Articles

A Framework for FP&A Skills

- By Bryan Lapidus, FP&A

- Published: 7/14/2020

Trying to keep up with business and technology changes is like changing a flat tire while driving a car at 60 miles per hour. You can’t stop the motion, but you can’t afford not to! As the business landscape and IT capabilities continue to evolve and the rate of change increases, it can be a monumental task for FP&A professionals to keep up. This simple, flexible framework can help.

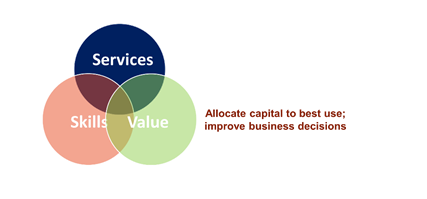

DELIVERING VALUE

To begin with, let’s place FP&A in context of the finance organization. The CFO is the steward of company capital, responsible for financial controls (reporting where the money has been), making the capital accessible, and deciding how the capital can be best used in the future. Let’s define this as the mission of FP&A—the way we deliver value.

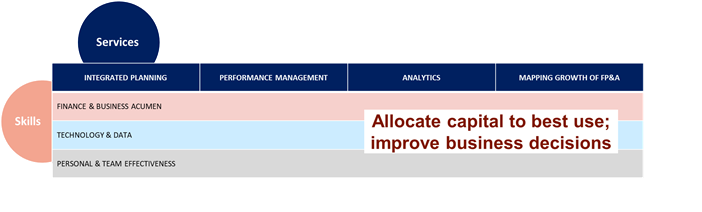

Next, we need to think about the services we deliver to derive that value. Typically, there are three broad categories of services that FP&A delivers to the company, and one we owe to ourselves. These are:

- Integrated Planning: To translate the strategic plan into a strategy that coordinates the company, can be measured, and can be checked. This includes forecasting and budgeting (for those companies that have a budget process).

- Performance Management: To operate a company by delivering the right information,n to the right person, at the right time, and in the right format. FP&A develops effective reports for various audiences that are trustworthy and timely and can effectively communicate the department’s credibility.

- Analytics: FP&A delivers insight based on constructed models, data and information.

- Managing Growth of FP&A: FP&A plans its own growth to remain relevant to the changing operating models of business, technology and careers. Data management and systems architecture to facilitate data manipulation are critical.

CREATING THE FRAMEWORK

With these elements in place, we can now develop a framework for FP&A skills. FP&A skills are applied over three dimensions, with various elements comprising the FP&A role ascribed to each of these:

Finance and Business Acumen: FP&A translates corporate and business strategy into a financial plan and supports the enactment of that plan through resource allocation. Processes generate input and insight through financial analysis, supported by enabling technology.

This is what defines FP&A as part of the finance organization—we bring financial analysis to the table and a focus on placing capital in its most productive place. Our ability to link operations to the general ledger, to model potential outcome, and identify assumptions and facts is how we add value to the other business units. Generally speaking, we find finance is well equipped with the financial and analytical skills; this is the prerequisite for a career in this field!

Technology and Data: Technology enables new capabilities for individuals and teams to apply to financial analyses and processes; data is a key economic asset leveraged throughout business analysis and operations.

We need to be able to understand data, the tools that help us to manage data, and tools of insight. For example, FP&A often struggles with operational and financial data being stored in different places and coded with different hierarchies and structures. Therefore, to provide the value we strive for requires us to spend three quarters of our time gathering and preparing data. If we can build better stores for our data, learn to use tools, and even automate this process, we can increase the time spent on analysis. That means we need to implement those tools, and ensure our teams are capable of using them. That may be through training, hiring or targeted projects in enterprise performance management (SaaS-based planning tools) for programming in Python, R, SQL; building and using algorithmic “bots” or workflow process tools; building dashboards and visualizations; and increasingly, managing natural language generation or processing tools.

Personal and Team Effectiveness: FP&A is a trusted advisor to the business, based on credibility, partnership and communication. FP&A continues to build its skillset in keeping with business and technological best practices.

Finance can add value through its finance skillset and ability to accurately, rapidly generate insight; the final critical skillset is having the relationship with the business where our voice can be heard. As with all strong relationships, it needs to be built on trust, understanding, and communication. Finance needs to demonstrate an interest and understanding of the business, present information in a way that can be digested, and balance the need to support the business while representing the CFO’s position of maximizing capital deployment for the long-term health of the company.

A full model of an FP&A would also require the layering of an operational structure, such as centers of excellence and central versus decentralized location of people to serve our customers. It also requires the consideration of supporting technology. By building a framework to think about your staff, you will be prepared for those and other changes as they arise.

A fuller discussion of this framework is in the FP&A Maturity Model, available here.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.