Articles

Let’s Talk Practice: 8 Ways Finance is (Or Should Be) Different

- By Bryan Lapidus, FPAC

- Published: 4/4/2022

We all know the stressors and challenges in our professional finance lives. The AFP's North American Financial Planning and Analysis (FP&A) Advisory Council (FPACC) recently had a conversation regarding how life in finance has changed and how to navigate these changes.

Frustration is high…

People are done being worked to the point of burnout — to the degree that they’re leaping without looking. Whether they’re senior staff or mid-level, they’re quitting. “I can't tell you how many people have called me and said, ‘I already resigned. Do you think that was bad?’” said Betsy MacLean, board member and Audit Committee chair. These are people with kids, even kids heading to college. People who are growing with the company, they’re upwardly mobile and they’re still quitting. “Across the board, people are like, ‘I just don't care. I don't want to do this anymore.’ And just walking,” said MacLean.

And they’re not walking to something new. They’re taking a leap of faith in a time when nothing is certain. The level of frustration that has to take needs to be recognized.

“There is an issue of people getting burned out right now,” said Raja Ramachandran, FPAC, CTP, Director, Global Financial Planning & Analysis, Owens & Minor. The majority of people are attached to some online platform (e.g., Zoom), in back-to-back meetings all day, and simply tired out. “Part of what we're seeing is that many people are at a breaking point. It's quite unusual to think of a sea of people leaving their roles without something else lined up; this speaks volumes.”

… and employees have alternatives

Part of the reason people feel they can do it is that there is a lot of opportunity out there, so they’re not worried about securing something new. It’s a risk they feel comfortable taking in today’s labor market.The dynamic has shifted. The power is now in the hands of the employees. Ken Fick, Vice President of Financial Planning & Analysis, Citrin Cooperman, recounts an event where a young manager came to his office and said she wanted to be moved up to director or she would leave. She was relatively new in her position. “It was just an odd dynamic that she felt that she had that power,” he said.

And America doesn’t have the market cornered on this phenomenon. “The market in the U.K. for finance talent is hot,” said David Gold, Regional Finance Director, Covetrus. It is more than people being poached with better salaries. “How do you make a counteroffer when somebody's leaving not to go to something specific, but just going because they want a break and to see what's out there? You haven’t got something to compete against.”

One response: be a better boss

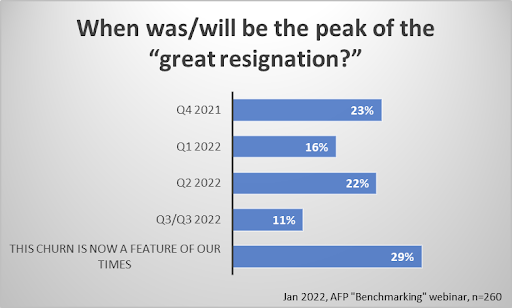

According to an AFP webinar poll, almost a third of finance people think that employee churn has no peak, but rather is the new constant for the foreseeable future. Then the question becomes: what are we doing about it? How are we changing the way we run our business?

The group consensus sounds obvious, but difficult to execute: give people the attention, respect and prioritization they deserve. It is not enough to just focus on the value proposition to external customers and shareholders.

Part of the issue is the old guard not wanting to evolve past the 1990s. “You need to provide flexibility; you can't just call people and yell at them. I'm not seeing as much understanding of this shift at the top as I’m seeing pressure from the bottom for change,” said Fick.

“For me, what has been working is focusing on the people proposition and better understand my team's motivational trigger points,” said Hector Rubalcava, FPAC, Director of Finance, Options Clearing Corporation (OCC). “What are their personal and professional interests? Getting to know them on a more personal basis is instrumental as the objective is to establish a trustful and engaging squad. Also, encouraging curiosity, exploration and accepting mistakes are essential elements for learning and growth. For example, allocating experimentation time to disrupt, look at different ways, challenge the current status quo and ultimately generate actionable insights and drive value creation. It has been said that people learn more from mistakes than from success.”

Mario Vasquez, FPAC, Financial Director, The E.W. Scripps Company, said his focus on retention involves management discretion for flexible work schedules, choice of where to work (i.e., remote or hybrid), pay adjustments, one-on-one career planning, automation and sharing information.

Increase risk tolerance

We all talk about encouraging risk-taking and failure, but have you or your company changed the performance review and bonus structure to compensate in a way that tolerates failure or encourages risk taking? “You can't say, ‘I'm going to allow you to fail, but I'm going to bonus you on success,’” said Bryan Lapidus, FPAC, director of FP&A Practice, AFP.“Right, except that's what we do!” said MacLean.

What if we started measuring volume of ideation, levels of ideation? “That's quantifiable, and maybe we can weave that into a culture where you've brought seven great ideas forward, and maybe five were not successful but two of them were. That's not failure. That's bringing new ideas forward,” said Scott Corvey, FPAC, Vice President of Finance, Consero Global.

