Articles

Digital Transformation in Finance: 6 Questions with Catherine Jirak

- By Joanne Oh

- Published: 10/3/2022

Catherine Jirak is an industry veteran at the intersection of finance and technology, having worked on one of the first major transitions to finance automation at a Fortune 500 company and continuing as the founding partner of QueBIT consulting, an enterprise performance management implementer. Jirak is also a member of AFP’s North American FP&A Advisory Council.

Catherine Jirak is an industry veteran at the intersection of finance and technology, having worked on one of the first major transitions to finance automation at a Fortune 500 company and continuing as the founding partner of QueBIT consulting, an enterprise performance management implementer. Jirak is also a member of AFP’s North American FP&A Advisory Council.

AFP’s director of FP&A practice, Bryan Lapidus, recently caught up with Jirak to talk about the evolving relationship between finance and technology, the biggest challenge with data today and the future of emerging technologies in finance.

Lapidus: Tell us a bit about your career journey.

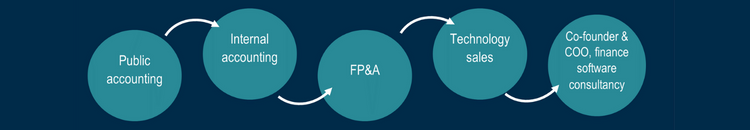

Jirak: Like a lot of accounting majors, I went into public accounting right out of school. After graduation, I began working at Main Hurdman, which was later acquired by KPMG.

Jirak: Like a lot of accounting majors, I went into public accounting right out of school. After graduation, I began working at Main Hurdman, which was later acquired by KPMG.

While public accounting entails a lot of long, hard hours I also found it to be fun, in part because of the exposure to multiple clients and types of work. I was subsequently hired by one of those clients, CPC International, a global food products company, to run the accounting department for the corn products division at its corporate headquarters. At the time I was very young, in my mid 20’s, and I was running a department of 50 people that was going through a major downsizing. It was very daunting, but I was fortunate to have the support of a great mentor, the VP of finance, whose faith in me taught me the importance of identifying people with talent and guiding them through their careers.

CPC was also where I really learned how a company works and how to work with and manage people. I quickly realized that no one in the finance team knew what the other parts of the team were doing, so I organized weekly lunch-and-learns where someone from one part of my department gave a presentation to the rest of the team. I also realized that few people in finance really understood the operations or financial condition of the company, so I started a department newsletter to share information.

I also got involved in a major digital transformation project when the company started transitioning from mainframes to minicomputers at both the corporate offices and at their processing plants. I helped several plants convert their financial data. I also learned how to use some of the mainframe systems. In a way, that marked my entry into the data world by learning query language to get the data I needed.

All these early career experiences laid the foundation as I embarked on building my own consulting practice. I was fortunate to get involved with budgeting and planning software early on, where understanding data as well as the business problem gave me an advantage in this area of consulting. My partner Gary Quirke and I started QueBIT. We were both doing double duty, working with customers during the day and building our business every other waking hour! We have grown from just the two of us to over 100 people with over 500 customers.

No two career paths are the same. Discover the unique journeys of other FP&A leaders in the FP&A Handbook: The Who, What and Why of Financial Planning & Analysis.

Lapidus: What macro-change do you see in the relationship between technology and finance?

Jirak: To be honest, the problems we’re solving in FP&A have not really changed in the last 20 years. What has changed is the huge increase in the amount of data being generated and the transition to cloud computing. It has taken a few years to combine the benefits of sophisticated tools, large data sets and managed data costs, and cloud ubiquity.

Data has been and continues to be a challenge in the systems we build, making sure that you have the right data, clean data and current data is as important as the tools you employ to build your budgeting and planning systems. Having the right amount of data is also key: too little and you cannot make inferences, too much data and your system’s performance is impacted.

Lapidus: What do you think is on the horizon for technology for the finance group?

Jirak: I believe companies will continue to invest in technology so they can have better, faster access to data that will help them run their businesses. Finance professionals will have a higher level of skill sets, moving away from Excel and VBA and using more SQL, Python and R to do machine learning (ML), artificial intelligence (AI) and data analysis.

Finance departments will be more of data engineering departments. As the millennials, who are digital natives, move into CFO positions, there will be a shift in how finance departments operate. They will not want to wait for data; they want information at the moment they need it.

Companies are realizing they need to get their data in order before they can run their forecasts automatically. I see the finance departments of the future embracing an xP&A journey, using data and technology to run their businesses. The finance department will want systems that are easy to use, take advantage of the speed of data and have better integration with all data sources

As for the next big thing in tech, I am not sure. There is a lot of current technology out there that is not being sufficiently employed across organizations, so there is still work to do. I believe there is still more opportunity to manage data better and I see software companies are focusing on user experience — how can we take what we have and make it easier to use without losing functionality?

Ready to get your data right? See the critical steps that go into the digital transformation process in the 2022 AFP FP&A Guide: Get Your Data Right, underwritten by Workday.

Lapidus: Do you believe in best-of-breed approaches or single platform approaches?

Jirak: Different technologies have strong points that enable them to be tailored for a specific market, a certain customer base. It's not like one technology solves everybody's problems. Different companies have different needs. A large multinational company is not going to use cloud solution with limited customization to do its global planning because that solution can't handle the complexity of the business processes as well as dealing with the data volumes.

I believe composable architecture will be the focus going forward. Composable just means that you're going to use different technologies to start to solve different parts of the problem. It’s not one-size-fits-all. The key will be integration.

The reality is that businesses are always acquiring new companies with different systems, and there will be multiple technologies to manage the entire FP&A process, including data hubs/lakes, AI and ML, modeling tools and reporting tools. It can get very complicated but being able to integrate data is key and necessary to be able to manage a constantly changing landscape. A good data strategy is equal to good communication to many parts of the business.

Lapidus: I always think the definition of AI is what people imagine computers will do for them 50 years in the future. If you were to go out, maybe 20 years in the future, what do you see finance doing?

Jirak: I would hope that the people in finance are making more strategic decisions and automating the basics of chasing down variances, performing routine reporting and wrangling data. That will enable people to make more timely, intelligent decisions about where the business should go, and you would have data to support those decisions without needing an army of people to put it together.

I hope that there will always be people in finance. Someone might say that computers can make decisions, but they can really only make yes-no decisions. Automation will not be able to tell the company what is best for the people it’s serving. And there will always be those types of decisions that need to be made.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.