Articles

Managing Reorgs and Purple People at Shell

- By Joanne Oh

- Published: 9/12/2022

.png?sfvrsn=38ce136b_1)

The APAC FP&A Advisory Council (FPAAC), a networking and advisory group, meets three to four times a year to discuss best practices, common challenges and innovative initiatives in the Asia-Pacific region. As part of our series profiling individual council members, AFP’s Director of FP&A Practice Bryan Lapidus, FPAC, spoke with Sai "Giri" Giridhar, Finance Director at Shell Energy India.

AFP: Tell us a bit about your career journey.

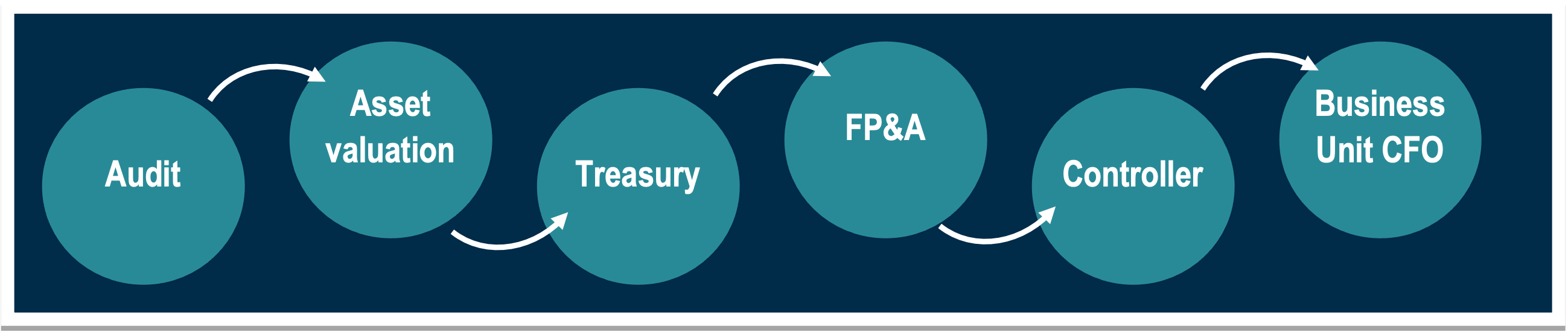

Giridhar: Like most people, I had several varied roles at the beginning of my career. I began in audit at PricewaterhouseCoopers, then moved to a start-up company that valued real estate property portfolios for several global Investment Banks. I then worked for American Express Bank on foreign exchange and money markets settlement before moving to G.E. Capital, where I was truly soaked into a full-fledged FP&A Role.

At Shell, I was mainly in FP&A roles except when I moved to the U.S. for a Deputy Controller role. I oversaw Upstream Americas, which included the Deepwater, Unconventionals and Oil Sands businesses. These were the core businesses of the Upstream Americas, and at the time, the Controllership was a centralised function in Houston.

After that, there were a lot of changes in terms of breaking the setup of Upstream Americas, making it a more global line-of-business-based organisation. It was a journey I can never forget because it was part of a big transition of our finance function where I was at the forefront, working through the whole design in many ways across FP&A and Controllership functions. It was an ideal scenario to bridge the capabilities of the Finance Operations' service centres and the dynamics of the Finance-in-business scope.

After that, there were a lot of changes in terms of breaking the setup of Upstream Americas, making it a more global line-of-business-based organisation. It was a journey I can never forget because it was part of a big transition of our finance function where I was at the forefront, working through the whole design in many ways across FP&A and Controllership functions. It was an ideal scenario to bridge the capabilities of the Finance Operations' service centres and the dynamics of the Finance-in-business scope.

After the U.S. stint, I managed teams delivering Controllership and FP&A, so I got to see the entire spectrum. Currently, I'm the Finance Director for the Integrated Gas business. As a CFO, you experience many challenges while being a conscience keeper for the business.

AFP: Everyone has their own journey, and trying different roles is part of what makes work fun. You found your way to FP&A, but I don't know how many people look into it in college.

Giridhar: I think it depends. In MBA campus hiring over here, often during interviews, few people seem keen on Controllership, but I see that enthusiasm for FP&A is relatively high.

