Articles

The Role of FP&A: Better Business Partnering Leads to Better Strategy

- By Brooke Ballenger

- Published: 6/1/2021

How much progress has been made in transforming FP&A into strategic business partners? How can FP&A make the business view finance as a primary source of insight? Companies have researched these long-term questions for decades, and surveys find that FP&A professionals are buried in basic duties.

To help address these questions and provide insight on how to solve the issue, Bain & Company’s Steve Beam joined Anders Liu-Lindberg and AFP’s Bryan Lapidus, FPAC, for a webinar, “Better Business Partnering Leads to Better Strategy.” During this engaging discussion, the experts shared their own findings and experience about how FP&A can become a better business partner.

Vision of business partnering

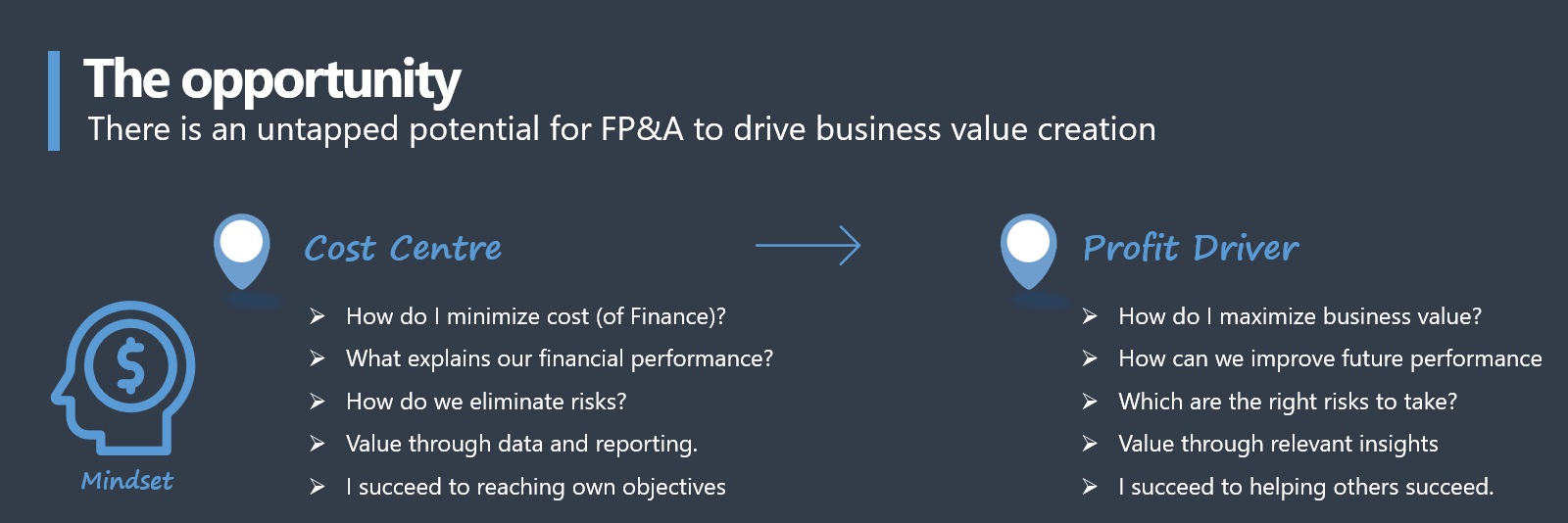

The idea of transforming FP&A into a better business partner is not new. According to Liu-Lindberg, we are stuck in a prohibitive mindset. “Our mindset is holding us back from creating the change that we need to make,” said Liu-Lindberg. “We need to get out of the finance function and FP&A lingo terminology, and start driving the profit for the business.”

What does this mean? According to Liu-Lindberg, we need to change our cost-centered mindset to a profit-driving mindset, starting with our language.

- “How do I minimize cost?” vs. “How do I maximize business value?”

- “What explains our financial performance?” vs. “How can we improve our future performance?”

- “How do we eliminate risk?” vs. “Which are the right risks to take?”

- “Value through data and reporting.” vs. “Value through relevant insights.”

- “I succeed by reaching my own objectives.” vs. “I succeed by helping others succeed.”

