Articles

The Future of FP&A: Two Ways to Take the Reins

- By Bryan Lapidus, FP&A and Anders Liu-Lindberg

- Published: 3/4/2019

This blog originally appeared on LinkedIn.

In a recent survey, CFOs named the function of financial planning and analysis (FP&A) a top priority to transform and get more value from. That’s no surprise to us because we see FP&A on the rise, driven by CFOs to become more strategic and a value-creating partner to the CEO.

THE BUSINESS NEEDS MORE FROM FINANCE

The demand for agility is changing all businesses, either as part of their effort to lead or to stay competitive. Market forces compel the change away from top-down, control-oriented hierarchies to flexible systems that highlight responsiveness, inclusiveness, and risk-taking. Our business partners, including the CEO, do not have time for a lengthy budget process and outdated forecasts because the market is moving so quickly. They are demanding quick financial closes, rapid interpretation of the data, and insights that they can convert to action. These insights need to be data driven and combined with business judgement; if finance cannot supply that, they will develop their own analytics capabilities.

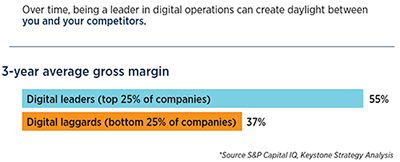

In addition, finance needs to stay on par with the company’s digital plans. Digital leadership is deployed throughout a company, creating an IT strategic plan including data management practices. Finance needs to be a part of that plan to have inter-operable systems and information that relate to other parts of the enterprise, as more thoroughly digital companies outperform their peers. (More data on that here)

THE CFO NEEDS MORE, TOO

This existing need has pushed the CFO into action. If executed well, the CFO becomes a strategic business partner while maintaining the traditional finance role as the steward of corporate capital and championing the company over business unit fiefdoms. Change needs leadership to be successful, and the CFO is the logical sponsor of a finance transformation. With an overall goal of harvesting insight from data in a short cycle time, here is a two-step process to realign finance:

First, increase efficiency everywhere. CFOs still retain the mandate for financial control, including reporting and compliance, but simply keeping books clean is no longer enough. CFOs need to deploy technology to free up people to move into the analysis and insight positions in FP&A. This will require some retraining, as accountants, auditors, and others move to new roles, and they will bring with them deep technical expertise.

Second, the CFO needs a framework to design the FP&A team of the future, a roadmap for investments in people, identifying the right technology, and designing the right processes. We will address this framework in another article which will set the tone for the future of FP&A.

FP&A NEEDS A NEW MINDSET

This should bring about a golden age for FP&A where opportunities are abundant to make an impact in the company. It starts with the right mindset for FP&A though, which will be the topic of a deep-dive in an upcoming article with views from different practitioners.

The days of sending around spreadsheet templates and linking the subsidiary sheets into a master model are over. FP&A requires efficient financial processes and acumen that support our vision, combined with enabling technology and the skills to use it. These technical skills will only carry us halfway; we need the interpersonal skills to be effective partners who know our partners’ business and earn a seat at the table.

The benefit for all three stakeholders is a transformed finance function that can plan continuously, reallocate resources quickly, increase decision velocity, and build agile operations.

TWO ACTIONS FOR FP&A TO TAKE

We can take the reins in our own career. As a community, we can share our individual experiences by developing case studies, contributing at networking events and attending conferences. We can continue our learning through research, certifications, and education.

Our research indicates that finance professionals who develop a plan of study to address their skill gaps, together with their bosses, feel most confident about their future. Don’t wait for your employer to guide your career; digital leaders often acquire skills and learn about opportunities independently and bring them back to the office. (More data on that is here)

Now is the time for each stakeholder to step up and grasp the reins; the future of finance is waiting. Are you ready to take a leading role in stepping into it?

Anders Liu-Lindberg is the Senior Finance Business Partner at Maersk supporting their largest product being the trade lanes between Asia and Europe. He’s also the co-founder of the Business Partnering Institute.

Bryan Lapidus, FP&A, is the Director of the FP&A Practice for AFP.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.