Articles

Top 5 Tasks of a Financial Analyst

- By AFP Staff

- Published: 2/17/2023

The finance department plays a critical role in any organization. It oversees the financial health (i.e., profitability) by tracking cash flow into and through the organization — in other words, where money is coming from, where money is going, how much the organization needs to pay back, how the organization is going to make a profit, and whether the organization is in compliance with state and federal laws and regulations.

How do you get started in finance? The entry-level position often is a financial analyst. Below, we’ve compiled the top five tasks of this position, along with a description of each, to give you an idea of what a financial analyst does.

DEVELOP RELEVANT PERFORMANCE REPORTING OF BUSINESS AND KEY INITIATIVES

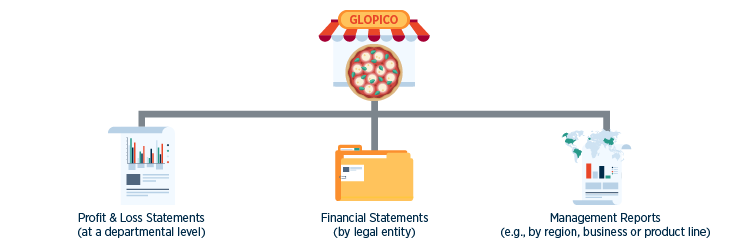

Companies are organized in ways that allow for managers to oversee their respective areas of oversight. Let’s take a pretend example of Global Pizza Company (GLOPICO). They may be reported and analyzed:

- At a departmental level which uses a profit and loss (P&L) statement to track expenses (say, engineering, legal services, HR, etc.).

- By legal entity that must report financial statements (income statement, balance sheet, cash flow statement).

- Through management reports that present data by any manner that helps the business make decisions. Typical dimensions include: the geography in which they compete (Southeastern U.S. region, Europe versus Asia), business lines (restaurants, quick-serve takeout), or product line (food, beverages, supermarket items).

A performance report tells how the business is doing, kind of like a report card or an employee evaluation. As a financial analyst, developing these reports includes data preparation (gathering, combining, structuring and organizing the data), report creation and quality control (for example, fraud prevention).

A performance report tells how the business is doing, kind of like a report card or an employee evaluation. As a financial analyst, developing these reports includes data preparation (gathering, combining, structuring and organizing the data), report creation and quality control (for example, fraud prevention).

Financial analysts also ensure consistency in the data (in terms of how you describe it) and create effective data visualizations. This last one doesn’t mean great memes; it means presenting the data in such a way that non-finance professionals — your partners in the other departments — will understand. As analysts get to know the business and what the data means, they will be able to research why the numbers moved the way they did (e.g., revenue was up 10% because the U.S. dollar strengthened against the Euro by 15%, and volume was actually lower), add that to the reporting, and explain it to the partners.

LEARN, PREPARE AND MAINTAIN FINANCIAL MODELS AND TOOLS

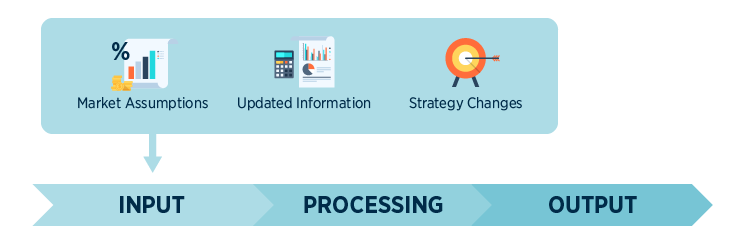

Financial models are a way of estimating the financial performance of something, be it a project or a department, or the entire business. Financial analysts help the finance team prepare financial models. This requires understanding what goes into the financial models and where to get that information. Financial analysts also maintain the financial models, which means updating the models with current information (such as actual results after accounting closes the books on a month), revisiting assumptions as the markets move, or reprioritizing based on tactical changes to strategy.

As part of this process, financial analysts work with data. Related tasks include helping to “define” data, which means using analytical processes to make the data useful by adding context and business purpose to the numbers. Financial analysts then take that data and load it into a financial model. Just like meteorologists forecast the weather, financial professionals, using a financial model, try to forecast the future financial activity of the company.

As part of this process, financial analysts work with data. Related tasks include helping to “define” data, which means using analytical processes to make the data useful by adding context and business purpose to the numbers. Financial analysts then take that data and load it into a financial model. Just like meteorologists forecast the weather, financial professionals, using a financial model, try to forecast the future financial activity of the company.

CONSTRUCT DOCUMENTS CRITICAL TO THE FINANCIAL PLANNING PROCESS

Before you get to the financial planning process, you have to gather the important information and construct documents that inform financial plans. Financial analysts work with business and operations partners, also called departments (e.g., sales, human resources, operations, IT), to create the details required to build a financial plan. This plan is a comprehensive overview of a department’s financial goals and the steps they need to take to achieve them. Analysts will work on the budget — typically the first year of a longer-term strategy plan that aligns the company on how it WANTS to make and spend money — and the forecast — periodic updates of how the company THINKS its current trajectory will actually play out, given the current environment.

