Articles

Reconstructing the Hierarchical Pyramids: A Dell Case Study

- By Andrew Codd

- Published: 2/28/2022

What do the ancient pyramids of Egypt and corporate hierarchies have in common? They have both existed for as long as civilization, they require a large base to support the apex, and neither is the best way of building for the future. Just as technology has empowered us to change the construction, shape and utility of our buildings, we are now changing the shape of the corporate hierarchy — from pyramid to diamonds.

Similar observations may be said of the corporate hierarchy. As a representative sample, we will examine the CFO organization, which is traditionally thought of as various levels of people who pour over lower levels of data, processes and technology to aggregate nuggets of knowledge and raise them up to the appropriate level of authorization for action. However, just as technology has been empowering our personal worlds with faster, cheaper, and more democratized access to knowledge, the same is happening in the corporate world. The result? A new shape of finance for the practitioner — from pyramid to diamonds.

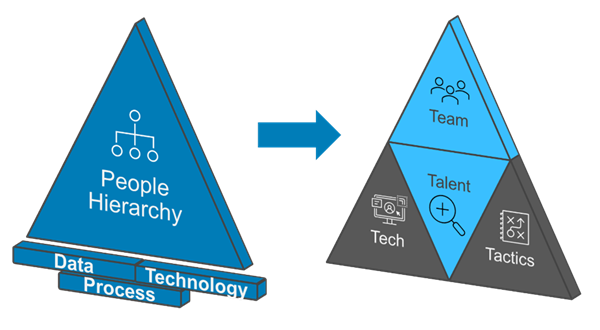

If we think about moving the technology and data into part of the pyramid, and adapting our practices and similarly moving that into the pyramid, it allows the people at the base — laying foundation stones and performing the “grunt” work — to ascend to the middle of the pyramid. At this location, they can work with the data to add value. Dell Technologies applied that thinking, and we called it the 4Ts.

Case study: The 4Ts transformation within Dell’s support services finance team

In 2018, Dell’s support services finance team was coming under increasing pressure to “do more with less.” Some attempts were made toward digital transformation by adding new tools to improve efficiency and scale value. They started with the implementation of a single-source-of-truth database, a Tableau server self-service dashboard, and hiring lower-cost and junior staff offshore to crunch the data within their $5 billion revenue business unit. Despite all this, business partners were unhappy at the quality of the analysis and the advice being provided to grow the business, and even worse, the team’s employee net promoter score and morale was at rock bottom: -100.After a change in team leadership, finance persisted with driving digital transformation throughout the team. This time, however, they changed their approach, building the effort around a 4Ts. One quick note: It is hard to say which of the four elements below should come first because the interlocking elements require all parts to be in place for success. In hindsight, I recommend planning them together.

Talent: Who is on the team, what are they achieving, and where are they going? We conducted a career-bone diagram (CBD) audit to understand individual strengths and created ideal job descriptions for each team member and development plans to plot their career path through digital for the next three years, including what type of mentors to match them with, digital training courses, and opportunities/projects to work on. In addition, every time a team member delivered value directly for themselves (e.g., implemented a new digital automation of a legacy process, performed four hours of community give-back service by painting a local school) or indirectly for a stakeholder (e.g., identified and implemented a new governance process to save $100 million in lost margin) it was logged in a value-logging app that allowed them to automatically request and track testimonials from stakeholders, and which linked to further reward and recognition awards.

Team: A blending of strengths. Dell created a noSQL database, Google BigQuery and PowerBI tools to create a team-matching tool. This involved the consolidation of all the individual team members’ strengths and role responsibilities defined via the CBD audit to ensure an appropriate fit with the use of tactics, technology and finance leadership to drive forward the digital transformation. In application, the team noted some specific skill gaps in automation, analytics and data engineering capabilities. This led to the creation of a low-cost, in-house software engineering and data scientist specialist team in Cairo, Egypt, to build robots, apps and accurate data sets specifically for the team. The team also assigned global owners to its areas of strategic advantage, such as governance policies, business case planning and bid-desk pricing and was tasked to digitalize each one as much as possible.

Tactics: Tell me what you want, what you really, really want. Team members conducted stakeholder analysis interviews, gathering and reconciling the difference between what stakeholders wanted versus what they received from their finance team, as well as other points of friction or pain. These have-want gaps were then timeboxed, prioritized along with business-as-usual and team digitalization activities, and then worked through to resolution on a continual basis to increase the business partners’ team effectiveness. Team members were also paired with BU regional leaders around the globe to ensure a follow-the-sun coverage model of FP&A support (funded by their business partners) — a good sign that the team was working on the right things.

