Essentials of Treasury Management, 7th Edition

Members: $185.00

Non-Members: $285.00

Format: Book

SUMMARY

This text updates the sixth edition to reflect the many changes that have taken place in the last three years to the responsibilities of treasury management professionals.

Here’s some of what’s new in the 20 chapters of the seventh edition:

- The Legal and Regulatory Environment chapter has been repurposed as an overview, covering the principles of regulation and listed the laws and regulations that most directly affect treasurers.

- The specific regulations are discussed in the relevant subject chapters. The Banks and Financial Institutions chapter includes detail on bank regulation; the Payment Instruments and Systems chapter includes information on relevant regulation. This reorganization is designed to make the content on regulation more accessible for readers.

- There is a tighter focus on the management of subsidiaries in multinational corporate groups, with additional content on their capital structure and the valuation of cash flows in non-operating currencies.

- There is a greater emphasis on the private sources of capital.

- Divestitures are discussed in more detail, and treasury’s role following a corporate transaction is outlined.

- There is more detail on various liquidity management techniques, such as in-house banking.

- The developments in payments and technology are reflected in the text, with updated information on real-time payments, cryptocurrencies and central bank digital currencies.

- The impact of LIBOR replacement is discussed in the chapters on Short-term Borrowing and Investment and on Financial Risk Management.

As with any publication, there are errors found after printing. An Errata will be posted once errors are reported.

2023-2025 CTP Exam Knowledge Domains

| Content Area | Percentage of Test Items |

I. Maintain corporate liquidity required to meet current and future obligations in a timely and cost-effective manner. | 26% |

II. Manage capital structure, manage costs of long-term capital and quantitatively evaluate long-term capital resource investments. | 20% |

III. Manage internal and external relationships. | 20% |

IV. Monitor and control corporate exposure to financial, regulatory and operational risk (including emerging and reputational risk). | 22% |

V. Assess impact of technologies on the treasury function. | 12% |

ESSENTIALS OF TREASURY MANAGEMENT, 7th EDITION CHAPTERS

I. Introduction

II. The Evolving Role of the Treasury Professional

III. Organization of Essentials of Treasury Management

IV. Notes on Conventions Used in this Book

V. Summary

I. Introduction

II. The Role and Organization of Treasury Management

III. Finance and Treasury Organization

IV. Corporate Governance

V. Summary

I. Introduction

II. General Regulatory Environment

III. Financial Regulatory Regime

IV. National Approaches to Legislation and Regulation

V. Tax Considerations for Treasury

VI. Bankruptcy/Insolvency Laws

VII.

Trends in Regulation

VIII. Summary

Appendix 2.1: Bankruptcy Procedures

I. Introduction

II. Banks

III. Nonbank Financial Institutions: Functions and Services

IV. Fiduciaries

V. Summary

I. Introduction

II. Payment Overview

III. Payment Instruments

IV. Payment Systems

V. Payment Regulation

VI. Summary

Appendix 4.1: Check Return Reasons

Appendix 4.2: Sample US Business Check

Appendix 4.3: US ACH Standard Entry Class (SEC) Codes and Payment Types

Appendix 4.4: Most Common NACHA Return Reasons Codes

Appendix 4.5: Banking and Payment Systems Information for Selected Countries

I. Introduction

II. Money Market Participants

III. Money Market Instruments

IV. Summary

I. Introduction

II. Structure of the Capital Markets

III. Debt Market

IV. Equity Market

V. Summary

Appendix 6.1: Listing of the World’s Top Stock Exchanges

I. Introduction

II. Bank Relationship Management

III. FSP Selection

IV. Assessing the Risk of FSPs

V. Summary

Appendix 7.1: Sample RFP Design – Global Treasury Services "

I. Introduction

II. Uses of Financial Statements

III. Accounting Concepts and Standards

IV. Financial Statement Reporting

V. Accounting for Derivatives, Hedges, and Foreign Exchange (FX)

VI. Accounting

for Governmental and Not-For-Profit (G/NFP) Organizations

VII. Summary

I. Introduction

II. Time Value of Money

III. Capital Budgeting

IV. Budgeting

V. Cost Behavior

VI. Financial Statement Analysis

VII. Summary

I. Introduction

II The Link Between Cash and Working Capital

III. Components of the Capital Cash Conversion Cycle (CCC)

IV. How Changes in Current Balance Sheet Accounts Impact External Financing

V.

Strategies for Investing In and Financing Working Capital

VI. Management of Trade Credit and Accounts Receivable (A/R)

VII. Management of Inventory

VIII. Management of Accounts Payable (A/P)

IX.

