Articles

AFP Survey Identifies Main Roadblocks to AI Implementation in Treasury and Finance

- By AFP Staff

- Published: 12/5/2023

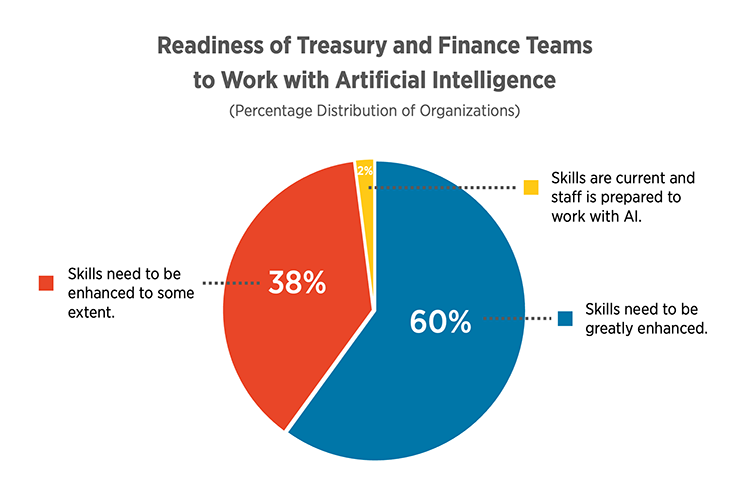

Treasury and finance professionals admit that skills within their teams need to be enhanced to work with artificial intelligence (AI) and remain competitive.

At AFP 2023, attendees were surveyed regarding their perspectives on AI, ranging from implementation to readiness to whether they felt AI would mean job loss or displacement. They named the following as the top three roadblocks they believe organizations have or will experience as a result of AI implementation:- Lack of knowledge and competence to work with AI (55% of respondents).

- Integration with current processes (48%).

- Data security, i.e., protecting all data from unauthorized access (44%).

Artificial intelligence (AI) and finance share a core aspect of their work: Both are powered by data. Given the fact that financial professionals largely reside in a data-driven world, it stands to reason that AI would be a comfortable tool to which they would naturally gravitate, welcoming its ability to enhance or assume certain tasks and optimize operations. Results from the AFP 2023 Onsite Survey tell a different story.

When it comes to the implementation of AI, the majority of respondents fell at either end of the spectrum, with 25% stating they had implemented AI to some extent, and 33% stating they were unaware of any plans to implement AI. The rest of the respondents fell in the middle, with 20% stating they were testing and planning to implement AI in the next 12 months, and 21% stating they are not planning to implement AI. Only one respondent stated their organization had implemented AI to a significant extent.

Do financial professionals understand the limitations and capabilities of AI? When asked what they believed the top three efficiencies are that organizations have experienced or will experience as a result of AI implementation, respondents chose the following:

- Drives faster outputs/decisions (79% of respondents).

- Cost reduction (57%).

- Greater accuracy (50%).

- Overreliance on technology (64% of respondents).

- Diminished visibility to the calculations (57%).

- Job loss and displacement (43%).

In addition, AFP asked respondents how concerned they are about AI replacing their jobs. Two-thirds exhibit some sign of concern to varying degrees. The majority (34%) are somewhat concerned, followed by 25% who say they are concerned, and 6% are significantly concerned. One-fourth are unconcerned, while 10% are unsure about how they feel.

The future of AI is largely unknown. Its capabilities evolve daily, with many AI-driven enhancements already accepted as commonplace in our daily lives — when was the last time your text message was automatically corrected, or your search term identified before you finished typing? For treasury and finance, it can be a game changer; business opportunities for AI are developing faster than ever. It will be interesting to see what comes next for treasury and finance professionals and how quickly their answers change with time.

ABOUT THE SURVEY

In order to gauge the perspectives of treasury and finance professionals regarding the implementation of AI, attendees of AFP 2023, held in San Diego this October, were asked to complete a six-question survey.

The survey received complete responses from 115 attendees. Over three-fourths (78%) of survey respondents were practitioners responsible for managing or executing treasury/finance functions at their organizations, while the remaining 22% provided products, consulting or services to treasury/finance functions at other organizations.

Interested in more data about the treasury and finance profession? Explore AFP’s survey research and economic data.

Copyright © 2024 Association for Financial Professionals, Inc.

All rights reserved.