Articles

Build Effective Communication into the Finance DNA

- By AFP Staff

- Published: 4/14/2023

When leadership changes prompted a global IT company to rethink its business review process, finance helped transform the process, implementing a new framework to simplify reporting and better communicate the main message.

The AFP FP&A Case Study series is designed to help you build up key FP&A capabilities and skills by sharing examples of how leading practitioners have tackled challenges in their work and the lessons learned.

Presented at an AFP Roundtable, this case study contains elements that are anonymized to maintain privacy and encourage open discussion.

Insight: A structured presentation design such as the Minto Method can organize your analysis and simplify the delivery of your message, making you a more effective partner.

| Company Size: | Large |

| Industry: | Information Technology |

| Geography: | Global |

| FP&A Maturity Model: | Communication |

Communication: Has frequent, clear communications with business; presents persuasively. Leads with insight, supported by strong analysis, based on consistent data and presentation. Communicates clearly in formal and informal settings.

Background: General Information About the Company

The subject of this case study is a global IT company whose business lines include cloud, devices, AI, consumer experiences, and research and development.

A change of leadership created the opportunity to reorganize the business and operations, and the strong relationship between the CEO and CFO has cascaded throughout the entire company. Finance at this company partners with groups across the organization, including engineering, field teams, central finance and others, and operates in a matrixed structure.

This case study was presented by a finance practitioner who was previously in the field team at the company and is now in central revenue planning. The speaker was at the company before, during and after the implementation of the Minto method.

Challenge: The Work or Difficulty FP&A Had to Address

Historically, the planning process included a mid-year review (MYR), a highly structured process that set the stage for discussing the company’s recent performance, execution for the next half of the year, and planning which would dominate the finance organization’s mindshare in the months to follow. The process was heavily structured with rigid frameworks and expectations. Finance had a very specific but limited role.

Preparation for the MYR was intense as finance would research every data point, every sensitivity and contingency, and prep the various teams before facing the executive leaders. FP&A staff would frequently rent hotel rooms near headquarters to allow more hours for work. However, more data, time and effort was not producing better results. In fact, discussions bogged down into data analysis and the additional detail was clouding the discussion of key outcomes.

Finance was asked to play a role in transforming the MYR, and the team applied a framework that was being used elsewhere in the organization.

Approach: How FP&A Addressed the Challenge

This description of the approach will discuss both the solution used, The Minto Method, and the way it was implemented.

The Minto Method Explained

Named for Barbara Minto, a consultant at McKinsey and celebrated author, the Minto Method is a framework to organize your thinking in a logical way so that your audience can easily grasp the main ideas. It is intuitive and can be applied to many forms of communication, including emails, memos, reports, and presentations.

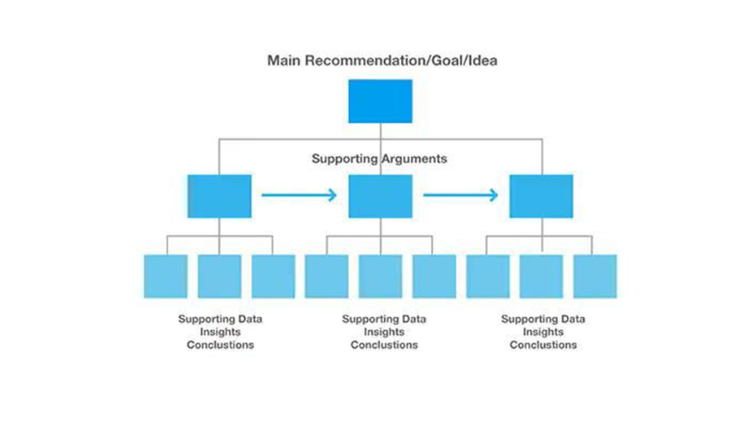

The first part is about developing the message, the WHAT you want to say. Start from the bottom-up, analyzing the mountains of data, grouping low-level information into categories that provide insight, and building to a central theme or message to be delivered.

The second part is about communication, the HOW you can effectively deliver that message so your audience understands it. Here you work from the top-down, starting with a single thought that should be the one thing the audience remembers. This can be the main story, a recommendation, a goal or an idea like a capstone to a pyramid. The single thought guides the reader down the rest of the pyramid to supporting arguments and insights, then at a lower level would be the supporting data.

The ideas presented in the overall pyramid structure should be “MECE”: Mutually Exclusive and non-overlapping, and Collectively Exhaustive to cover the full scope of what the main recommendation.

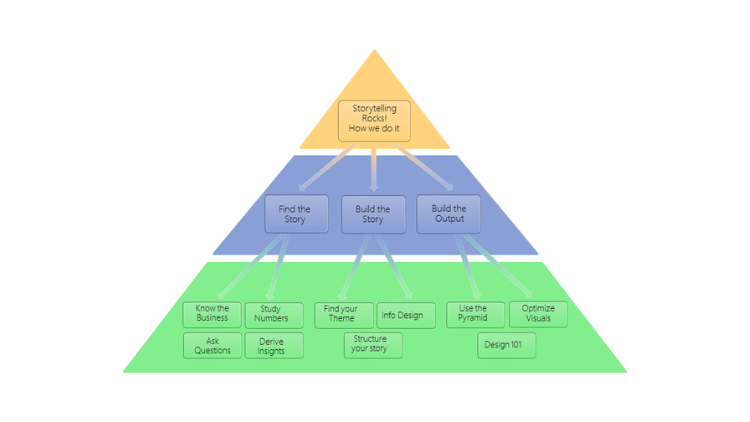

Here is an example of The Minto Method applied to how we tell stories. The headline is at the top, at the next level are the MECE arguments that support the headline, and one level below are supporting details.

