Articles

Earnings Credit Rate: Predicting the Cloudy Future of ECR

- By Bridget Meyer, CTP

- Published: 4/25/2016

In December 2015, the Federal Reserve hiked the overnight lending rate by 0.25 percent. Considering the high balances that large corporations typically leave in their commercial demand deposit accounts (DDAs), and the impact that the earnings credit rate (ECR) and corresponding earnings credits have on offsetting transactional bank fees, two questions come to mind:

In December 2015, the Federal Reserve hiked the overnight lending rate by 0.25 percent. Considering the high balances that large corporations typically leave in their commercial demand deposit accounts (DDAs), and the impact that the earnings credit rate (ECR) and corresponding earnings credits have on offsetting transactional bank fees, two questions come to mind:

- Should treasurers expect a corresponding increase in the ECR that their banks are providing on average daily collected balances?

- Is this the beginning of an increasing interest rate trajectory that could lead treasurers to consider alternative yield-capture instruments, such as hybrid accounts and hard-interest accounts, that are more beneficial than analyzed checking accounts?

ECR’s future

We question the future of ECR now because the combination of Regulation Q’s repeal in 2010 and Fed rates finally moving higher has led corporate treasury to a crossroads: There is no longer any corporate benefit to ECR. If banks are no longer prohibited from paying hard interest on corporate deposits in the United States, what is preventing them from converting all commercial clients to simply earn hard interest on DDA balances? Nothing except technology and habit.

Billing systems that were customized to produce account analysis statements would have to be reconfigured to calculate and offer hard interest instead. In fact, most major banks have already come out with what they call hybrid accounts, which calculate the amount of compensating balances needed to offset transaction fees (treated the same as ECR and earnings credits), and then apply a hard interest to any additional balances after all fees have been covered. These products were first created in 2011 and have been fine-tuned since, however, corporate and bank adoption has been slow. Few corporations have enough balances in the current rate environment to offset all transaction fees and benefit from a hybrid checking account. However, as rates rise, the adoption of hybrid accounts or corporate interest checking accounts could eclipse the usage of the traditional analyzed checking account we know today.

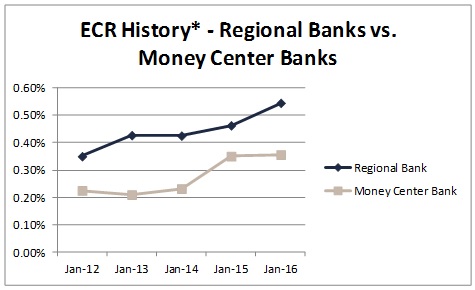

Finally, to address the first question: are banks finally increasing ECR? Our market intelligence and experience confirms that ECRs are in fact finally on the rise—but not for everyone. In recent RFPs, Redbridge has been pleasantly surprised to learn that the banks that have not budged on rates in the past three years are finally coming to the table with higher exception ECRs that are attractive. ECR continues to be used by banks more and more to lure new clients that have significant operational balances, even as those same banks look to shed certain non-operating balances due to Basel III. The difference between the typical ECRs offered by regional banks compared to those offered by global banks show a stark difference. The hypothesis being that the profitability structure of smaller regional domestic banks are different, especially as these same regional banks do not have to contend with the restrictions of Basel III, allowing them to offer the higher ECRs as a considerable differential benefit. The following chart shows the progression of ECRs between these two groups of banks in the past five years.

*Based on Redbridge’s BankScore™ of Global Rates & Fees

While rates are on the rise in a competitive environment, such as an RFP, it will take time before ECRs are increased across the board—especially at the large money center banks focused on shedding deposits rather than attracting them. Irrespective of who is benefiting from the rate increase, it is encouraging to see that rates are demonstrably on the rise, regional banks are still providing very attractive exception rates, and the future of ECR appears to be safe—for now.

Bridget Meyer, CTP, is director, North America for Redbridge and a nationally recognized treasury expert in the field of bank relationship management and account analysis. She is hosting the upcoming AFP training session, Decoding Your Commercial Analysis Statements, May 16-17. Register here.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.