Articles

Decisions at a Distance from HQ

- By AFP Staff

- Published: 1/26/2023

Developing budgets and targets is a messy process. Top-down expectations collide with bottom-up estimations, compensation is on the line, and everyone sees something different. Communication is compromised as corporations grow larger; regions are far from headquarters, some businesses get less attention, and owners have different goals than managers. This case study explores these challenges.

The AFP FP&A Mini Case Study series is designed to help you build up key FP&A capabilities and skills by sharing examples of how leading practitioners have tackled challenges in their work and the lessons learned.

Presented at an AFP Advisory Council Meeting, this case study contains elements that are anonymized to maintain privacy and encourage open discussion.

INSIGHT: Regional challenges and advantages, global events and their effects on the type of business and its workforce must all be considered when a budget process is driven through a global company’s headquarters.

| Company Size: | Large |

| Industry: | Software |

| Geography: | Global |

| FP&A Maturity Model: | Plan and Forecast Development |

Plan and Forecast Development: Leading practices connect long-term strategy to current and anticipated operational activities, financial performance and risk framework.

BACKGROUND: GENERAL INFORMATION ABOUT THE COMPANY

The global software company has annual revenue over $1 billion and is mainly held by private equity firms. Business boomed at the height of the coronavirus pandemic as 1) government agencies and large companies rushed to add licenses when their employees were forced to work from home, and 2) many customers accelerated their cloud migration plans.

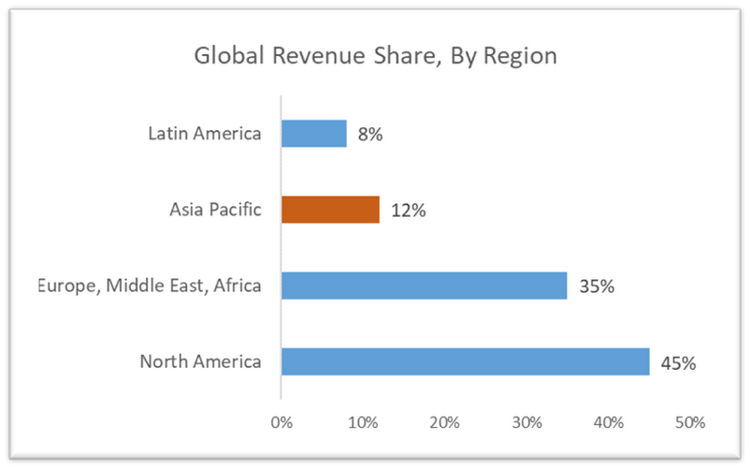

The global revenue and APAC regional revenue, by percentage, is shown as follows:

This case study was presented by the head of FP&A for the APAC region.

This case study was presented by the head of FP&A for the APAC region.

CHALLENGE: THE WORK OR DIFFICULTY FP&A HAD TO ADDRESS

The company’s budget was top-down, centrally developed by headquarters (HQ) in the U.S., then cascaded down to regional offices. Unfortunately, HQ’s global revenue growth target was based on economic tailwinds and operational norms that were no longer applicable. The APAC management team worked with sales, ops and other functional leaders to translate their share of the global plan into local targets, operating expenses and headcounts for the coming year. Specifically for APAC, some of their challenges included:

Budget challenge: Aggressive targets (35%+) growth rate

- Australia/New Zealand was over 50% of the regional revenue, but as mature markets, the estimated growth rate was will slow down to single digit.

- Meeting the overall target required the smaller, newer markets to grow exponentially.

“My experience is, no overachievements in prior years are rewarded with smaller targets,” said the FP&A professional. Growth rates are usually based on recent trends, but it was the circumstances surrounding the pandemic that had boosted their growth. Management wanted to pursue similar growth rate as before, and APAC was given a target growth rate similar to the global business.

Budget challenge: Global HQ expected continued growth in margin

- The target growth rate assumed year-over-year sales productivity improvements and no meaningful headcount increase. This meant increasing the average revenue per sales executive through a higher close rate. For example, if the close rate was 20% of the pipeline, they were expected to win (grow) 30% of their coming-year pipelines. They were also expected to increase the size of the contract per customer, for example from $50k per contract to $70k.

- Maintain the low travel expenses of the lockdown years. HQ assumed that APAC can achieve the plan by maintaining a low level of travel post-pandemic.

Budget challenge: APAC requires investments

- New markets require start-up investment. Australia/New Zealand (ANZ) were two mature markets with a productivity rate of around 3x of those in other parts of APAC. Teams in less developed markets require investments in headcount and training to improve sales productivity.

- APAC is heavily relationship dependent. APAC sales depend more on face-to-face interactions with customers to maintain and build relationships, and customers expected a return to pre-lockdown interactions.

APPROACH: HOW FP&A ADDRESSED THE CHALLENGE

The plan to address all these challenges was to conduct detailed analysis to forecast the outcome of the budget constraints, negotiate with HQ for better terms, and simultaneously plan for the best possible outcome in case they could not achieve concessions.

Approach: Dive into the details

- Increase granularity with bottom-up analysis. The finance team broke down sales productivity by region to demonstrate the challenge of applying a single growth factor across many markets. One example they discovered was that with the proposed travel budget, each sales rep could only travel for three days every six weeks. Was this reasonable to hit sales goals? What would the impact be to the business when their competitors could be in the face of customers every single week?

- Establish a more accurate baseline. Finance also “normalized” growth performance with a longer view, removed outlier projects that skewed trend lines, and examined pre-pandemic performance to forecast the current environment.

