Articles

Machine Learning for Finance is Applicable and Accessible

- By Chandu Chilakapati and Devin Rochford

- Published: 8/29/2018

There are several misperceptions that lead many corporate finance teams to avoid investing in machine learning. Machine learning for finance is applicable and accessible.

FINANCE TEAMS AVOID MACHINE LEARNING

A recent PwC study found that over the next two to three years “basic and intermediate AI,” or machine learning, will be the single most important technology impacting the finance function. It’s easy to see where the respondents are coming from: The finance function, by nature, is forward looking and machine learning’s ability to make accurate predictions will lead to faster, more informed decisions. Despite this, a recent Workday survey found that only 35 percent of corporate finance teams are making extensive use of advanced analytics, including machine learning, in key finance areas such as planning, budgeting, and forecasting. This begs the question, why is there such a disconnect between the perceived benefits of machine learning and the application of the technology?

We believe there are four misperceptions leading to approximately two thirds of corporate finance teams not investing in machine learning:

- Machine learning requires big data

- Machine learning requires staffing data scientists

- The cost is high with limited or unknown benefit

- It is more science fiction than true science.

We will break down these misperceptions to show how applicable and accessible machine learning can be in the finance function.

MISPERCEPTION: BIG DATA IS NEEDED

Currently, the perception of many finance professionals is that machine learning is a solution that requires big data. Most FP&A departments don’t have big data. Machine learning can produce extremely effective results with small or medium data sets as well. To illustrate this, we devised an experiment where 30 inputs were manipulated through a variety of mathematical techniques and then randomly weighted to generate an output. To confuse any prediction algorithm further, we gave half of the inputs no weighting at all. Only the inputs and the single output were fed into our platform, all manipulations and weightings were hidden. By any conventional statistical methods, our outputs resembled chaos.

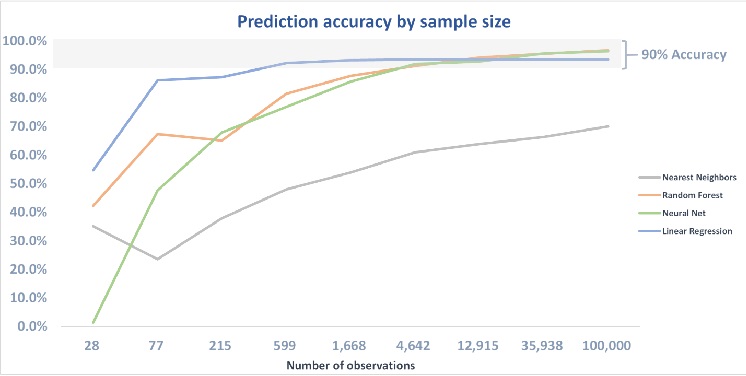

We then tested selected prediction algorithms on a scale from 10 to 100,000 observations. The results showing the accuracy of the algorithms by number of observations are illustrated in the graph below. While certain algorithms struggled with smaller data sets, others were able to learn very quickly showing decent results with as few as 1,000 observations, and most algorithms were over 90 percent predictive once the number of observations increased to 5,000. This is a clear example that the machine learning tools don’t need a lot of data to predict better than humans. We also see that certain algorithms are a better fit for certain data than others. Analysts tend to use the same tools for all problems and datasets, but with the power of processing we can use the right tool to solve different problems.

Measuring the impact of data size on the accuracy of selected algorithms using Alvarez & Marsal’s Machine Leaning Platform.

To use a real-world example, we were able to utilize machine learning to produce a model to estimate S&P Credit Ratings using only publicly available data with approximately 40,000 quarterly observations of public company filings. Our model SCRE (Sample Credit Rating Estimator) started with those observations and 400 features (data components) per observation to produce a final model that required fewer than 10 features and outperformed any of the commonly used models.