Working Capital Management Tools for Corporate Groups

X. Summary

I. Introduction

II. Fundamental Working Capital Metrics

III. The Cash Conversion Cycle (CCC)

IV. Calculations for Trade Credit Decisions

V. Accounts Receivable (A/R) Monitoring

VI. Summary

I. Introduction

II. Disbursements

III. Collections

IV. Concentration of Funds

V. Summary

I. Introduction

II. Managing Short-Term Investments

III. Pricing and Yields on Short-Term Investments

IV. Managing Short-Term Borrowing

V. Debt Financing

VI. Market Information

for Investors and Borrowers

VII. Summary

Appendix 13.1: Selected LIBOR Replacement Risk-Free Rates

Appendix 13.2: Listing of Some Major Credit Rating Agencies

I. Introduction

II. Purpose of Cash Flow Forecasting

III. Types of Forecasts

IV. Forecasting Process

V. Forecasting Methods

VI. Best Practices for Cash Flow Forecasting

VII. Summary

I. Introduction

II. Information Technology for Treasury

III. Treasury Management Systems (TMSs)

IV. Project Management

V. Communications and Technology Developments

VI.

Summary

Appendix 15.1: Outline of Different Electronic Message Types

I. Introduction

II. Risk Management

III. Categories of Risk

IV. Techniques Used to Measure Risk

V. Managing Insurable Risks

VI. Disaster Recovery and Business Continuity

VII. Summary

Appendix 16.1; Types of Insurance Coverage

Appendix 16.2: Disaster Recovery Checklist

I. Introduction

II. Types of Financial Risk

III. Managing Financial Risk

IV. Derivative Instruments as Financial Risk Management Tools

V. Managing Interest Rate Exposure

VI. Managing Foreign Exchange (FX) Exposure

VII. Managing Commodity Price Exposure

VIII. Accounting and Tax Implications of Financial Risk Management

IX. Regulation of Financial Instruments

X. Hedging Policy

Statement

XI. Summary

I. Introduction

II. Overview of Treasury Policies and Procedures

III. Creating a Treasury Policy Document

IV. Overview of Key Treasury Policies

V. Summary

Appendix

18.1: Sample Short-Term Investment Policy

I. Introduction

II. Valuation of Capital Market Securities

III. Managing Capital Market Investments

IV. Summary

I. Introduction

II. Capital Structure

III. Raising Long-Term Capital

IV. Managing Long-Term Capital

V. Alternative Financing

VI. Summary

EXCERPT

Essentials of Treasury Management, 7th edition, Chapter 9: Financial Planning and Analysis

V. Cost Behavior

This section describes the different types of costs, break-even analysis, and leverage (i.e., operating, financial, and total). These topics aid managers in determining the risks and returns associated with existing operations and future investment opportunities.

A. Types of Costs

Financial planning and analysis requires an understanding of cost behavior. Cost behavior describes the relationship between costs and cost drivers, defined as business activities that influence costs. Costs are

classified as either fixed, variable or step-up.

Each type is described as below:

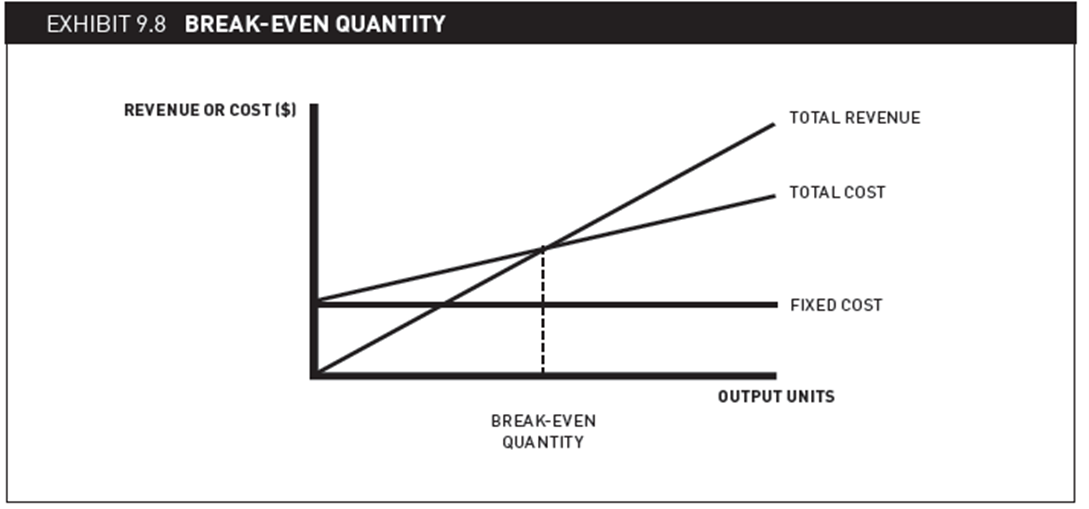

Exhibit 9.7 displays the behavior of these types of costs in relation to production output. Note that the level of fixed costs does not vary with production volume (i.e., the fixed cost curve has no slope). Meanwhile, the positive slope of the variable

cost curve indicates that variable costs increase with production output. The step-up cost curve increases in a stair-step fashion. Lastly, the total cost curve is the sum of each cost component for a given level of production.

