An in-depth look at FP&A-related topics that are developed via interviews with finance professionals. Presented as quarterly case studies with practical applications and tools to help you make informed decisions about key FP&A methods.

AFP Guide to Financial Modeling and Model Supervision

Underwritten by Board

To succeed in these uncertain times, it's not enough to create just any old model. Leaders are looking for agile models that adapt to the rapidly shifting finance landscape in order to provide strategic insight.

Finance and finance leaders depend on modeling for a variety of needs including financial reporting, performance analysis, capital planning and budgeting, regulatory requirements, and M&A. To do this well, we should view models as wing-to-wing decision-making processes (inputs, calculations, outputs) to better align the entire work process with our overall corporate objectives and, at the same time, lower enterprise risk.

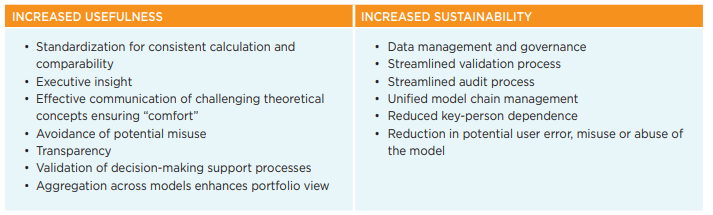

“At the end of the day, Executives weigh the inputs from different functional areas. What does each group bring to the table? Finance has methods for thinking through an uncertain future and quantifying our thoughts and decisions,” says guide author Rob Trippe. This is the basis for a coordinated, corporate-wide financial modeling program can lower operational costs and increase effectiveness through the following benefits:

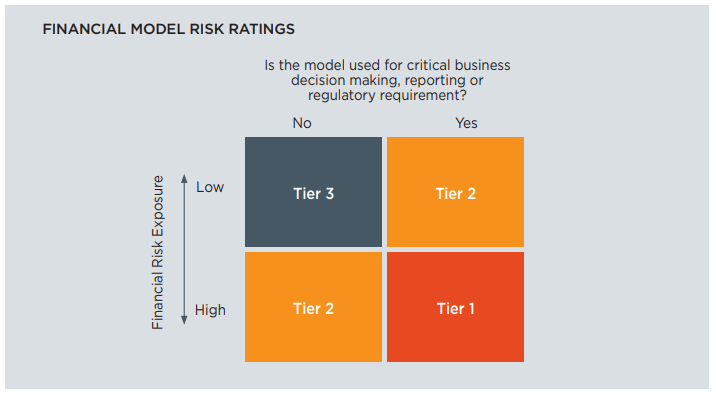

Prioritize models based on risk exposure

Models imply that value is at risk and therefore requires scrutiny. By reviewing and determining what is and is not a model and building a model inventory, we can concentrate our efforts, identify risky control points, and place ourselves in a far better position to implement policies and procedures to address risk exposures.

Improve your modeling process

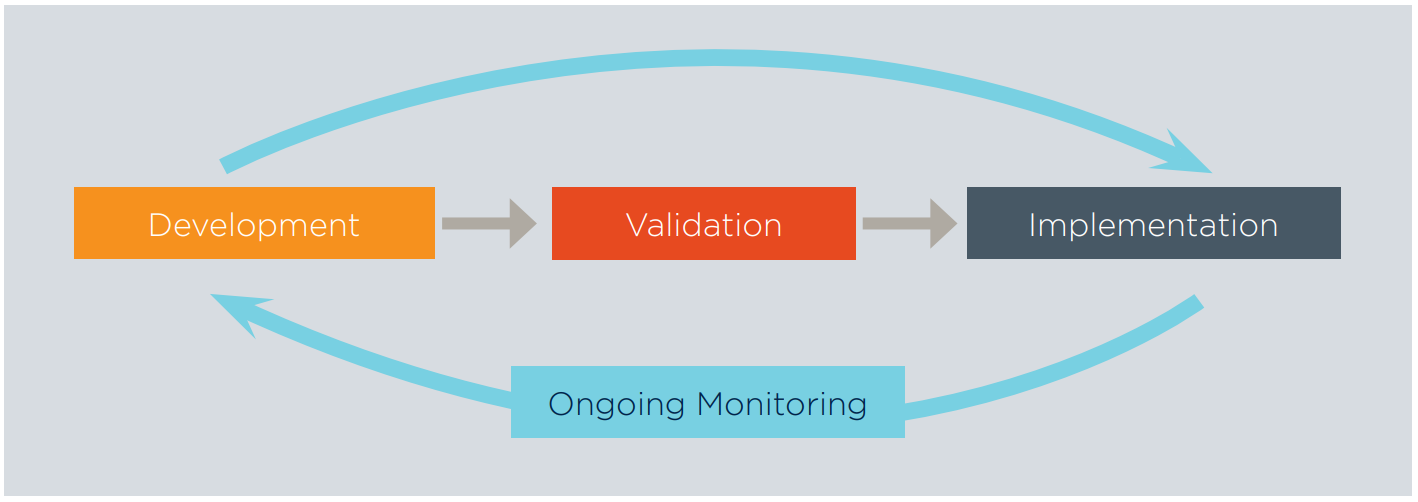

Governance processes cover the model lifecycle (below) to provide toll gates for success and completion of models, and visually assist us when it comes to separating model roles and responsibilities. There exists common model governance and risk management activities at each stage in the process.

Build agility into models

The “Agile” approach to software development has gained popularity for its customer focus and for the fact that it views model development as a circular and iterative process, not a one-time event. This approach offers the opportunity for finance to de-risk modeling by proactively preparing for change delivery on model goals. Aligning key elements of Agile with modeling goals and best FP&A practices can deliver better results for the business through close relationships, flexible models, and institutionalized excellence.

Download the Guide Download the Modeling Tool