The key for FP&A is about widening the playing field. In all these shifts, from the cost center to the profit driver, it is about expanding the role of finance to bring more value to the table and help others succeed. “We should be providing value all over the company, from sales and marketing to operations and IT, and even human resource,” said Liu-Lindberg. “There should not be any limits for FP&A to influence decisions and change them for the better.”

Why business partnering has been so hard to achieve

Change is difficult and uncomfortable, and transforming a company’s culture is no easy feat. “We need to go back to the basics and rationalize what the FP&A function is doing,” said Beam. “Let's understand. Let's ask why. Let's focus on the process and cycles again.”

Transforming FP&A is long-term development, from the mindset down through people, processes and technology. There is no real destination, because FP&A continues to evolve, and we need to evolve with it.

Other critical challenges companies encounter when trying to transform their FP&A, which Beam and his colleagues discuss in an accompanying webinar, include:

- Lack of alignment among business leaders.

- Sticking with the traditional approach to FP&A.

- Persistent gaps in skills.

- Inability to adopt or scale up new ways of working.

- Inadequate technology and data.

Role of the CFO

Having a CFO who is on board for transforming FP&A makes life easier, but it is not traditionally the case. According to Beam, it is a lot harder to explain the benefits of this transformation to CFOs than it looks. “Imagine explaining the color blue to someone who has never seen blue,” said Beam. “Sometimes that is the way it is with CFOs who may be uncomfortable doing less.”

While there is also a lot of risk, massive transformations and significant movements can happen with the FP&A leader. “I would encourage FP&A leaders to ask what control they have, and where they can focus to make significant improvements and win over the senior leadership,” said Beam.

Liu-Lindberg adds that CFOs are typically born out of accounting, meaning they might be groomed for accounting, making the change uncomfortable. “I think the CFO and FP&A should just get together and say, ‘We know what we need to do. Logically speaking, emotionally speaking, we have changes to make, and we can work together on a transformation plan,’” said Liu-Lindberg. “FP&As can also do it on their own, but why not work together? They are one team.”

To be better partners, FP&A should do more of this

According to Liu-Lindberg, the first step is to get out of the finance FP&A cubicle and see how money is made, what is happening and how you can help. “FP&A cannot help or make a difference in front of the screen, and research shows that they are stuck in front of the screen working with data and trying to analyze numbers,” said Liu-Lindberg. “FP&A can make a difference by bringing everything they know to the table, and discussing what it means for the organization’s options, risks and decisions.”

The second step is to focus on what matters. Instead of analyzing all the numbers, figure out the top three priorities of your business leaders. Then, go back to your screen, analyze, and come back with a recommendation. If you do not know the key pain points of your business, you will not get anywhere. “Do not start with data, start with what the business needs from us and how can we help them,” said Liu-Lindberg. “By following that process, you will eliminate a lot of work you are already doing.”

“It is probably more important to be descriptive about what FP&A will no longer do than what it will do at the start of a transformation,” said Beam. “For example, FP&A is not going to do variance analysis on tasks that are less than $10,000 or $50,000. They are no longer going to run metrics, support reconciliations and closing packs, or complete 50 PowerPoint pages. Let's focus on 10 or 15 metrics that matter to the shareholders and people that depend on the success of the organization, and then focus on the analysis and decision support.”

“To summarize, align your FP&A organization to focus more on what matters to the business and cut out some of the things that are low materiality,” said Lapidus.

Action Steps

Concluding the webinar, both Liu-Lindberg and Beam provided their top three action items for FP&A professionals to become better business partners.

Liu-Lindberg’s Action Steps:

- Create a definition/description of what you want your staff to do differently.

- Outline what skills your staff needs in order to succeed in their new tasks, and do a self-assessment of the team.

- Create a benefit case of what you would like to achieve with the change.

Beam’s Action Steps:

- Stop: Ask “What can you do less of?”

- Start with something that moves you from a D to B grade. Do not aim for the top right away.

- Remember, technology is not the goal.

Check the latest knowledge and trends in FP&A on AFP’s FP&A page, and visit AFP's Career Hub for more resources on career skill building and management.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.