Articles

The AFP FP&A Momentum Index: Results from Q4

- By Bryan Lapidus, FPAC

- Published: 12/13/2021

FP&A Momentum Index: Trend Report

Results:

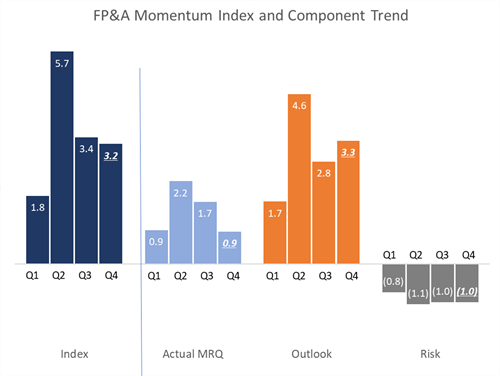

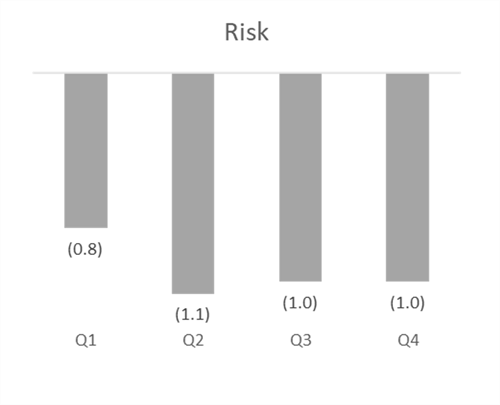

The Momentum Index was slightly lower in Q4, dropping to 3.2 from 3.4. The downdraft from a disappointing 0.9 score in the Q4 Actual most recent quarter (MRQ) was greater than the increased optimism of 3.3 for the Outlook. The Risk score remains unchanged at (1.0), even as the make-up of that risk shifted during the quarter.

Commentary:

- This is still a covid economy, and the economy has not escaped that gravitational pull. The Q4 Actual MRQ plummeted as the recovery was postponed by the rapid spread of the delta variant in the U.S. However, growth expectations are building: companies plan to invest for growth in 2022, and trust that revenue will follow thereafter.

The Quarter That Was: Drivers of the Actual MRQ Component

Results:

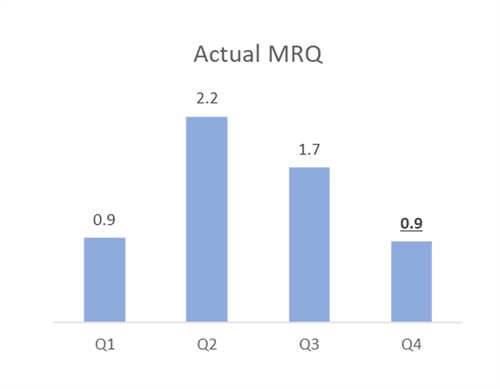

The Actual MRQ component continued to slide from Q2’s high, down to 0.9 from 1.7 in Q3. In Q3, revenue was expected to be flat, but the actual results showed decline. Earnings decreased even faster, as companies increased spend on sales & marketing, business travel and entertainment (T&E). Other areas remained flat, except reduced M&A and increased working capital.

Commentary:

The Actual MRQ seems to show a “failure to launch” in the quarter as revenue growth fell despite the previous prediction that it would be unchanged. However, business is eager to get back to work as growth-oriented spending increased (sales & marketing and T&E). Companies accepted decreased profitability in order to spend their money (and accumulating working capital) and get back into the market, which looks like an investment in the growth for 2022.

