Articles

The AFP FP&A Momentum Index: Results from Q2

- By Bryan Lapidus, FPAC

- Published: 6/16/2021

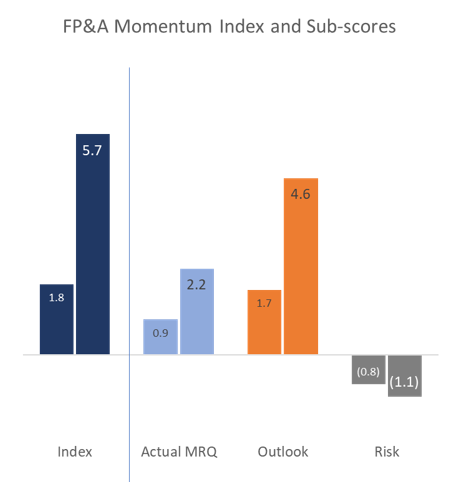

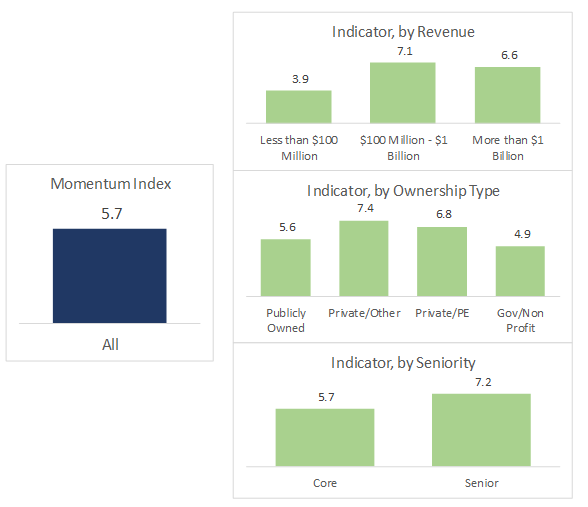

The total indicator score for Q2 2021 is 5.7, an increase from 1.8 in the first quarter.

Measurements of the Actual Most Recent Quarter (MRQ) moved higher, from 0.9 to 2.2, and so did the Outlook for the next six months, from 1.7 to 4.6. The Outlook scored higher than actual, indicating an accelerating business climate. The Risk outlook worsened, from (0.8) to (1.1).

The Momentum Index reflects the strong gains in business operations as the country reopens after a year of lockdown, but risks remain on the horizon.

- Actual MRQ results surpassed expectations and prior quarter.

- The Outlook is higher than both recent expectations and prior quarter.

- The Risks to growth are also increasing.

The Quarter That Was:

Drivers of the Actual MRQ Component

Results:

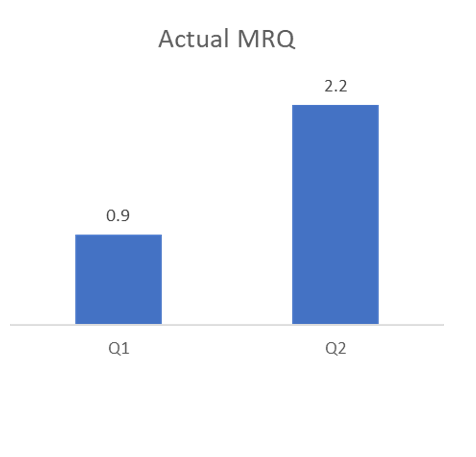

The Actual MRQ results are better than forecasted, increasing from 0.9 to 2.2.

Both revenue and operating earnings are favorable to expectations for the second consecutive quarter. Spend in most categories is slightly lower but still close to forecast for sales & marketing, company employment, and business investment. However, travel & entertainment outlay were significantly below forecast. Within business activity, new product development, new market entry, and mergers and acquisitions (M&A), joint ventures (JV) and divestitures exceeded expectations for the second consecutive quarter.

Observations:

The economic recovery is evident in both the top and bottom lines of the income statement; companies are growing while containing spend. One Momentum Index member said, “I'm definitely seeing an uptick in spend at my company. Especially from a sales and marketing standpoint. They're pushing, they're coming up with creative marketing, advertising, and promotions because they see the opportunity for travel to increase.”

Looking Ahead:

Drivers of the Outlook Component

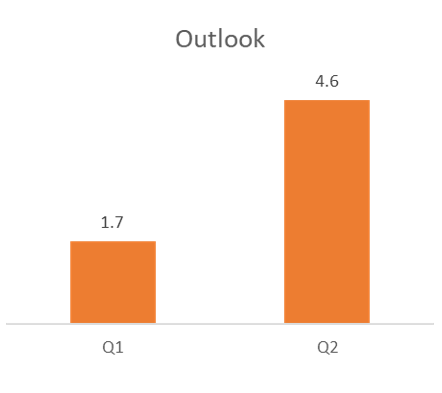

The Outlook increased from 1.7 to 4.6 and drives the overall gain in the composite Momentum Index.

Revenue and earnings are expected to increase even as companies increase spend on sales & marketing, business investment, and hiring. However, travel & entertainment expectations are unchanged. The activity outlook for new business activities remains high—new products, markets and mergers & acquisitions (M&A).

