Articles

Ditch the Spreadsheets: Adopt Modern Business Planning Now

- By Frederick Kurniadi

- Published: 7/31/2019

As a finance director for Glint—a LinkedIn company whose people success platform helps improve employee engagement and business results—I have witnessed a steady and welcome evolution in my field: Finance is maturing from a traditionally siloed department of number-crunchers to a strategic and respected adviser to the business. While crunching numbers will always be baked into the role, these two functions are no longer mutually exclusive. Not anymore. Technology is carving out space for both.

As a practitioner of cloud-based business planning, I’ve leveraged technology to change the perception of FP&A from financial gatekeepers to strategic assets that really understand the needs of the business, can advise on the best course of actions, and provide valuable counsel to the leadership team. With 73 percent of CFOs reporting that they’ve delayed major business decisions because they lacked access to timely data, it’s clearly time for finance to put modern technology to more strategic use.

Like most organizations, Glint’s finance department had long used Excel spreadsheets for planning, budgeting and forecasting. I knew when I joined that sticking with spreadsheets would only invite complications, errors and version control headaches. As a company, Glint was growing rapidly, and spreadsheets are simply not built to scale. I’d had previous experience with implementing one of the leading business planning cloud platforms and successfully made the case to abandon spreadsheets for this more modern planning environment.

Later, when Glint was in talks to be acquired by LinkedIn, I leveraged our cloud financial planning platform to quickly deliver multiple financial scenarios and SaaS/P&L/departmental ratios to the parties evaluating the potential deal. When you’re assessing the future of your business, the ability to be part of those discussions—and to contribute insights that help make fairly monumental decisions—is essential. Whether it’s here at Glint or in my past lives in finance at Sage Intacct and NICE Satmetrix, I rely heavily on customizable and insight-driven tools to accelerate scale and gain a competitive edge. That came in handy during talks with LinkedIn, and it continues to be an advantage for Glint as a growing, agile business in a fast-changing industry.

FOUR REASONS TO ADOPT MODERN BUSINESS PLANNING

It isn’t difficult to find reasons to modernize the way you plan in finance and beyond. But from my hands-on experience implementing, configuring, integrating and managing cloud planning platforms at three different companies, four in particular stand out.

Reducing the number of hours spent cleaning and verifying data allows finance teams to focus on more strategic initiatives and discussions.

Traditional finance departments are consumed with low-level, manual tasks such as tracking budgets vs. actuals, maintaining spreadsheets and gathering numbers. But that’s not what I believe finance should be. Adopting an agile planning model empowers finance to evolve from a functionary role to a fiduciary one, focusing less time on the tactical (for us, it’s a savings of hundreds of hours a year), and more time on providing insightful, trusted guidance that allows the business to plan for what’s next. And it allows you to answer questions that would have been difficult to answer before: What can we do to reduce risk? What’s the most optimal way to achieve 100 percent-plus revenue growth? Should we expedite hiring— and if so, where and in what roles?

I’m not alone. Across industries, this pivot is becoming more prevalent. Innovative finance teams are abandoning spreadsheets in favor of automated, modern solutions that are attainable and accessible.

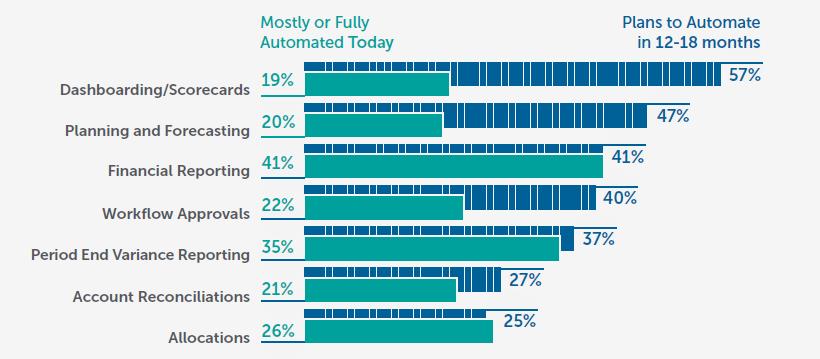

Looking for finance to take on a more strategic role, CFOs plan to automate key tasks (CFO Indicator, Q4 2017 Report)

The ability to share up-to-the-minute KPIs, and enable an executive to act on those metrics, helps finance earn a seat at the decision-making table. Finance becomes an enabler to essential courses of action versus being a financial gatekeeper or validator.

