Articles

Extreme Automation: How to Execute on a Vision of Finance

- By Bryan Lapidus, FP&A

- Published: 10/11/2019

At FinNext 2019 in Las Vegas, KPMG LLP’s Brett Benner, Managing Director, Advisory Finance Transformation, and Brian Mace, Director, Advisory Finance Transformation, laid out a vision of the future of finance, which contained six radical changes from how it is practiced today. We reached out to Brett and Brian again, and asked them to dive deeper into their view of how companies can move towards two of these elements: extreme automation and insights and analytics.

“I am of the mindset that there are no ‘necessary’ conditions [to get started in] digitization. I see the digitization of not only the finance function but all business and operational data as an inevitable outcome, an evolutionally state for the way businesses operate and interact with their customers,” says Mace. All companies are in some state of digitization already, and the low cost and ease of use of cloud technologies, data mining tools, and improved computing make this progression easier and inevitable.

“Agreed,” says Benner. “Most of our clients today are either looking to find new ways to automate parts of their finance function, or to expand on and refine their current digital strategy. Unlike other emerging trends, this is something we are seeing across all industries and markets, which allows for multiple entry points for organizations. The ease of entry has allowed organizations to approach digital transformation from multiple fronts which has led to roadblocks for clients that do not think through how all of these technologies will work together.”

Benner and Mace both agree that there are common conditions in their most successful clients that helped make the adoption of digital technologies easier for organizations. These conditions include:

Organizational Foresight: This includes knowing where your business is headed and linking your business strategy with your digital strategy to help ensure that you are building a solution that will meet your future data needs.

Data Awareness: Do you know where your data is coming from, how reliable it is, and how easy it is to link across functions? Obtaining clean, reliable data is the biggest impediment to executing an effective digital strategy. The sooner an organization can get its arms around its data or pull the trigger to restructure its data model, the easier it will be to move forward with more advanced technologies.

Pragmatism: You need to be realistic on what can and can’t be achieved through digitization. There is not a “magic bullet” solution that will solve all of your data needs. Embarking on a digital transformation is more than just selecting the right toolset. A well-thought-out strategy will include changes across the complete operating model from people, process, technology, service delivery, data, and controls.

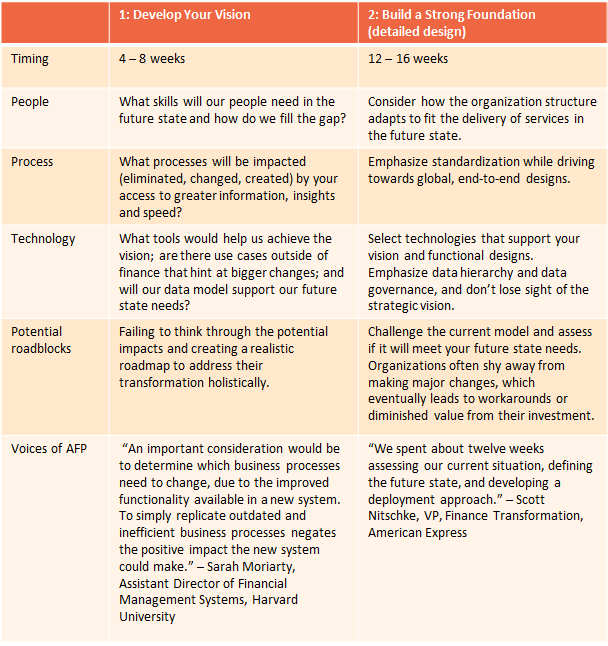

Benner and Mace provide the following roadmap as a way to act upon your view of a digitally-enabled finance organization, along the parameters of people, process and technology—where tech is an enabler of data.

1. Develop Your Vision. How aggressive do we want to be with automation?

Create a view of where the organization is headed and what outcomes, capabilities and benefits you are looking to achieve. For example:

Develop extreme automation—the confluence of robotics, advanced analytics, cloud applications, blockchain, and more—to deliver more value with less effort, respond quickly to the needs of the business, and truly shift from traditional processing work to strategic partnering.

2. Build a Strong Foundation. How does it tie together, within finance and out to the broader company?

Assess the current situation, define the future state and develop a deployment timeline. This covers the development of an end-to-end data model, detailed process and technology designs by functional area, assessing their foundational ERP platform, whether moving to a cloud-based environment is in the short- or long-term strategy, and determining the detailed organization roles going forward.

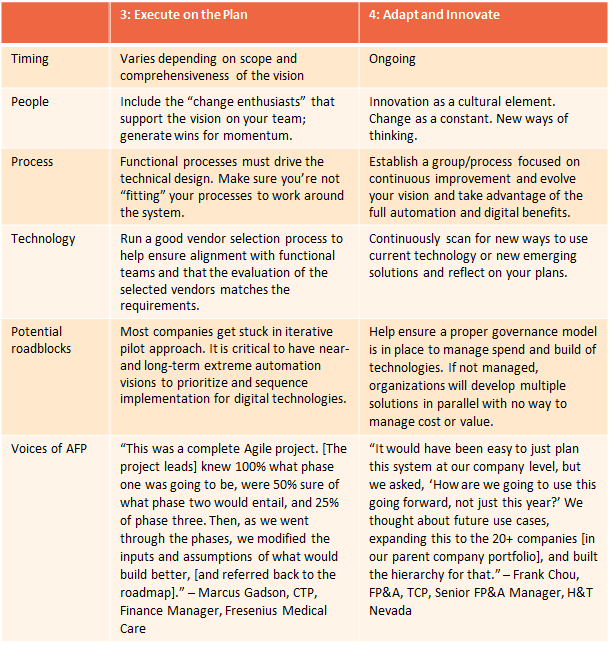

3. Execute on the Plan. For each workstream, will you pursue “Big Bang” vs. “Pilot and Expand” approach?

The most successful organizations ensure they have the right infrastructure and governance to track and monitor the value they are delivering to the organization and ensure the intended ROI is achieved.

4. Adapt and Innovate. How do we create a mindset of continuous improvement to drive and support innovation?

Develop a mindset supported by a proper governance model to seek out and incorporate continuous improvement opportunities. Most of the value is not unlocked on day 1 and must evolve as the organization adapts to the new operating model.

The FP&A track at AFP 2019 has multiple sessions on digitization in finance. Learn more here.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.