Articles

7 Steps on an EPM Transformation Journey

- By AFP Staff

- Published: 12/2/2022

The AFP FP&A Mini Case Study series is designed to help you build up key FP&A capabilities and skills by sharing examples of how leading practitioners have tackled challenges in their work and the lessons learned. In this case study, a consultant advising a genomic testing services company shares their seven-step approach to successfully establish a new enterprise performance management (EPM) reporting & planning platform, foundational business process changes, and the operational benefits it provides.

Presented at an AFP roundtable, this case study contains elements that are anonymized to maintain privacy and encourage open discussion.

INSIGHT: FP&A leaders must determine what services and capabilities to develop, and design a roadmap to deliver on those.

| Company Size: | Small company subsidiary of multinational giant |

| Industry: | Life science and healthcare |

| Geography: | Global |

| FP&A Maturity Model: | Reporting, Analytics |

Reporting and analytics: Leading reporting practices use a standardized, customizable and automated enterprise reporting platform, seamlessly integrated with a common data repository. Predictive and prescriptive analysis facilitates the exploration and explanation of data, data science approach, computation and visualization.

BACKGROUND: GENERAL INFORMATION ABOUT THE COMPANY

In this case study, the company we’re discussing is relatively small in terms of revenue and number of employees. But it’s owned by a multinational healthcare giant and has a particular and unique set of capabilities, skills, and offerings. The company develops, manufactures and sells genomic profiling assays based on next-generation sequencing technology for solid tumors, hematologic malignancies and sarcomas.

The business is organized around two essential business segments: 1) biopharmaceuticals, which includes a finite number of large clients, and 2) clinical, which includes a vast number of clients. It provides testing and data services to biopharmaceutical companies and health care providers (e.g., physicians, hospitals, health care clinics).

Prior to starting this project, the company hired a new vice president of FP&A who brought significant experience, expertise and a more forward-looking perspective to the organization. This case study was presented by an external consultant working on the project.

CHALLENGE: THE WORK OR DIFFICULTY FP&A HAD TO ADDRESS

The team identified four areas to be addressed:

The company’s management reporting was a manually intensive process, fully dependent on Excel. There were multiple FP&A and accounting associates pulling data from various sources and doing their own manual data transformation, reconciliation, and data management rollups; these activities were fragmented, time-consuming and often duplicative. The management reporting output was rather immature; the monthly reporting package was non-standard, provided limited insights and analysis around the “why” of business performance results, and did not optimally support forward-looking decision-making. In short, the reports did not tell the greatest story. The team lacked a framework for driving a conformed and consistent management reporting & analysis discipline as well as guided analytics.

On the EPM solution side, the company had two prior failed implementation efforts where the solution was not adopted by FP&A, finance or accounting. All management reporting and planning was conducted outside of the EPM solution. Planning and forecasting were also completed outside the EPM solution in Excel models including the consolidation of actuals and plan data for reporting. That said, there was a solid core foundation in place including actuals data integration, EPM data model structures, as well as a defined IT support model.

The analytics were very limited given the technology landscape. The ERP and operational systems weren’t structured for analytics as they provided transactional accounting data only without additional data attribution and relevant business views (e.g., customer, vendor). Given all this, there were significant information & analysis gaps around customer, vendor, volume and price-volume-mix analytics.

All the FP&A team’s time was spent on data collection, data transformation, reconciliation and report creation rather than analysis and insights. The team lacked direction, guidance and best practices and had no concept of the “art of the possible.” The void around its ability to be a business partner was increasingly being addressed by shadow business groups across the organization.

APPROACH: HOW FP&A ADDRESSED THE CHALLENGE

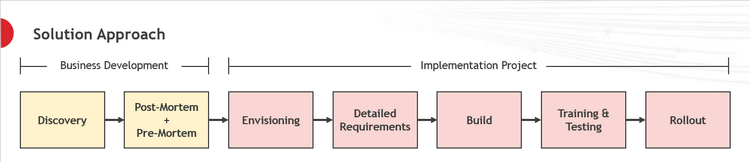

The new vice president of FP&A came on the scene and started asking questions: Why aren’t we doing these things? Why aren’t we leveraging the EPM platform we invested in? How are we partnering with the business? And thus began the solution approach, which came in two phases and seven steps.

