Articles

Three Pillars for Reimagining Data Strategy

- By Brooke Ballenger

- Published: 4/12/2021

According to KPMG, while CFOs agree that data-driven insights are critical to better decision-making, 84% of CFOs do not trust their company’s data. As a result, 66% of CFOs admit to using their gut instincts over data-driven insights when making strategic decisions. If finance teams do not trust their company’s data, then the time and effort spent on reports is rendered useless or worse, bad data is used.

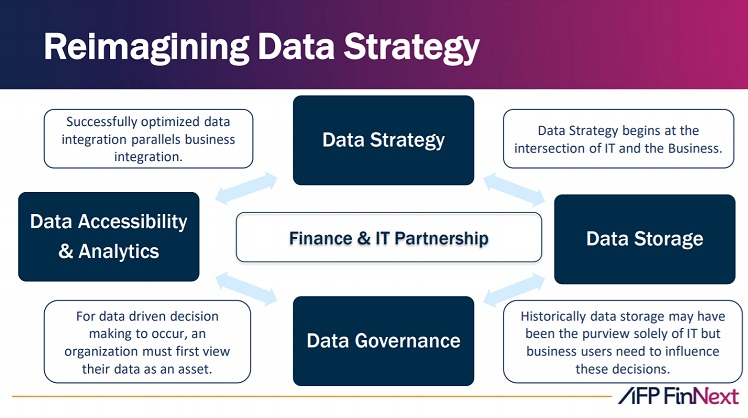

In a recent AFP FinNext Virtual session, Creating Data Strategy: A Finance & IT Partnership, Camille Felton, CTP, FPAC, senior lead analyst of financial analytics and automation at Chick-fil-A, and Matt Burton, CPA, director of financial analytics and automation at Chick-fil-A, showcased how an organization’s finance team can partner with IT to reimagine their data strategy and unlock their analytical potential.

Specifically, Felton and Burton explore data strategy across three pillars — data storage, data governance, and data accessibility and analytics — to show the role that finance can play in moving toward data-driven decisions.

Data storage

The goal of data storage is to aggregate key financial data sets from a fragmented systems landscape into a single integrated location. At Chick-fil-A, Felton and Burton describe two components of its data storage: data lake and data mart. The data lake is a collection of raw unrefined data from a diverse array of source systems. The data mart is refined “gold” data sets that are suited for complex queries and stringent performance requirements.

“This is a partnership; the data storage, tools and pipes are where IT helps us,” said Felton. “But finance adds to the conversation by adding data context.” Felton described an example of this partnership when she was dealing with cash flow forecasting. Sitting in treasury, she had the bank data, which was ultimately at the very end of the line. However, to see the entire cashflow forecasting picture, Felton needed access to their AP data. This curiosity began the data storage journey at Chick-fil-A from a financial services perspective; they knew that AP was one of the first datasets they wanted stored in a centralized location to enable different aspects across financial services. Ultimately, receiving the AP data allowed Felton to complete cash flow forecasting and think through the end pieces.

Data governance

For data-driven decision-making to occur, an organization must first view their data as an asset. This perspective is where data governance starts. “Because our company views data as an asset, they are going to govern it like they might govern people,” said Felton. At Chick-fil-A, three departments play into finance data governance: business owner, business steward and technical steward. Before a dataset is put into the data lake, it must be registered within these assigned three roles.

- The business owner maintains the data and sits in the business. At Chick-fil-A, the owner is the finance team. They are the individuals that have control over the data, decision power and access controls.

- The business steward is the business-unit FP&A who is a subject-matter expert and uses the data day in and day out. They help the finance team by confirming with IT if data is correct and by making sure the business contact is communicated effectively as the datasets move in and out.

- The technical steward typically sits in the IT department and ensures they understand the implementation and the maintenance of that dataset. They understand how that data is created, transformed and stored.

Data accessibility and analytics

Data accessibility and analytics work when successfully optimized data integration parallels business integration. According to Burton, it is crucial to elevate financial services’ analytical skills beyond spreadsheet manipulation. “We want financial service individuals to be empowered to bring their own tools to the table; tools that have been vetted and approved by IT enterprise analytics so that they can answer their own questions,” said Burton. “The second individuals are boxed in and simply receive a tool that they have to use. It is not going to provide a use case in the future, and that is what we are trying to prevent.”

When businesses begin sharing the power and upskilling their teams, they can drive insights faster instead of having to ask technical teams to pull insights for them. However, it is important that everyone across the spectrum is equipped with the appropriate tools to access data. “Accessibility and analytics are not only about not leaving anyone behind but also about driving toward insights in a way that you teach them to fish for themselves,” said Felton. “Everyone must have access to these tools, and teams need to understand the power of what they can do.”

Any organization can start this data strategy journey by following the steps below:

- Vision cast around your organization’s finance of the future.

- Identify individuals within finance who are tech savvy.

- Open a dialogue with IT around the role finance would ideally play in data and technology.

- Be the catalyst to partner across your enterprise to further the idea of “data as an asset.”

- Start from where you are in building analytical insights with your current resources. It is a journey, but this will help you begin to identify opportunities, sparking further organization-wide discussion.

For more information around this topic, download the 2020 AFP FP&A Survey: The Technology and Data Platform Supporting Finance Decisions, underwritten by Workday.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.