- Zero-based budget (ZBB) to highlight limits on travel with given T&E budget. HQ wanted to know if the region was sandbagging, so finance examined every expense through a ZBB analysis.

Approach: “Socialize” your recommendations through consistent communication

- Unified message based on detailed analysis. The region and the company frequently used different sets of data tied to their respective functions. Finance led an effort to standardize the data and analysis that would show how decisions in one area impacted another, such as how limiting HR’s training budget would limit sales team development.

- All function heads met with their counterparts in HQ. All the functional heads made sure they delivered the same message back to HQ.

Approach: Deliver a plan based on given budget

- Develop an operational plan based on the budgeted expenses. The APAC team was realistic; they knew it would be unlikely to earn a significant change in management’s directives, so they created a bottom-up plan and projection based on the given budget.

- Identify areas of savings or redeployment opportunities.

- Manage performance metrics. The APAC teams developed plans for low performers (sales ops, HR, finance) and performance measures to track them over time, all the way to separating them from the company.

- Guidelines for travels (finance). Gave managers discretion on how to spend their travel budget.

OUTCOME: WHAT CAME OF FP&A’S EFFORTS AND WHAT WAS LEARNED

There's no happy ending to the story. The budget remained top-down because it was already committed. APAC did receive a little bit extra headcount but failed to get additional travel funding. At the end of the process, the functional leaders in HQ were all aware of the challenges and were educated about regional dynamics for future years. “And we're all waiting for the ‘I told you so’ moment, although we will probably say it a nicer way,” said the head of FP&A.

All the discussions and assumptions are now documented so when, in the future, there are talks about the challenges and how those are impacting the business, they can bring these up again. “And hopefully, during the forecast year, we can get a little bit of funding here and there to address some of the problems,” he said. The education of HQ happened at the end of the process for this year; perhaps it will lay the foundation for better communication in future years.

DISCUSSION: A Q&A SESSION AMONG COUNCIL MEMBERS

Question: What are some other ways to manage country or regional target-setting in discussions with HQ?

Answer 1: I have to provide the targets for the region’s operating companies, and what helps is that every year we have a three-year strategic plan whereby we classify operating countries into developed, developing or in gestation, cash cow/rock star, and question marks. Each category has a certain expectation of growth, and when something hits, we moderate that expectation, and the classification is known to the region, as well as the global operation. For a certain category of companies, we expect certain bandwidth in terms of growth.

Answer 2: We have a robust discussion in terms of what local management feels they can achieve in terms of target, and we in the central office provide them with a good incentive to hit the stretch target. This provides us with an opening for discussion. The assumptions are top-down, but it’s up to local management to comment on why the assumption may not be right, which provides a good listening angle to both sides. In the end, we have a normal target, we have a minimal target, and we have a stretched target. Low targets meet with low bonuses, stretch targets yield stretch bonuses.

Answer 3: HQ has to establish credibility of growth to investors or the market, but the ground teams might give up from the start if expectations are too high. This backfires on HQ and hurts the credibility they are trying to meet. While the top-down approach might be good, it makes sense for the region to really push back and communicate. More important is to pre-sell where the market is, for example, in the case study, ANZ is a high-market-share merchant, merchant market and limited in its growth; therefore, to have a double-digit growth expectation would be out of the window from the start. Those are good conversations to prep the annual discussion on budget.

Question: What are some of the other challenges in setting or receiving targets from HQ?

Answer 1: Budget stacking! Every level in the budget process wants to keep a buffer. HQ gives us a number with a 5-10% buffer, then the country manager raises it by another 5-10%, and so on. By the time the process is done, it is 50%, which really demotivates. A sales rep who has made a killing in the past year may say, ‘Hey, I'm just going to take a break, and just expect that I won’t get a big commission this year.’

Answer 2: Sometimes targets are set above the heads of management by a holding company or the private equity owners. For example, they got a consulting firm that said, ‘All you have to do is increase your sales force by X, and it's going to generate a yield of Y.’ Their model produced a straight line up, but that's not how it works in the actual world. There was some pushback, but they needed to justify the expensive consultant. When the BHAG, the Big Hairy Audacious Goal, was not met, bonuses were not achieved, and the CEO was asked to move on to greener pastures.

Question: What does negotiation with HQ look like?

Answer 1: We're on a different trajectory from the company in the case study. Our company hit rock bottom during the pandemic, and we’ve been trying to grow back. Our director is expecting acceleration back to pre-pandemic levels, and funnily enough, even though the trajectories are very different, the directives and the conversations are very, very similar: They're expecting us to grow back with a very low-cost base, while other countries' level of demand is still recovering, and when we've still got staff out sick.

We built a five-year plan for the directors. We said, ‘Here's where we are now, here's where we want to be in five years, and it's all dependent upon these factors in the market.’ We committed to the fact that we're going to be revising this every year. The environment the pandemic created is so volatile, and the point we kept hammering on was the fact that it was more important to address that volatility than it was to meet the budget. That seems to have worked.

Answer 2: Even though they're very tough in what they're doing with the top-down budget for our business, HQ also said to us: ‘We understand there's a portion of this that is very difficult to achieve, but in exchange for that, we will allow you to make investments, whether that’s the acquisition of another business, an open checkbook to get salespeople in early, or an adjustment to the run rate of the cost for the next year.’ We're allowed to make an investment earlier in the year, proceeding to ensure that we get that job and then work that into the five-year plan. The business will give the value they feel they can achieve, but will stand back if they think the targets are unreasonable.

Build up key FP&A capabilities and skills with AFP’s FP&A Maturity Model, a roadmap to help you and your team become leading practitioners.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.