Technologies: Upgrading the tools. Where existing tools were added on an ad-hoc basis, the 4Ts approach replaced these with systems, which were designed from inception and dedicated to service this effort. The original Tableau server was swapped out for the team’s own three virtualized Windows server set-up for production, development and proof of concept. The production environment was built around a micro-services architecture (containerization) to allow apps to run via different programming languages without conflicts and to allow administrators to have access control at the user and data level. PowerBI became the go-to visualization tool, along with some bespoke visualizations in R, and a number of Excel templates were automated into apps utilized by the team members and business partners. Due to the team’s switch from two high-cost locations to nine distributed cities worldwide, they were relatively immune to local lockdown disruptions or work-from-home mandates during the coronavirus pandemic. To keep track of and continue to drive the digital transformation progress, the team utilized Finnetics™ software and dashboards to track individual value logs, and career bone diagrams and stakeholder analysis to ensure what mattered got measured and what got measured got managed.

Fast-forward to 2022, and the team has now recorded over $3 billion of added value in their logging app and helped the BU grow its business 36% while reducing prices 15%. Plus, their scope has grown to include another BU of a similar size. When compared to 2018, the team’s OPEX is half that of its prior level — 30% of team members are now funded by the business and 70% are based remotely in low-cost locations — even though two-thirds of the team has been promoted.

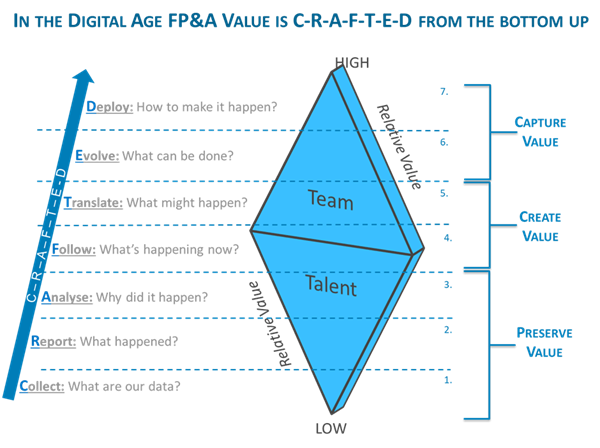

The new shape: CRAFTED value

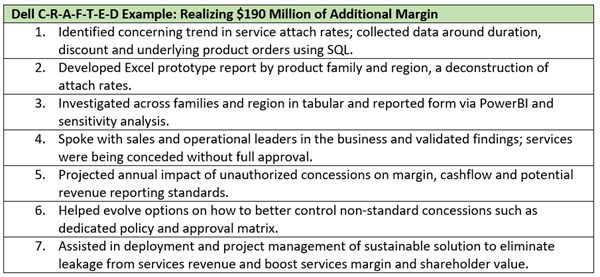

In traditional finance pyramids, only the most senior finance officers were expected to make things happen and to deploy solutions within the business. Most of the finance team was busy collecting, collating, and coaxing meaning from disparate data. With this 4Ts approach, there are now more team members contributing at higher relative value levels because the supporting digital technologies and tactics are pushing FP&A out from the preserve value zone of collecting, reporting and analyzing data, and up into these create and capture value zones. There are now many more team members available to offer evolving options as to what to do next with their business partners, helping them see around corners, and adding genuine value directly and indirectly. These once rare levels of value are no longer the domain of a select few; it is now open to the whole team (see panel below).

Talent is no longer an afterthought. Our new digital technology and operating tactics have freed us up to move to higher levels within the diamond of team and talent, and FP&A has become the platform where individual talents can be supported.

The more we, as FP&A professionals, adapt our traditional pyramid heritage to the 4Ts, the more effort we can put into delivering valuable outcomes for our business partners, strengthening not only our team, but the entire business.

PARTNER CONTENT:

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.

![UMB Bank Vert Full Color CMYK[2] UMB Bank Vert Full Color CMYK[2]](/images/default-source/default-album/association_of_financial_professionals/umb-bank-vert-full-color-cmyk-2.png?sfvrsn=169a146b_1&MaxWidth=140&MaxHeight=140&ScaleUp=false&Quality=High&Method=ResizeFitToAreaArguments&Signature=27622428BC9C346FF684161B44C690104798350E)

.png?sfvrsn=2c6d166b_2&MaxWidth=80&MaxHeight=50&ScaleUp=false&Quality=High&Method=ResizeFitToAreaArguments&Signature=E38BCEACDE40B47D5C22BBB194B034137985F265)