Looking Ahead: Drivers of the Outlook Component

Results:

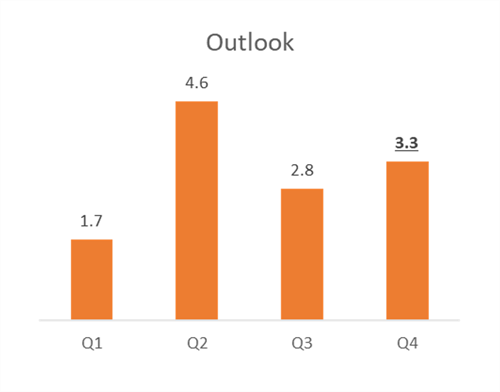

Companies exude optimism in the Outlook, with the measure rising to 3.3 from 2.8 in Q3. Revenue expectations are flat, but businesses expect a significant increase in business investment, capital expenditures, and T&E. The expectation is for growth to come from all sources: new markets, new products and M&A, joint ventures and divestitures. Correspondingly, the Outlook for earnings is lower. It is worth noting this result reflects data before the omicron variant of coronavirus became known.

Commentary:

-

Optimism climbed in Q4 after the delta variant knocked it down in Q3. The Outlook for business growth is up for new products, new market and M&A/JV activity are all higher. The biggest jump is in business investment/capital expenditures indicating that companies are spending strategically to position themselves for an expanding economy in 2022.

Challenges Ahead: Drivers of the Risk Component

Results:

The overall Risk component remains at (1.0), but the character of that risk has shifted slightly. Concerns about Human Capital (the ability to attract and retain talent) and Cyberrisk have ebbed for the second consecutive quarter, while Operations (supply chain) concerns increased and now have become the number one Risk.

Commentary:

-

The discussion from the previous index components (diminished revenue and increased business costs) are showing up as an increase in financial (margin) risk as companies work through concerns of how fast to invest in growth. If the revenues fail to materialize and financial risk grows, we may see a sharp pullback in spend.

-

The reduction in Human Capital risk may indicate that we have passed the peak of the “great resignation,” perhaps due to people settling in new roles, or companies adjusting to the new reality.

State of Play in FP&A: Global Techniques in Modeling and Analysis

Results:

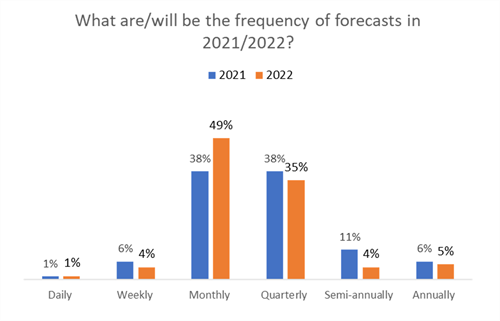

FP&A respondents indicate that, in 2021, the typical forecast cycle was monthly or quarterly (each at 38 percent).

For 2022, we see greater emphasis on the monthly cycle as it grows to almost half of responses. The gain in the monthly forecast is pulling from the all the other potential responses.

Commentary:

-

The results overall indicate a faster cadence of forecasting. This may reflect the increased use of faster platforms or automation that ease the effort of reforecasting.

Recap of the AFP FP&A Momentum Index

The AFP Momentum Index survey was developed by members of the AFP FP&A Advisory Council, finance practitioners representing various industries and companies. It is administered by the Research Department of AFP, and the data is from a survey of independent FP&A practitioners. The Index has a single composite score based on three individual sub-scores that will be tracked over time. The sub-scores are as follows:

- Actual Most Recent Quarter (MRQ): how did your ACTUAL RESULTS compare to the most recent forecast? Data is gathered on 10 elements.

- Outlook: how has your company's OUTLOOK changed for the subsequent six months? Data is gathered on the same 10 elements.

- Risk: what is your company's RISK OUTLOOK for the next six months? Data is gathered across six risk categories.

AFP has launched the Momentum Index, a quarterly survey designed to take the pulse of the business community as seen from the point of view of the FP&A department. The survey was developed by members of the AFP FP&A Advisory Council.

Reading the results: This is a momentum survey, where the resulting number indicates the direction relative to past readings. A positive or increasing composite number indicates business growth; a negative or declining number indicates a diminished economic performance.

PARTNER CONTENT

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.

.tmb-small.png?sfvrsn=3731146b_1)