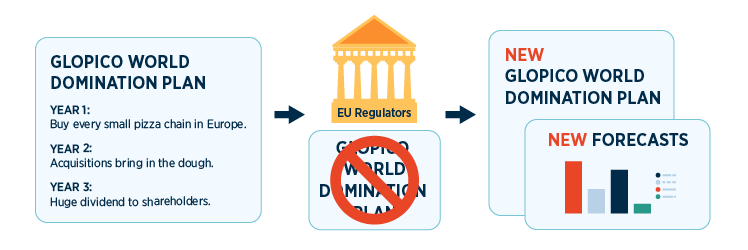

Returning to our earlier example, in the case of GLOPICO, it might work out like this: The company sets a strategy for world domination in five years and builds a model of when money will be spent and made. The budget is the first year of laying the groundwork, such as buying smaller chains in Europe. However, suppose EU regulators do not allow that; GLOPICO needs to adjust its plan and create a new forecast of what will happen. These reforecasts will be compared to the budget and teams will analyze the differences (variance analysis).

Returning to our earlier example, in the case of GLOPICO, it might work out like this: The company sets a strategy for world domination in five years and builds a model of when money will be spent and made. The budget is the first year of laying the groundwork, such as buying smaller chains in Europe. However, suppose EU regulators do not allow that; GLOPICO needs to adjust its plan and create a new forecast of what will happen. These reforecasts will be compared to the budget and teams will analyze the differences (variance analysis).

CREATE DETAILED FINANCIAL ANALYSIS AND INFLUENCE INVESTMENT DECISIONS

The financial plans describe business performance, but if you peel back the layers of a company, you see that product, business or corporate performance is really the sum of lots of decisions. Some of those decisions might have a lot of money or risk involved (“are material” in finance-speak), and so you might be asked to build a model just for those.

For example, say GLOPICO wants to know whether to open a new location. Is this a good decision? They could roll the dice, ask a Magic 8 Ball or build a financial model which follows these steps:

- Estimate the costs for the long-lived equipment (capital expenditures), ingredients (inventory expenses) and staff (salaries).

- Estimate sales by modeling the timing, quantity and size of the orders that, when combined with prices, yield the revenues.

- Consider how the company will pay for all this since the expenses will likely arise before the revenue arrives. Consider paying from savings or profits from other locations (cashflow), debt (loans) or investors (equity).

A detailed financial model helps you organize all the assumptions, parameters, variables and interlocking parts. FP&A supports business decisions by translating assumptions, facts and unknowns into a model to estimate the outcome. This requires close collaboration with the business units to learn each facet. From there, FP&A can apply their finance skill.

A detailed financial model helps you organize all the assumptions, parameters, variables and interlocking parts. FP&A supports business decisions by translating assumptions, facts and unknowns into a model to estimate the outcome. This requires close collaboration with the business units to learn each facet. From there, FP&A can apply their finance skill.

PERFORM ANALYSIS TO IDENTIFY AREAS OF RISK AND OPPORTUNITY

Very few plans play out exactly as envisioned (there would be no variance reports!) so while the finance analyst is putting together the expected outcomes, they also need to think about the other possible outcomes. “Risks and opportunities” are ways of thinking about the ways things can go wrong and derail plans, go really right and you want to accelerate operations or pivot to something else. These may be presented as “pluses and minuses” to the plan, such as a private equity firm consolidating mom-and-pop pizza shops, then expanding them with their investment capital is a risk; signing a big deal with a major client is an opportunity.

A sensitivity analysis would test how the model output changes if you adjust an input. For example, if the Federal Reserve raises interest rates to 7%, does the cost of financing make debt financing for new equipment out of reach? Scenario analysis is a more comprehensive approach asking the question “what-if”? If our expansion is so successful and we are stressed to meet demand, what are all the different resources available to us?

Going back to GLOPICO, they might consider the financial risk of higher interest rates that make it more expensive to borrow money to fuel their expansion; an operational opportunity would be automation that robotically creates the pie for you; an unknown would be whether a recession would decrease demand because fewer people eat out, or increase demand because people shift from higher-cost meals to pizza. That sounds like a project for the financial analyst to research!

Going back to GLOPICO, they might consider the financial risk of higher interest rates that make it more expensive to borrow money to fuel their expansion; an operational opportunity would be automation that robotically creates the pie for you; an unknown would be whether a recession would decrease demand because fewer people eat out, or increase demand because people shift from higher-cost meals to pizza. That sounds like a project for the financial analyst to research!

On The Rise Newsletter

Monthly advice on navigating a career in treasury and finance.

Subscribe today.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.