management helps companies track and drive continuous improvement through critical drivers and reporting related to strategic goals, operational planning and financial results.

The guide includes a general framework from Jeremy Pawlak, FPAC, Managing Director of Accordion, to align, measure and manage company performance:

- Be intentional in your performance management program.

- Align strategy to metrics.

- Establish process cadence.

NAVIGATING A FINANCIAL CRISIS AND TURNAROUND

Hear from Dr. Tamer Alsayed, CFO, FII Institute, Author of The Art of Becoming a Strategic CFO about navigating a financial crisis. He tells how a mid-sized player in the retail sector was hit by a perfect storm: An economic downturn, fierce competition and internal insufficiencies led to cash scarcity. It was an opportunity to demonstrate the critical importance of strategic financial leadership by the CFO. To do this, there was a dual strategy:

- Financial reconstructing: renegotiating with creditors to ease the immediate cash flow pressure and to allow room to maneuver.

- Aggressive cost reduction: reviewing and renegotiating vendor contracts, reducing discretionary spending and right-sizing the workforce.

Published May 7, 2024