Observations:

The Outlook signals a significant increase from last quarter’s reading, as well as compared to the actual results. The implication: the business ecosystem is ready for launch!

One Momentum Index member said, “I think M&A's going to [grow exponentially]. I think supply chain is going to be such a drag that I think businesses are not going to be able to do a lot of things organically. Income will accumulate and companies will hunt for growth.”

Challenges Ahead:

Drivers of the Risk Component

Results:

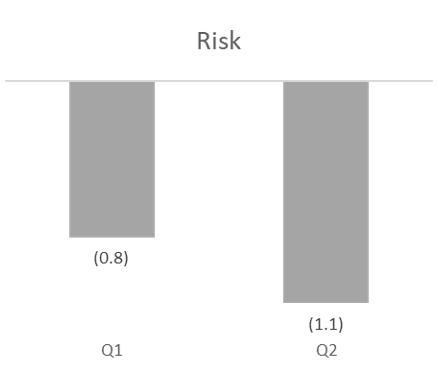

The measure of Risk shows increasing warnings for businesses as it moves from negative 0.8 to negative 1.1.

All measures of risk are negative for the second consecutive quarter, with pessimism increasing in five of the six measures. The only risk position to improve was business model risk. The outlook for human capital/the ability to attract and retain appropriate talent, is both the largest risk in absolute terms and the largest uptick from the first quarter reading. The second largest risk is technological/cyberrisk, and third is operational/logistics and supply chain.

Observations:

- On human capital: “There's a lot of articles predicting significant labor movement in the next four months. A lot of people are going to be looking for new employment once they go back to the workforce and realize they are unhappy with the job ‘fit,’ whether it is too much pressure, not enough flexibility, not aligning to their expectations. They're going to be actively searching for new opportunities. Companies and market watchers are projecting lots of attrition.”

- On technology/cyberrisk: “Already this year we had the defense department and Colonial Pipeline hacks, and this data does not reflect the meat packer hack. I predict cyber risk will explode as well, with more and more hacks coming out, hitting other industries.”

- On logistics/supply chain: “I think supply chain is going to be more of a shock than we realize, and will get significantly worse before it gets better. People and businesses want to spend but just can't find what you want to buy because everything's out. FOMO (fear of missing out) has become FORO (fear of running out). I predict this continues at least to the end of 2021.”

Demographic Analysis

Observations:

Drivers of differentiation:

The middle-tier companies ($100 million - $1 billion) has the highest overall reading, powered by strong results in the most recent quarter; the largest companies (revenue more than $1 billion) have higher Outlook scores while smaller companies with revenue less than $100 million lag. The most noteworthy divergence among these groups is non-cash working capital: smaller companies expect this to increase, and the other two groups anticipate decreases.

Drivers of differentiation:

Publicly-owned organizations have the highest score in Q1 at 5.5; in Q2 that is third highest as all other groups increased significantly. Privately-owned companies/Other have the highest Outlook expectation for the top line, and Government/Non-Profit had the highest expectation for the bottom line.

Drivers of differentiation:

Senior finance practitioners are more bullish regarding the Actual MRQ, driven by investment spending, and also for the Outlook, driven by revenue, earnings, new products and M&A activity.

State of Play in FP&A:

Improving Your Analysis

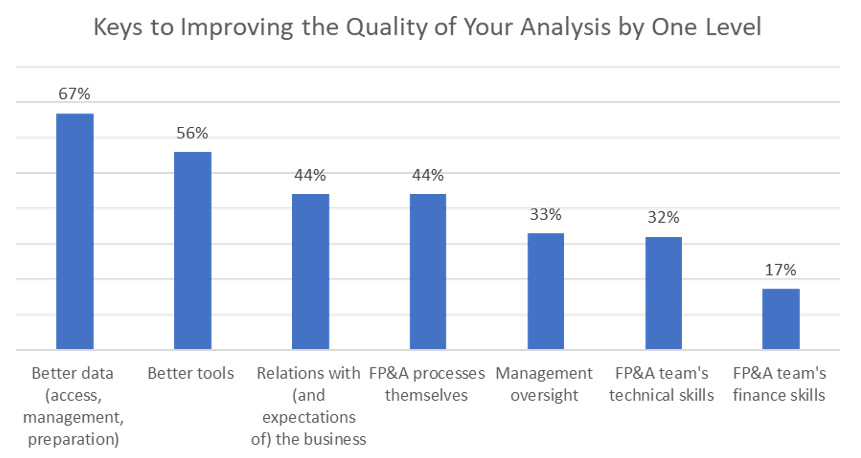

In addition to the Momentum Index, AFP includes a question each quarter specific to the practice of FP&A. This quarter’s question was, “What is required to increase the quality of FP&A’s analysis by one level?” Respondents could choose up to three options.

As a category, Technology & Data is a priority, with “Better Data” cited most-often by 67 percent of respondents and “Better tools” came in second (56 percent of respondents).

The middle tiering contained process issues, including “Relations with the business” at 44 percent, “FP&A processes” at 44 percent, and “Management oversight” at 33 percent.

FP&A self-assessed their technical and financial skillsets as the areas least in need of improvement.

| Core vs Senior Finance | Ownership Structure | Company size, by revenue |

|---|---|---|

|

|

|

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.