Articles

Innovations in Cash Flow Forecasting, Liquidity Management

- By Carosin Buitendag and Terence Kades

- Published: 8/10/2016

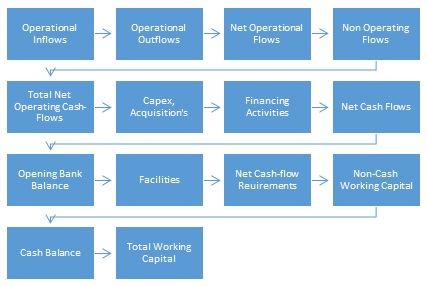

Next is putting these accounts into a structure with a format that is useful for understanding any business. Typically this will begin with inflows and then be followed by the various categories of outflows. This design is a new cash flow statement that depicts both the strategic and operational aspect of a business. At the end of this exercise, we have a new cash flow statement. We termed this structure the funding model, shown in the diagram below.

The diagram shows the 14 parent categories in the funding model and within this, we have identified 44 “child” accounts. The model is very comprehensive to accommodate all cash-related items, but not all of these apply to all organizations and should therefore be customized to suit each business.

The opening bank balance for the first month (or daily or weekly) is input and the model will calculate the bank balance for the future periods. If there is a leak, it will show in this row. This means that a great amount of detailed data can be analyzed, forecasted and used to assist management.

The funding model is populated by the business units either from the accounting system or directly into an Excel template which is automatically consolidated by the CFO or treasury. We developed a software tool that automates this and other important and useful tasks. The funding model provides several benefits:

- It shows actual, budget and forecast data.

- It is the basis for generating forecasts.

- It is useful to all stakeholders. For management, it shows all the sources of cash, as well as all the movements and outflows of cash.

- For providers of finance, it shows the entire cash picture and quickly highlights leakages and potential problem areas.

- It provides an extended format for new ratios that focuses on cash and liquidity risk.

- It provides the basis of graphic views that show a clearer cash-focused picture in a business.

- Understanding cash in its entirety paves the path to improved cash management, lower liquidity risk, and better control of the important parts of the business.

Innovative forecasting

Now, let’s highlight some innovative tools relating to the funding model.

Users of forecast data require the assurance that projections are as accurate and reliable as is possible. Evidence of accuracy and reliability is usually based on realistic assumptions and expectations, necessary economic variables and business drivers, and valid and understandable calculations.

Cash flow forecasts are required for both internal and external stakeholders. The question is, what forecast techniques are valid for what particular purpose? It depends on the method mandated or preferred by the provider of finance or user of forecast data. Predictive analytics uses a variety of forecast techniques and is a term currently in vogue. The problem is that it’s mostly a “black box” to the majority of users because the statistical algorithms are not readily understood. We developed an innovative alternative method that has shown to be reliable and possesses the characteristics required by all stakeholders.

Economic and business driver cash flow forecasts

We found that cash flow forecasts and modeling based on economic drivers are intuitively logical, easy-to-understand and very useful. A set of economic drivers are selected and each is weighted for its importance. Only the critical economic drivers are included in the algorithm. This is done by each business unit to keep it in context, and it certainly differs by country where different drivers are relevant. Next is to apply this basket of economic indicators to the various line items in the funding model that drive cash flow, such as cash sales and all the different inflows, debtors, non-operational flows and expected capex outflows. We run this on a monthly basis for the desired period of the forecast, usually from two to 30 years. Once set up, even a 25-year forecast can be created within a few minutes. And “what-if” modeling can be performed on the forecast figures to help finally shape an acceptable forecast data set.

Scenarios, assumptions and stress-testing for uncertainty

Scenarios provide upper and lower boundaries or bands. The scenario terms high road, low road and expected road are familiar to many. Usually the high road is a 5 percent increase over the expected road and the low road is a 12 to 15 percent decrease from the expected road. Scenarios facilitate individual economic drivers to be varied within a context of possibilities. Using scenarios means the element of surprise is limited.

Developing cash-focused budgets

Developing budgets are usually regarded as a chore and for this reason; it is not uncommon that a new budget is the previous year’s budget plus x percent increase. In cash terms however, a 10 percent increase on last year’s budget usually does not necessarily mean a 10 increase in cash. The cash effect needs to be understood so that it does not become an unseen or unintended risk. Budgets should be affordable and should show the sustainability and appeal of the business model.

Managing liquidity risk and sustainability

The start to manage risk is to identify and understand the different types of liquidity and cash flow-related risks in a business. It is not uncommon that the analysis and management of cash flow and working capital is inefficient. An interesting tool termed the “naked cash flow model” shows sustainability and viability of a business, purely from a cash point of view. This naked cash flow model uses eight dimensions including sales, purchases, inventory, debtors, creditors, cash surplus and gross profit. It graphically depicts the business model of a single business unit at a time (not consolidated view) based on budget or forecast figures, and it shows the sustainability of the business model from a cash perspective. It is interesting to see that management might believe it has a good business plan, but when it looks at it through a cash lens, it is not what it intended.

Carosin Buitendag is group treasurer of DAWN Limited in Johannesburg, South Africa. Terence Kades is managing director of PowerStrat BI.

A longer version of this article appears in the July/August edition of AFP Exchange.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.