Business development

- Discovery. The first step in the process: The team sought to understand the existing reporting, planning, analytics and business partnering environment. This included documenting pain points, improvement opportunities and a future state “wish list”. Once that was established, the team codified the overall goals and objectives of executive and FP&A leadership and established the parameters that would mean they had achieved success.

- Post-Mortem + Pre-Mortem. This discovery phase also meant examining their past projects to figure out why they hadn’t been successful, and what had prevented users from adopting those past solutions. And, looking ahead, what factors would be critical to ensuring the success of the new solution they were developing.

Implementation project

- Envisioning. What is possible? The consultant provided knowledge and expertise around industry best practices from both a functional and technical perspective. Four items comprise this step: Leverage the reporting wireframe framework, identify the right EPM reporting tool for the defined use cases, establish a roadmap for delivery, and deploy new customer and vendor reporting cubes for more advanced analysis and insights.

- Detailed Requirements. This step is all about reporting: Prioritize and gain agreement on the most important reports for the first phase of implementation, create detailed specifications for each report including content, format, & expected usage, determine upstream data sources and data dependencies (including necessary changes for the ERP GL Chart of Accounts), and introduce new reporting & analysis capabilities.

- Build. In this step, leverage a highly iterative approach for building the reports: create and review in a hands-on manner new reports in Business Adoption Model sessions; demonstrate the reporting functionality, capabilities, end-user navigation, and report updates via the sessions; and solicit end-user feedback early and often through the sessions to ensure that the business requirements are optimally satisfied.

- Training and Testing. They provided over 15 training sessions for larger groups and individualized trainings for select users, and established office hours for ad hoc questions; created resources such as guides and how-to videos; and conducted comprehensive testing for all data load and metadata management processes, reports and administrative support.

- Rollout. This final step was a comprehensive plan for 100% conversion to the new EPM system that included separate communication plans for executives and staff, alignment with the planning cycle, and integration with necessary upstream ledgers, data management and administrative support processes.

OUTCOME: WHAT CAME OF FP&A’S EFFORTS AND WHAT WAS LEARNED

What do those same four elements that challenged the company from the beginning — management reporting, EPM, analytics and business partnering — look like now that the seven-step approach has been applied?

To start, the company has an enhanced management reporting package based on industry best practices, with automated actuals data integration from source systems with frequent updates. Usage of EPM tools is “fit for purpose,” including standard reports, report books that bundle a core set of reports & business views, ad hoc analysis and dashboards.

Use of the EPM solution provides a single source for all management reporting and analysis including actuals, plan, and forecast data with purpose-built customer and vendor cubes delivering more advanced, detailed analytics. In addition, they now have a robust foundation that provides for future planning capabilities including driver-based modeling & planning, system-enabled labor & workforce planning, allocations, and other planning capabilities.

They now have strong analytics regarding their customers, vendors and standard cost variances (e.g., volume, price, mix) with the ability to seamlessly drill through to transaction-level detail. The data attribution of source actuals data feeding the EPM solution has also been greatly enhanced.

Last but not least, they have substantially increased the amount of time the FP&A team can devote to practices that make them better business partners thanks to a dramatic reduction in manual efforts and duplicative work, as well as reduced time spent on the reporting cycle. A revised model for engagement with functional business leaders has been fruitful, and now FP&A, finance and accounting are all positioned to lead business transformation efforts across the organization.

DISCUSSION: A Q&A SESSION AMONG COUNCIL MEMBERS

Q: What would you say to a CFO who is building the accounting foundation, regarding the challenges and decision points they need to be prepared for?

A: Design is very, very, very important. If you do not design your accounting-centric, transactional-centric chart of accounts with an analytic lens, you’re going to miss out, and you’re going to have significant problems downstream. You also need to be thinking in terms of, what analytics will I need to be able to deliver, be it planning, modeling, or whatever, where actuals have to help me support that. It may not say, “I'm going to radically change that accounting chart of accounts,” but at least you're mindful of what segment strings exist or don't exist. If it's not in the GL segment string, does it live in a subledger? If it doesn't live in a subledger, where does it live? How would I get at it? How do I align those from a data lineage perspective?

Q: What would you say to someone who is maturing and overhauling their FP&A group?

