Articles

What Will it Take for ISO 20022 to Gain Traction?

- By Magnus Carlsson

- Published: 8/4/2016

When I talk to people in the payments industry there always seems to be a great interest in universal standardization. The ISO 20022 standard appears to be the gateway to achieving this, however, there are currently different versions of it in use all over the world. That’s clearly not a standard.

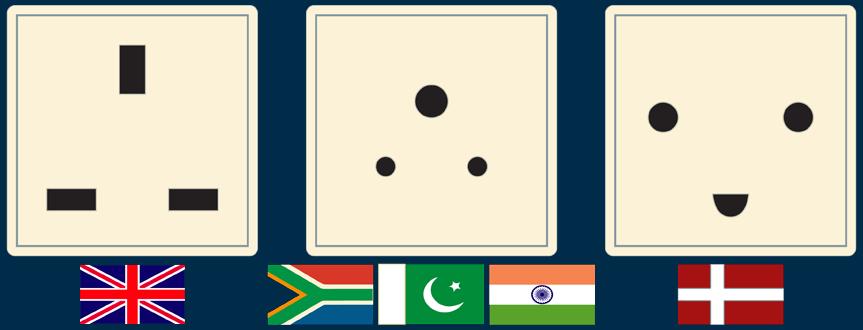

In general, using different standards, for anything, really doesn’t make much sense. For example, when it comes to regular power outlets, why are we using 110V in the United States, but 220V in Europe? Obviously everything would be easier if the same standard was used. But because both standards have existed for a long time, all the surrounding applications have been developed to fit the respective standard. So, in this case, if the United States and Europe agreed on a single standard, it would be extremely expensive for the party who had to make the changes to their electrical infrastructure. The result is that with no incentive big enough to offset the cost, the different standards continue to live on.

This may be a simple example but it exposes some of the issues we face when we look to standardize payments. Using different payments standards is, like using different electrical standards, a relic that dates back a long time.

On top of this, another key problem with legacy payments standards is the limited space for remittance information. The reason for this is actually quite simple; they date back from the time of early mainframe computers and their technological restrictions, such as 80 column punch cards for storing remittance information. Technology has since then of course developed but the old standards, in many cases, still remain. In a world that is becoming more and more interconnected, the use of different, dated and insufficient payments standards also means costly manual intervention and reconciliation.

The potential of ISO 20022

The prospect of a standardized payments format can be very appealing for many reasons, and it looks like we are getting to a point where some changes are starting to take place. The good news is that there now are tools such as ISO 20022 available that can help facilitate this. The fact that I’m starting to hear more and more corporate treasurers asking their banking partners to support IS0 20022 messaging shows even more promise. This is of particular importance in the United States where I don’t think there will ever be a federal government mandate to switch out the old legacy standards.

Of course, this makes things a little more difficult as changing to new standards will have to make sense for businesses. Like most other things in the corporate world, there has to be a business case for it. In other words, it has to pay for itself, probably with a decent margin before it triggers any real interest at the corporate senior level.

What is ISO20022 and why does it seem so complicated?

Now, with that said, I also know there are many corporates out there who are not familiar with ISO 20022. With the risk of being a little simplistic, ISO 20022 is basically a kind of dictionary for standardized financial messages that can be used for payments. But using ISO 20022 messages doesn’t automatically mean an organization has entered the one true global and universal way of making payments. In different countries and markets, different standardized messages are used, even if they all are ISO 20022. Local requirements or desires can often dictate that a specific version of ISO 20022 be used, or other various nuances.

To be interoperable, you have to use the same standards as your counterpart uses, and the same version of the standardized messages. So, doesn’t this complicate things? Yes, it most certainly does! I believe this is one of the main reasons it is difficult for corporates to get their hands around the prospect of ISO 20022.

When faced with the prospect of making internal changes in an organization’s infrastructure there will be questions of “why.” Why would an organization invest funds for making their internal systems use ISO 20022 messages? With the uncertainties mentioned above, is it even possible to make a positive business case for it? Many sources say no, which makes it very difficult to build a business case for ISO 20022. Uncertainties like these will almost certainly lead to the classic wait-and-see approach.

Build it and they will come

Does this mean we are starting in the wrong end when talking to corporates about ISO 20022? I think most corporates understand the benefits of using a standard such as ISO 20022 but can’t move forward with any thought of actual implementation until many of the uncertainties are removed. For this reason, would it make more sense if there already existed a new payment system with a set of specific, standardized ISO 20022 payment messages? Daniel Ellecamp, CTP, AAP, Treasury Consultant at CSAA Insurance Group weighed in: “I see a lot of value in agreeing to and working toward one universal messaging standard for remittance data. Once adopted, corporates can begin adopting to the standard at their own pace as they upgrade or replace existing payments systems. Those who adopt faster will reap the benefits sooner and eventually all corporates will be ‘speaking the same language’.”

So it does seem like the concept “build it and they will come” might work well when it comes to payments standards. But the end product has to be good enough that a business case can be built around it.

With this in mind, it will be very interesting to see what outcome the Federal Reserve’s Faster Payments Task Force comes up with once it is done evaluating its solution proposals. I for one would hope that the outcome is a payments solution that is not overly complicated; one that is simplistic and robust enough to make adoption as frictionless as possible. At the same time, the solution should have characteristics that are already in place in other markets. Why not glance over to SEPA and use IBANs (International Bank Account Numbers), BICs (Business Identifier Codes) and ISO 20022, version 3? In addition, this new payments system has to be capable of carrying substantial amounts of remittance data, something SEPA failed to do by capping it to 140 characters.

At the end of the day, I am certain ISO 20022 will become the standard for payments—eventually. With so many other markets using it, it makes perfect sense for the United States to also jump on the bandwagon.

**********************

Learn how Cargill and Microsoft successfully implemented ISO in order to improve cash reporting formats and transaction exchanges during the session, Successful Corporate Adoption of ISO 20022 Standards at the AFP Annual Conference this October.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.