B. Break-even Analysis

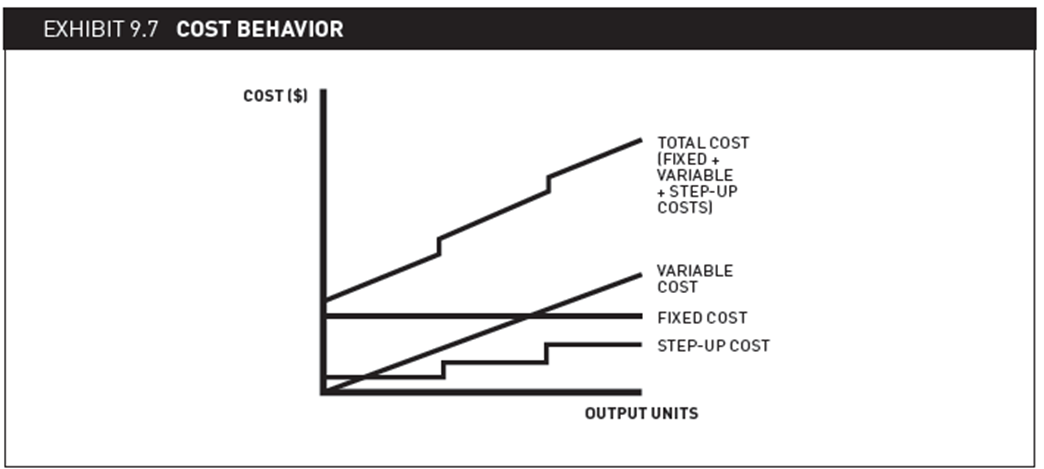

Break-even analysis involves calculating the level of sales required to earn an operating profit of $0. This quantity is referred to as the break-even quantity.

Exhibit 9.8 provides a graphical illustration of the break-even concept. To simplify the graph, the step-up cost curve is omitted (both on its own and as part of the total cost curve), and the variable cost curve is only included as part of the total

cost curve. The graph also includes a revenue curve. The slope of the revenue curve is steeper than the total cost curve, which results from the markup earned on each unit sold. The point of intersection between the total revenue and total cost curves

represents the break-even quantity of sales. At a sales level above the break-even quantity, an operating profit is earned, as shown by the vertical distance between the revenue and total cost lines.

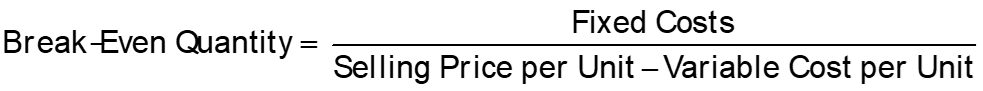

The break-even quantity can be calculated using estimates of the fixed costs, the per-unit sales price, and the variable cost per unit. A general formula appears below:

The denominator of the formula is commonly referred to as the contribution margin, which represents the component of the sales price that offsets fixed costs.

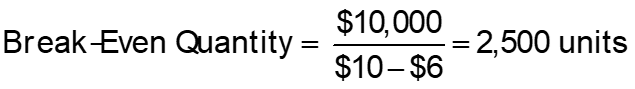

An example will help illustrate the concept. Suppose that management is considering entering into a new product line that will require $10,000 in fixed costs. Each unit sold will also result in $6 in variable costs. Further, each unit will sell for $10. The break-even quantity is calculated as:

The calculation indicates that the product line will earn an operating profit of $0 at a sales volume of 2,500 units. This calculation can be verified by checking that the operating profit equals $0 at a sales level of 2,500 units. If the firm sells more

than 2,500 units, operating profit will expand by the contribution margin of $4 per unit.

Break-even analysis is quite helpful in financial planning and analysis. If management believes that future sales from a product line will fall below the break-even volume, then it would be advisable to avoid continuing with the product line. There are also numerous applications for break-even analysis in treasury management. One example is the calculation of the break-even amount of funds transferred that would justify a wire transfer versus an automated clearinghouse (ACH) network transfer.14