A: Establish the core set of capabilities from which you can then build upon over time. An example here would be financial modeling capabilities. What is needed in the near-term vs. mid-term vs. longer-term? Organizationally, FP&A leaders must determine what services and capabilities are best delivered from a more centralized team vs. a decentralized, distributed team. It’s critical to determine what services FP&A provides (e.g., what is the charter of FP&A), what capabilities are needed to deliver these services, and where are we today in terms of our maturity as an FP&A team? Defining a roadmap that spans people & organization, data & information, business processes, and enabling tools & technology is very important.

Q: What would you say to someone who has an institution with overly institutionalized processes?

A: Change is obviously extremely hard. When there are people who are not going to change, you help them realize that this may not be the best place for them. Not that you push them out, but you set expectations of this new organization, and here's how the world works in the new organization. When those people are very slow to jump on the bandwagon, we make that, in a professional, constructive way, highly visible to their leaders. Associates are given every opportunity to learn, grow, and succeed in a new environment but must be held accountable to embrace the revamped organization and ways of working in the brave new world.

Q: You used the term, “pre-mortem.” Would you explain what that is?

A: Pre-mortems are about ensuring you’re executing successfully before you start. In a post-mortem, you analyze what went wrong and why. In a pre-mortem, you’re imagining what could go wrong, and working backwards to try to figure out what scenarios could lead to that failure. For example, we identified the fact that a project manager was needed. She’s been great. She holds them accountable, makes them show up for meetings. She beats the drum for them, because in the past they were like, “Well, I'll make it if I can.” Pre-mortems highlight the elements that are paramount to success and optimize your chance of success.

Q: How did this company prioritize what to do first — and what comes next?

A: For the first phase of implementation, they focused almost exclusively on reporting. The work executed in the phase established the initial “win”, put in place the foundation for the future, and demonstrated to the entire organization that they could successfully deliver against the strategic objectives and expected business benefits.

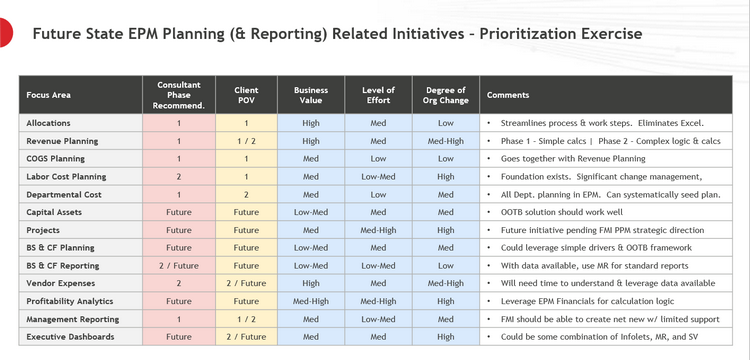

In terms of what comes next, the roadmap below which shows the areas of focus, how the consultant ranked them, how the client ranked them, and (in blue) the various criteria used to evaluate each of the potential initiatives.

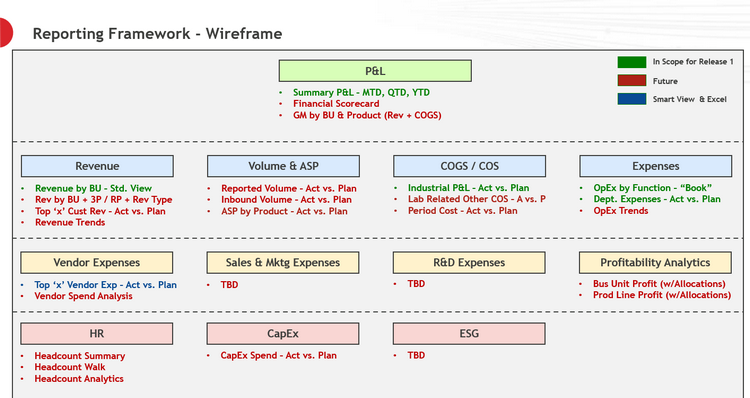

In the next slide, you can see that some features of reporting were created right away, and others prioritized for future EPM solution releases.

Build up key FP&A capabilities and skills with AFP’s FP&A Maturity Model, a roadmap to help you and your team become leading practitioners.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.