Articles

AFP Jargon Watch: Amara’s Law

- By Bryan Lapidus, FP&A

- Published: 9/7/2018

AFP Jargon Watch is an occasional series to help finance professionals better understand the changing knowledge and definitions of the industry. #AFPJargonWatch

Here is the latest installment of #AFPJargonWatch:What it is:

While Moore’s law has been a great predictor of increased computing power, Amara’s Law may be a better indicator of how technology will be implemented in meaningful ways in our day-to-day lives. “We overestimate the impact of new technology in the short run, but we underestimate it in the long run.” -- Roy Amara, Stanford University computer scientist, head of the Institute for the Future.Why it matters:

“Amara’s Law implies that between the early disappointment and the later underestimate there must be a moment when we get it about right,” said Amara. Finance professionals should take care not to overhype the importance of new technology to management, while management should not dismiss new technology out of hand.Trendspotting:

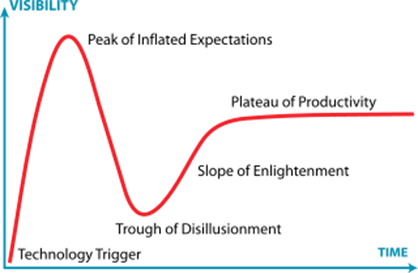

Gartner has trademarked the Hype Cycle, representing the maturity, adoption and application of technologies, based on this law. A graphic representation of the maturity and adoption of technologies and applications, and how they are potentially relevant to solving real business problems and exploiting new opportunities:

Here is a more granular view:

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.