Research

2023 AFP Liquidity Survey

Underwritten by Invesco

.png?sfvrsn=1f091b6b_1&MaxWidth=300&MaxHeight=30&ScaleUp=false&Quality=High&Method=ResizeFitToAreaArguments&Signature=23D81EFF867B095C3F9D1160390B135DBFF3CF2C)

The 2023 AFP® Liquidity Survey reports that cash and short-term allocation to bank deposits is down 8 percentage points from last year, to 47 percent – the lowest rate in four years. Concerns about the banking crisis have led organizations to move their short-term investments into Government/Treasury money market funds, treasury bills, and Agencies. This year, 222 treasury and finance professionals participated in this survey and their responses form the basis of this report. The survey, now in its 18th year, was underwritten by Invesco.

Other survey highlights:

- Safety continues to be the most valued short-term investment objective for 63 percent of organizations.

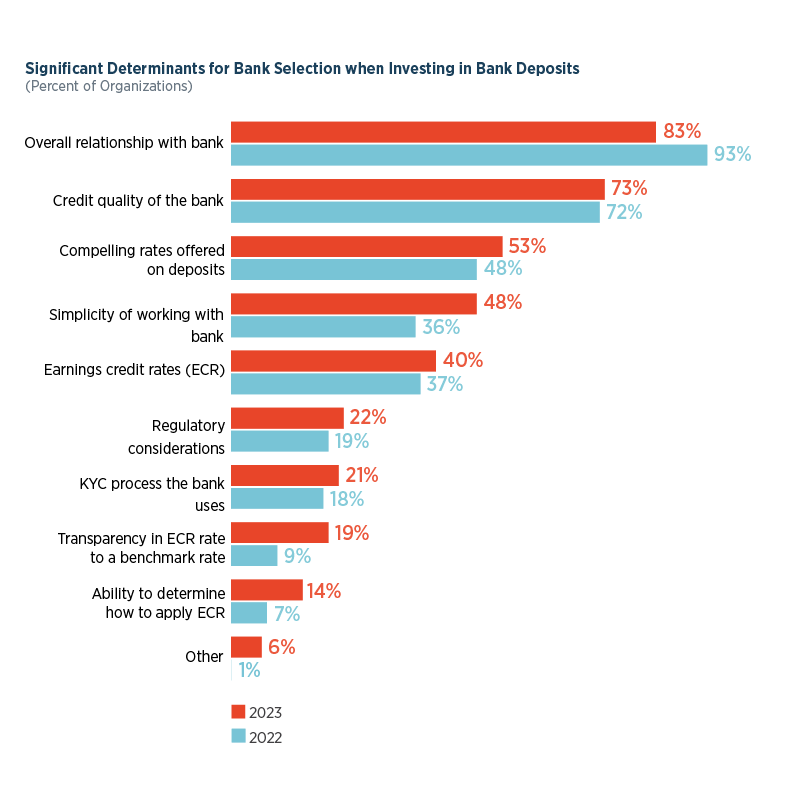

- Eighty-three percent of organizations consider the overall relationship with their banks a primary determinant when choosing banks. This figure is down 10 percentage points from 2022, however, perhaps a reflection of the impact of recent bank failures.

- Thirty-six percent of respondents report an increase in their organizations’ cash holdings within the U.S. in the past 12 months, just one percentage point lower than reported in 2022, signaling cautious optimism among corporate practitioners.

- Environmental, Social and Governance (ESG) Investment parameters continue to influence investment policy revisions, with 27 percent of respondents reporting that their organizations are adding ESG mandates this year.

.png?sfvrsn=3ea9ee6b_0)

Not a member? Download the highlights piece.

Download HighlightsPress Inquiries

Press release - Survey: Cash and short-term allocation to bank deposits drop to 47 percent

Contact [email protected] or call 301.907.2862 for more in-depth information, to read the full report or to arrange an interview with the AFP Research team.

Questions about this subject?

Contact Tom Hunt, AFP's Director of Treasury Services.

Contact Tom Hunt, AFP's Director of Treasury Services.