Articles

Getting Your Talent Right Matters for FP&A

- By Bryan Lapidus, FPAC

- Published: 5/5/2023

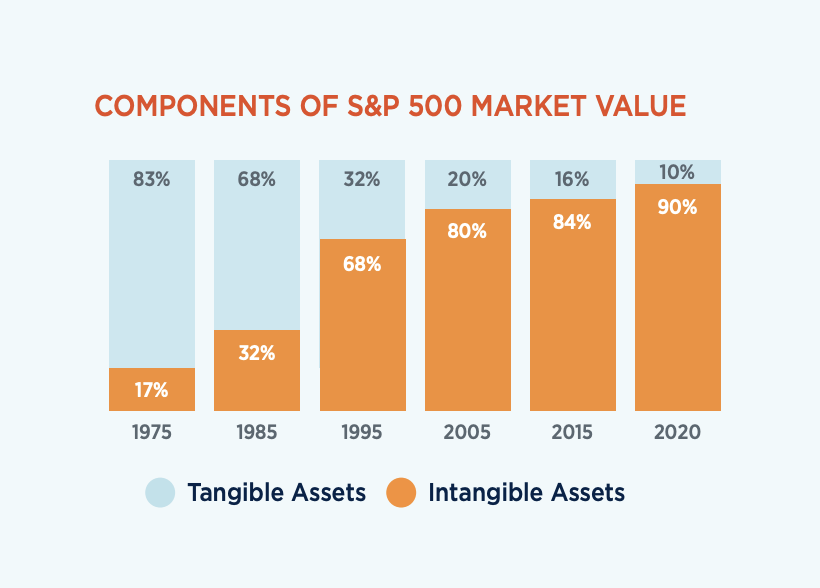

In 1975, 83% of the market value of S&P 500 companies was composed of tangible assets such as PPE (property, plant and equipment), inventory, cash, land or stuff you could touch. By 2020, that was down to 10%.1 2

In 1975, 83% of the market value of S&P 500 companies was composed of tangible assets such as PPE (property, plant and equipment), inventory, cash, land or stuff you could touch. By 2020, that was down to 10%.1 2The intangibles include goodwill, brand equity, licensing, customer lists, R&D, and intellectual capital assets such as patents, trademarks, copyrights, preference rights and data capabilities. They also include the value of human capital.

Human Capital Increases Company Value

Strategic Finance Magazine looked at the chart above and made the connection between valuation and people: “Managers make investments that create intangibles or enhance their value, and often those actions are key to the companies’ strategies.” In addition to the aforementioned intangibles, they emphasized the need to “identify, hire, and nurture a workforce that can deliver on the company’s value proposition.”3 Experts in corporate valuation have also noted this change:

Over time there’s been a ton more emphasis being placed on the qualitative aspects of valuations for M&A activities [in addition to discounted cash flows]. What kind of management team are you going to be getting with this? What does it mean in terms of the capabilities this target will bring on to us?4

Improve your process for bringing in new talent, upskilling the talent you already have, and creating career paths for yourself and your team. Register for the AFP webinar "How to Build Your Finance Team" on May 24, 2023, at 3 PM ET.

Talent Matters in a Digital World

The opportunity for companies in a digital economy is to increase employee access to data assets and have them use the data assets well — within the boundaries of appropriate controls and access restrictions. For FP&A, this means providing better data management and applications to increase utility. It also means getting people with the skills and aptitude to maximize those data tools and add on their human expertise.

People do not appear as a tangible asset on the balance sheet, but they drive a company’s valuation, direction, growth and longevity, as Andreas Ohl explained in Strategic Finance Magazine:

Human capital is particularly important in knowledge-intensive businesses because employee knowledge and skill drive the production of services, products, and new projects … But this investment isn’t typically transparent in the financial statements. The idea that human capital is an asset, and that value can be created by investing in it, stands in contrast to the historical perspective of labor as a cost that needs to be tightly managed to create value.5

The opportunity to get your talent right holds great rewards for companies in general, FP&A in particular and everyone in terms of individual career progression.

This article is an excerpt from the 2023 AFP FP&A Guide: Get Your Talent Right, underwritten by AARP. Read the full guide to learn more.

1 Ocean Tomo. Intangible Asset Market Value Study.

2 Per the Ocean Tomo study, European and Asian markets are following the same trajectory of decreasing share of tangible assets comprising their market values, although the actual percentages are higher, 25% and 50%, respectively.

3 Strategic Finance Magazine, Intangibles as ESG Opportunities by Andreas Ohl, May 1, 2022.

4 AFP 2022, “How Corporate Finance Decisions Are Really Made,” Steve Higgins, Managing Director, Delancey Street Partners.

5 Strategic Finance Magazine, Intangibles as ESG Opportunities by Andreas Ohl, May 1, 2022.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.