Some Controllers do the FP&A job, but how do we persuade Controllers to gain this fundamental knowledge and, if possible, the FP&A certification? Because generally, if you say you've done Controllership, you won't typically be seen as someone who can do business partnering. Whereas, if you bring the FP&A certification along, it adds significant trust and reliability.

See how becoming certified in FP&A can advance your career and validate your unique skill set. Download the FPAC brochure.

AFP: You work at Shell, a huge multinational company. How have you seen the organisation and arrangement of teams change across functions, businesses and continents?

Giridhar: I've seen many reorganisations within Shell. Although we call them reorganisations, they are not just for the sake of change, but to ensure that Shell maximises value out of these organisational setups. From the Finance function, we look at starting off with the basic tasks and routine work, and then transition slowly and design the teams so they can drive optimal value.

You need to give time for the individuals to understand the business and develop their skills before you say, "Yes, I think this team is now ready to take on more accountability." For example, when I started in Shell, I was a core FP&A analyst for Europe Shell's Cards business. And then, over time, I built the whole team responsible for the Global Cards business on FP&A scope.

AFP: Do you think a company ever fully settles on the best solution and stays there?

Giridhar: I don't think that's the case, and I hope that's not the case. The change in the finance function is often driven by the business side. So, if the business is going to reorganise itself, that could be another reason why finance has to rethink the whole support model, not from the back-end but more from the front-end, as these are roles with deep business partnering. You do have to be adaptive to what the business is seeking and what changes they bring in. It's not purely from an independent finance function lens that you need to look into for organisational setup.

And sometimes, organisation structures are dictated by legacy or logistical factors. The legal entity I work for was a joint venture with Total, and Shell bought them out in 2019. Shell inherited a legacy ERP (enterprise resource planning) system that is not the standard ERP system used in other parts of the company. With a legacy ERP system, there is currently no scope delivered out of Shell's Finance Operations because it does not provide economies of scale, and there is a lack of value levers. It will take a couple of years to roll out the standard ERP system with my team, so until then, I'm trying to optimise the organisation's design today.

AFP: How can smaller companies think about their organisation or reorganisations?

Giridhar: If I were to start off fresh, I might realise that my team is actually doing multiple roles that do not typically fit into the typical finance operations shared service design. So you might see an individual who is doing a controller's job at the beginning of the month. This person might be doing an FP&A job in the second week, and maybe in the third week, working with Contracts & Procurements (C&P) to understand where there are opportunities within contracts.

Now, if I were in finance operations, I would have a team dedicated to, let's say, conversations with C.P. where they would focus on contract value maximisation. There, I would have a separate group for accounts payable focused on A/P metrics and seeing what they can improve there.

AFP: What does it mean to be "purple people" in Shell finance?

Giridhar: Let me start with the "purple people" concept. With significant scale-up of digital opportunities, we realised that there is an opportunity to increase our scope of activities, reduce the time needed to prepare some of these reports, and then enable people to drive insights.

To enable that, you need to convert a lot of the underlying reporting landscape, which requires strong I.T. skills — not necessarily I.T. individuals — to understand the functional requirements of the reporting.

It started by identifying interested individuals with a technical leaning, although at their core, they need to be finance folks. Today, we are saying that we expect all individuals to have those technical skills to enable a good understanding of the I.T. landscape — and how to bring that value along with the functional expertise to leverage technologies.

Learn how to increase the data capabilities of your finance teams with the 2022 AFP FP&A Guide: Get Your Data Right, underwritten by Workday.

AFP: Is this "purple people" concept a consequence, or is it driving the need for Shell to reorganise every few years? As that capability comes into play, that changes what is possible?

Giridhar: Rather than reorganising, I would say it's a reskilling opportunity within the same setup. I don't think it's led to any reorganisation or would lead to further reorganisations. After bringing in these "purple people," I think the collaboration with our I.T. folks is even more profound. This is because we now have our own individuals within the finance function who understand the tools better, enabling I.T. to scale up and speed up some of the execution of their projects. Now we can appreciate what we need clearly as an end state. So, I think it is just a question of reskilling individuals with that passion for digital.

Giridhar’s career path:

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.