MISPERCEPTION: DATA SCIENTISTS ARE REQUIRED

By removing the need for big data from the picture, the job description of people who leverage machine learning to make more accurate predictions stops resembling the qualifications of a data scientist and starts resembling that of a traditional analyst. Someone who can not only work with numbers but also understand the meaning behind those numbers. A finance function will never get completely sanitary or clean data, it will always be heavily contextual. No matter what you are doing with the data, you will need people who can understand its context and limits. Those are your analysts and managers, not necessarily a data scientist.

It will be important to find the right partner or staff that understand how to apply and interpret the machine learning results, but that person isn’t necessarily a data scientist. While having resources with knowledge of the underlying models and concepts is undeniably important, it would be useless without team members who understand the underlying data and business. This understanding will guide how you tune your models and feed it the right data to train the model.

MISPERCEPTION: PROHIBITIVE COST

Most assume that implementing machine learning will be complicated and expensive. Combine that with unknown benefits and it is easy to see why only 35 percent of Finance departments have invested in it. Our view is that these techniques will be commonplace in Finance functions such as FP&A and Treasury within the next few years. That growth will increase competition among vendors and reduce costs. The primary perceived cost to running algorithms is processing power. However, the cost of processing power is already low and decreasing. Moreover, for “finance functioned sized” datasets the processing power required isn’t nearly as great as originally imagined.

We built our Alvarez & Marsal Machine Learning Platform (AMMP) using Python and open source libraries with processing and data storage powered by AWS. In developing SCRE, our increased monthly costs on AWS over the development period was in the hundreds of dollars. Processing and storage on demand is inexpensive due to the competition between cloud service vendors and technological advances in material science and hardware development.

Once you jump the cost hurdle the bigger obstacle to move forward is the feeling that the benefit is unknown and potentially intangible. Two key takeaways that we learned from building out SCRE that might highlight the benefits are: the machine corrected for our bias and outperformed any of our prior models, and the end product created tangible and intangible benefits beyond our stated purpose.

Imagine running a scenario analysis to determine what your performance would be under certain market conditions. To do this, even the best analysts will have to make certain general assumptions, take shortcuts and potentially introduce certain biases in the processes. This isn’t necessarily a fault of the analyst, it’s just that reexamining every single assumption in light of updated information is difficult and time consuming. In this example, machine learning techniques could be applied and continuously updated over time to ensure that the predictions are both more accurate and reflective of the most current possible information. Not only will this produce better results, it will also lead your analysts to doing what they do best: asking questions and searching for insight.

MISPERCEPTION: SCIENCE FICTION

Many finance professionals feel that artificial intelligence, deep learning, or machine learning is still science fiction. Or if it isn’t science fiction it is only for marketing, robots, tech companies, or tech companies marketing robots. The truth is that tech companies are developing and using these types of tools and have been for over a decade. The trickle down to the Finance department is happening now and it is science no different than statistics or regression analysis. The difference is that this science is now accessible to everyone.

The science fiction or magical part of the process is that we can combine technology and financial know-how to collate disparate, unstructured data sources into a useful dataset. It is no longer science fiction that we can capture data at the SKU (stock keeping unit) level and combine that with purchase data for the ingredients in that product. Combining those means that we can have a machine predict when the next sale will be and therefore the next ingredient purchase.

In our opinion, the biggest misperception that keeps machine learning investment at bay is the idea that the current process is working. Machine learning is here now, and it is accessible and applicable to all sizes of data without the need for an army of data scientists. The benefits are tangible and intangible and ultimately lead to a competitive advantage. The costs are negligible, providing you have the right partner to guide you through organizing your data and making the platform user friendly for your current data analysts. Most importantly, the finance department is responsible for providing the informed and accurate analysis to drive decisions and growth using the best tools available. As part of this mission, machine learning is an essential part of the modern finance skillset.

Chandu Chilakapati, Managing Director, and Devin Rochford, Director, are with Alvarez & Marsal, Valuation Services.

Check out our interactive Roadmap to The Future of Finance to see how you can master the new capabilities and models impacting finance.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.