As a strategic business partner (who still crunches numbers), I understand the business better than most. This is because finance is where all the company’s financial and operational data converges. As a result, finance is uniquely well suited to help the business balance risks with opportunities in ways that promote and enable business agility. For instance, finance can use data to uncover and propose ways to help the company grow faster: I can now use KPI information to advise on the company’s growth trajectory, recommend the most effective ways to distribute resources (say, by department, geo, or role), and anticipate budget surpluses that could be reallocated where they will be needed most.

At any given moment, we’re tracking 1,000-plus KPIs. We distill these KPIs along with integrated sales data to create custom, business-critical dashboards designed for executive eyes. For instance, when we’re forecasting sales and factoring in upsell opportunities, with each cut we can view the forecast by market segment, sales channel, or geo. This allows for quick and informed decision-making and more accurate forecasts throughout each quarter.

Deploying tools people can learn quickly and maintain themselves gives the business greater agility and brings more stakeholders into the planning process.

According to an AFP survey, it takes an average of 77 days to complete an annual plan. In today’s business environment, that’s just too long. Companies can’t be agile with a long, ineffective planning process.

We opted for an intuitive and navigable planning solution that didn’t have a steep learning curve. This was just as important as other criteria, because planning processes that involve the people closest to the business produce more accurate forecasts and more reality-based plans. Planning may best be orchestrated by finance, but it shouldn’t be contained in finance.

At Glint, viewing KPIs and data is frictionless and painless for anyone, whether they’re in finance or HR or sales or operations. It’s effortless—just as it should be. And the value of collaborative planning extends well beyond finance. Glint’s own experience shows how:

- Sales leadership can better assess performance overall and by territory, track attainment, engage in continuous capacity planning, and allocate resources where they’re likely to have the biggest impact.

- HR can spot where its energy should be focused and what roles and skills to target for new positions.

- Business unit leaders can easily toggle from macro to micro vantage points, digesting overarching trends and digging into individual transactions.

- Nearly every department head can quickly eyeball their real-time KPIs, and identify pain points and growth opportunities, as well as areas to funnel additional resources.

- C-level executives can see our cash burn rate and decide whether we can afford to hire more people to expedite growth.

- Decision-makers can use interactive dashboards to review KPIs, then drill down to see the details.

All this would have been impossible if we were still working from static spreadsheets.

Leveraging tools that seamlessly integrate with other systems make data management nearly effortless.

Every business is unique and has specific needs that often translate into a varied and sometimes extensive suite of operational tools. When selecting a cloud-based business planning solution, it’s important to choose a system that can easily plug into your back-end software environment and day-to-day processes. At Glint, we were also careful to deploy a system that didn’t require a lot of heavy lifting on our end—or extensive hand-holding from IT.

The business planning cloud platform we chose is platform-agnostic. This made it easy to integrate it with our CRM and accounting tools—in our case, Salesforce and Sage Intacct, respectively. This ensures that your plans, budgets, and forecasts are populated with current data—a big advantage over spreadsheet-based plans, which are inherently “dead on arrival” because much of the data has perished the moment it’s keyed in.

In today’s blink-and-you’ll-miss-it, data-driven business environment where companies need to be agile to thrive, data silos are unacceptable. The only reasonable solution is to have a single, dynamic source of truth. Moreover, modern business planning achieves one of my core values–transparency. Having a single source of truth allows key stakeholders to get the latest forecast related to their department at any time. And when all plans, from the departmental level to corporate finance, are linked, the problem of silos and disconnected planning is gone for good.

Number crunching will always be part of the job description, and that’s how it should be. But with our modern, cloud-based planning solution, my team and I find we’re more than number crunchers. The role of my department has evolved from financial gatekeeper to a trusted, strategic advisor to the business. We’re executing with agility, and finance has played a major role in that success.

Frederick Kurniadi, CFA, CPA is a finance director at Glint, Inc., a LinkedIn company based in Redwood City, Calif. Glint was the third successful company exits through acquisition that he led. His expertise is in SaaS industry, sales finance, and business transformation.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.