Articles

Finance Holds Multiple Points of View

- By Bryan Lapidus, FP&A

- Published: 11/16/2020

Did your 2020 outlook resemble the way this year has played out? This year is proven unpredictable, to say the least. A common internet meme shows a 2020 calendar with each month highlighting a plague, calamity or catastrophe of global importance, concluding with a meteorite strike on Earth in December.

Every year, FP&A goes through the exercise of preparing a plan for the upcoming year. Those with a formal budgeting process will bring it to the board, negotiate back and forth, and certify that for the year. And then it all changes. Dwight Eisenhower was famous for saying, “Plans are worthless, but planning is everything.”

What is a planning function to do in the wake of this? Be ready for everything.

Finance’s response to unpredictability is to hold multiple points of view (MPV) simultaneously.

Let’s start with the information challenge we face. Consider this: VUCA is an acronym used to describe the lack of clarity and lack of knowledge we face described by four factors:

- Volatility: What just happened? The situation changes quickly, in unexpected ways.

- Uncertainty: What will happen next? Unsure of the present, unsure of what to do next.

- Complexity: Why is this happening? The confounding of issues, no cause-and-effect chain is evident, leading to confusion.

- Ambiguity: What does this mean? Cause-effect relations are unclear, making interpretation difficult.

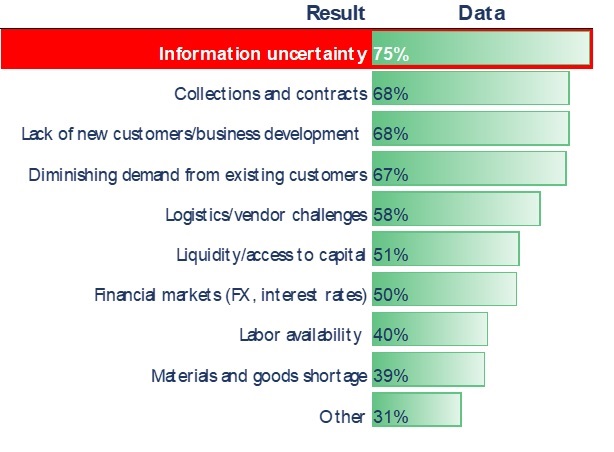

We live in a VUCA world because the pace of activity happens very quickly, the number of actors that impact a situation is large as barriers segregating markets and people fall, and powerful tools proliferate. In an April 2020 survey in response to the COVID crisis, information uncertainty was rated as a more significant challenge than collections or customer demand. Therefore, FP&A needs to expect change and build the capability for rapid alterations to its processes to provide the best outlook for organizations.

Here is what finance in the MPV looks like:

FINANCE ACUMEN: BE IN MANY PLACES AT ONCE

In the area of finance skills, we recognize that multiple outcomes are possible, and that single point estimates of forecasts and valuations may be limiting for each budget, forecast and investment. FP&A helps the organization create strategic alignment from these unknowns by applying tools that allow for multiple views.| Finance Approach |

|||

| Single plan |

Multiple scenarios |

Probability adjusted (i.e., Monte Carlo) | |

| Single valuation |

Probability or range valuation | To consider the resilience of contingent | |

| General-ledger focus |

Operational focus | KPIs that tie to business and risk | |

| FP&A Processes |

|||

| Fixed planning cycle |

Frequent, event-driven replanning | ||

| Rigid budget |

Flexible, directional, or no budgets |

Scenario planning was identified as the breakout activity and skill in the AFP COVID 19 survey, contributing to increased visibility among senior business leaders. - AFP 2020 Survey, The Technology and Data Platform Supporting Finance Decisions (releasing December 2020)

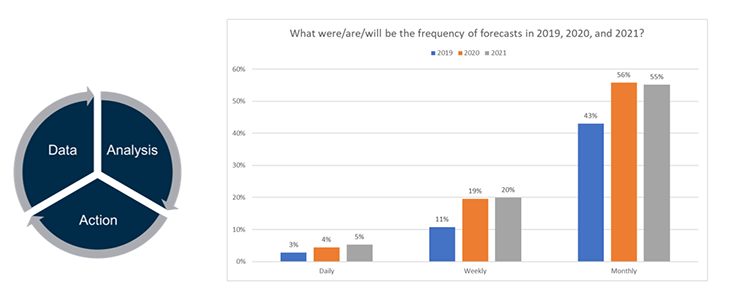

TECHNOLOGY & DATA: SPEED THE DATA-ANALYSIS-ACTION CYCLE

FP&A turns data into action, which creates more data and starts the cycle again. The faster a company gets around this data-analysis-action wheel, the more opportunities exist to read the market, accelerate, decelerate, and recalibrate. In the first months of the COVID crisis, nearly one third of FP&A practitioners delivered more than four company reforecasts each week; overall, FP&A experienced a sustained increase in daily, weekly and monthly reforecasts in 2020, and survey data indicates it will continue in 2021.

FP&A needs access to high quality tools, and the supporting processes, to manage its data assets.

It is cliché yet critical to say that we need a “single source of truth.” More insightfully, we have a structural problem: we need input from many people and other systems, but financial data ties to the general ledger and operational data ties to transactional systems. Until a company bridges that data chasm, FP&A will constantly spend time reconciling data. AFP research shows that from 2010 to now, FP&A has consistently spent half its time gathering and preparing data for use. Yes, the flow of data increased, but the tools did as well. And the frustration remains.

In addition, as mentioned above, the use of statistics will increase as will the language for describing large data sets and proximities. These capabilities are built into spreadsheets, EPM tools, reporting software, and business intelligence packages at rates of increasing sophistication. If we are not using these tools, then we are sub-optimizing. If we are using them incorrectly, then we are in danger of drawing false conclusions.

PERSONAL & TEAM EFFECTIVENESS: FLEXIBLE, ADAPTABLE AND CURIOUS TEAMS

Multiple points of view in our FP&A teams means moving away from thinking about the head-down, nose-to-the-grindstone mentality of churning through repetitive work. The bots and algorithms of the future will do that. FP&A should hire people with a wide skillset to be able to adjust to changing conditions.

Your ability to tie specific tasks to the business context will matter more, especially as you move into leadership roles. Based on your business knowledge and finance acumen, it is important to ask questions and formulate hypotheses as a way to steer through the VUCA haze. This requires creativity and partnership with the business.

Your team needs to embody multiple points of view itself, including a diversity of professional and personal backgrounds, skills and personality traits. You may need expert modelers and strong partners, people who can read contracts and electrical wiring diagrams. Can you find that all in one person?

More than likely, you will have flexible and fluid teams formed around tasks, projects and processes, which may last for a few days or years. It consists of anyone who can contribute, including co-workers both remote and on-premise, customers and suppliers who have integrated data, vendors, consultants, gig/freelancers, and even automated bots.

Fully 39% of FP&A teams are hiring data and IT professionals directly onto their staff. - AFP 2020 Survey, The Technology and Data Platform Supporting Finance Decisions

As FP&A develops and matures as a discipline, it is must develop an identity different from its cousins in accounting. Niels Bohr famously said, “It is very hard to predict, especially about the future.” FP&A should embrace that uncertainty by developing the finance skills, tools and mindset to react in close-to-real time to represent a changing present and contemplate multiple potential futures.

At FinNext 2021, we’ll be looking at FP&A from every point of view. Interested in more real-time insight and deep analysis? Register today.

PARTNER CONTENT:

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.