Here is an example of The Minto Method applied to how we tell stories. The headline is at the top, at the next level are the MECE arguments that support the headline, and one level below are supporting details.

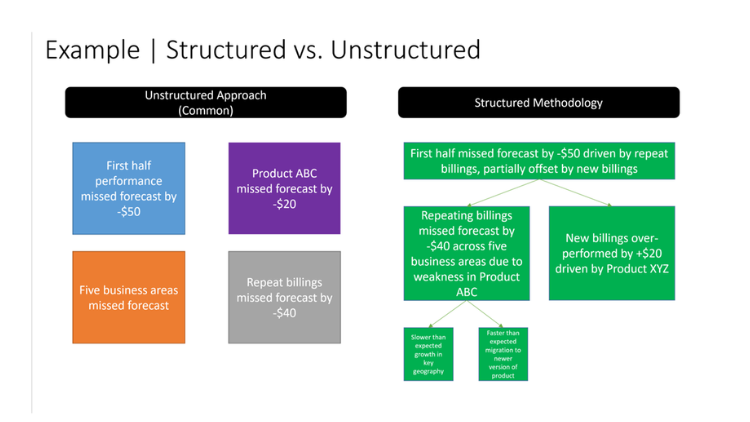

Here is an example of approaches to communicating the same idea. On the left is an unstructured approach to reporting on segments and areas. All the facts are presented and supported, and the presenter will have a few bullets for the audience who then form their own takeaway points.

Here is an example of approaches to communicating the same idea. On the left is an unstructured approach to reporting on segments and areas. All the facts are presented and supported, and the presenter will have a few bullets for the audience who then form their own takeaway points.

The example on the right applies the Minto Method. It starts with the main headline, then divides into two halves of the business which each tell a story. The structured approach does not include all the available information, only includes the information that the audience needs to know to walk away with the main story about the business.

Implementing a Global Change in Communication

Implementing a Global Change in Communication

The challenge was bringing the Minto Method to scale and getting it adopted widely across the company. It required a coordinated approach with overlapping reinforcements to make a part of the everyday DNA of finance!

- From the top-down, the CFO was a clear champion who used this approach and spoke about it. This became the proscribed template for the Finance Leadership Summit (the annual meeting for directors). Other senior leaders continued to reinforce the method, and the CEO even wrote a blog post about it!

- From the bottom-up, the method was adopted in immediate deliverables, such as the finance team members’ slides for the MYR. It was also included in formal training programs, such as a “Storytelling Jumpstart” training, and included in training when onboarding new members.

- The method was embedded everywhere, including business-unit “health” reporting and various documents around the company. For example, even the company leadership principles document lays out three very high-level principles, then drills down to what each of those principles mean, then again drills down to three bullets for each.

While the finance organization never mandated the use of the Minto Method, it gained wide adoption because leaders encouraged their teams to take that approach and aligned their feedback with the principles of the method.

Outcome: What Came of FP&A’s Efforts and What Was Learned

The Minto Method has helped finance gain a seat at the business decision table and become a part of the finance organization’s standard rhythm of work. Even without consciously deciding to follow the method, the team members find themselves applying it to their communication. Still, periodic reinforcements are needed to ensure that the method remains part of the DNA.

Another important lesson the team learned is that while the method is highly effective in certain cases it also has its limitations. Examples where it is not effective or even detrimental include:

- When a clear main story does not emerge or there is a conflicting main story.

- When brainstorming.

- When you want to present options or sub-options and you don’t want to give the notion that you’re picking one over the other.

DISCUSSION: Q&A AMONG ROUNDTABLE PARTICIPANTS

Q: Could you talk more to how this change in communication related to other changes happening at the company at the time?

A: This approach was adopted during a period when other organization dynamics were also changing, and this was aligned with those changes. The CEO and CFO have a great partnership and set the example for the rest of the team to culturally emulate at different levels. On the whole, there was a drive toward simplification. It helped us to be very agile in terms of the insights they provide, and to execute communications faster.

The change has paid big dividends and improved partnership. Beyond communication, one unique way we applied Minto is what we call the analytical framework within finance, which means taking our business and breaking it down to drivers, and then mapping our data to those drivers. Using a Minto approach allowed us to almost restructure the thinking of our entire analytical processes, and through that process, the partnership dynamics completely changed. It was very empowering and helped secure us a seat at the decision table. It also made us very agile.

Build up key FP&A capabilities and skills with AFP’s FP&A Maturity Model, a roadmap to help you and your team become leading practitioners.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.