Perhaps we need to start with what we’re defining as failure. “If you’re bringing new ideas to the forefront and they don’t take hold, are they really failures?” said Cathy Jirak, Principal and Chief Operating Officer, QueBIT Consulting. “If you're taking a risk, you're learning something.”

And, what are we defining as “success”? In the past it’s been a monetary measure, how many millions of dollars we brought in from this idea. Maybe we need to change that to operational or qualitative measures, such as, “Did you launch something new?"

In order to make that level of change, you have to first build an environment of trust. If people are going to take risks, they need to feel safe doing so. “So much has changed that the trust level has been destroyed,” said MacLean, “and I'm not sure that's a company thing. It feels like it's pervasive.”

Communicate …

“One thing that I haven't heard yet, but that is top of my mind is communication,” said Joe Groat, FPAC, Director, Financial Planning and Analysis at U.S. Steel Corporation. “People are working remotely more often, which presents opportunities and challenges. An increase in effective communication has been essential for our team to continue to grow and thrive.”Groat’s team at U.S. Steel took actionable steps to improve their communication, and what helped them was three things: 1) one-on-ones with leadership making a concerted, personal effort to connect; 2) locking down the cadence of the planning calendar to help the team schedule their work and personal lives; and 3) initiating an employee morale survey to ask what the company and leadership is doing well or could be doing better.

… but not too much

Communication is about quality, not quantity, and cutting through the fog of messages and message channels is challenging. Now it feels like there are a dozen different ways to get ahold of someone, and people some people have given up on email.“I receive a significant number of emails each day,” said Corvey. “I don't think a lot of people have really figured out the calculus of, how do I interact with this? How do I weave it into my work stream? They just push it off to the side and it's dead. It's dead as a communication medium.”

“Perhaps the abundance of emails is because we're remote? It used to be, you could walk down the hall and have a conversation with somebody and have a decision,” said Jaime Dzerve, FPAC, Senior Finance Manager, Verizon.

“Exactly. That's now three emails, two Teams notes, and finally a text that actually gets answered,” said Corvey.

The rise of the chief of staff

Enter the chief of staff. Once relegated to government, and best known as the right hand of the president, businesses are now actively recruiting for the role — a senior role, “mini-COOs.” This is a person who knows all the goings-ons, someone who can sit in on high-level meetings in place of the CFO, CEO or COO. They’re an extension of whatever executive they essentially report to, filtering anything that's going to the CFO/CEO, deciding if that person really needs to hear this, or if they can handle it. It’s a project management position, keeping things on track, keeping things moving, making sure everyone's doing what they're supposed to do.From “enterprise” to “micro-prise” applications

“There's so much buzz, call it low-level background noise, that's increasing around tools and automation, but it's not from the usual players,” said Lapidus. “If finance evolution began with ERPs, then moved to EPM/CPMs, what I am really hearing about are solution-specific, small tool add-ins. So many small companies with a handful of employees reach out to explain and demo software. It's this startup universe creating a new ecosystem. But there are so many, I don't know how to test it out, or how to vouch for it.”The group agreed about the growing trend to hyperfocus. It starts with a specific problem to solve, aggregates data, and then bridges data science. Their focus allows them to solve problems that EPM/CPMs users might solve outside those platforms and then port back in. And the low cost and ease of implementation mean the tools are within the spending authority of the FP&A manager to purchase.

The state of practice of FP&A will be on display at AFP 2022 in Philadelphia. See the latest sessions and keynote speakers, including Organizational Psychologist & Bestselling Author ADam Grant and Dr. Lisa Bélanger, Behavioral Change Expert & Researcher. See the lineup.

Hyperfocus also means layering. There are base systems, and then there are systems on top of systems. Then you've got your data lake, and your data lake house on the lake. And you've got your mesh on top of all these other things. The ecosystem is expanding.Let’s stay together

The conversation led to another overarching question: what's holding us together as a company when there are so many reasons for splitting apart? I work from home. I don't see as many people. I have the ability to be a free agent. I am getting a new email every other minute. I don't have the personal connections. The tools themselves, the processes, are feeling fragmented. People leave, and the people who stay are getting additional workloads. What's holding the finance organization together?“I'm not sure it is holding, to be quite honest. I think it's thin,” said MacLean.

“I don't have a good, pithy answer to this,” said Lapidus. “What people look for in work is to be valued. They want their work to be meaningful, and they want to see a growth pattern for themselves. The company that can provide that is going to win the war for talent. Maybe it's the difference between somebody staying for one year versus three years, but every time you can make that connection and keep that connection after they leave is a win.”

PARTNER CONTENT:

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.

.png?sfvrsn=2c6d166b_2&MaxWidth=150&MaxHeight=&ScaleUp=false&Quality=High&Method=ResizeFitToAreaArguments&Signature=0B8AE2C0112CB1EA5276286C15E0643CC529660A)