Research

2022 AFP Payments Cost Benchmarking Survey

Underwritten by

The 2022 AFP® Payments Cost Benchmarking Survey, provides treasury and finance professionals with a tool to gain more granular information regarding costs of various payments methods. Survey participants had the option of either selecting cost estimates within defined cost ranges or providing their best estimated costs as dollar values. The survey questions also distinguished between external and internal costs for payments. The analysis is based on responses from about 350 practitioners. The survey was underwritten by Corpay, and we thank them for their support.

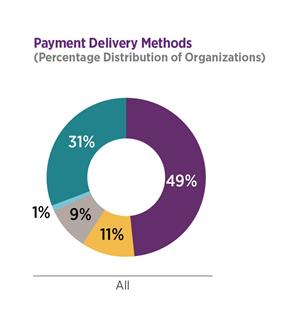

Report findings reveal that nearly half of organizations deliver their payments from a single centralized corporate treasury operation. Centralized payments operations provide various benefits such as economies of scale, consolidated foreign exchange purchases, centralized flow of payments and a reduced number of bank connections. Additionally, these operations have the added advantage of having skilled workforce in a single location. About one-third of companies delivers payments using a mix of methods.

The survey also reveals that A vast majority of organizations continues to use checks (92 percent) and ACH Credit (87 percent) for incoming payment transactions. Results from this year’s survey suggest that the use of checks for payment is not going away anytime soon. Checks are low technology, contain all the remittance information and are easily traceable and reconcilable. In terms of incoming payments, the share of companies that accept checks is the same for both small and large companies across the board.

Other insights include:

• Eighty-six percent of organizations use checks for outgoing payments. ACH Credit and ACH Debit are each used at 78 percent of organizations, while Fedwire /CHIPS is being used at 74 percent of organizations.

• A vast majority of survey respondents is extremely aware or aware of payments costs for checks (85 percent), ACH Credits (87 percent), ACH Debits (86 percent) and Fedwire/CHIPS transactions (90 percent). Cost awareness among this group is slightly less for credit card (77 percent), debit card (65 percent) and virtual card (60 percent) transactions.

• Seventy-three percent of organizations are currently in the process of transitioning their B2B payments from paper checks to electronic payments. This figure is less than the 79 percent of respondents who reported their organizations were shifting from checks to electronic payments in the 2015 AFP Payments Cost Benchmarking Survey.

AFP thanks Corpay for its support of the 2022 AFP® Payments Cost Benchmarking Survey.

Download Comprehensive Report (For AFP Members and Survey Participants)

Download Highlights

AFP Payments Cost Dashboard:

Access the AFP Payments Cost Dashboard.

Press Inquiries:

Contact [email protected] or call 301.907.2862 for more in-depth information, to read the full report or to arrange an interview with AFP Research.

Learn more about AFP member benefits and join today.

Questions about this subject?

Questions about this subject?

Contact Tom Hunt, AFP's Director of Treasury Services.